Electric vehicles (EVs) accounted for 7% of new vehicle registrations in the U.S. in January, up from 4.1% in January 2022 — another sign that the EV transition is gaining momentum.

- As the overall EV pie grows, Tesla's market share continues to shrink.

Why it matters: EVs aren't just for early adopters anymore.

- With broader selection and some signs of moderating prices, mainstream car buyers are increasingly turning their EV curiosity into purchases.

- At the end of 2022, there were 47 electric models available for sale in the U.S., up from 33 the prior year.

Axios has been tracking the historic shift away from gasoline using vehicle registration data from S&P Global Mobility.

- EVs made up 5.6% of all new U.S. car registrations in 2022.

- That's up from 3.1% in 2021 and 1.8% in 2020, but still way behind China and Europe.

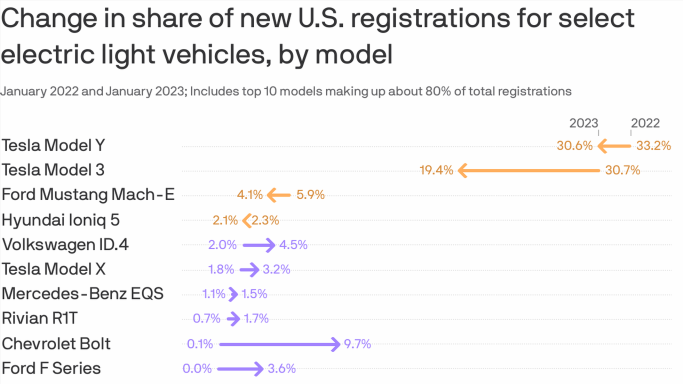

Zoom in: The latest data shows that Tesla continues to dominate, but its market share is shrinking as competitors roll out new models.

- Since January 2022, for example, Tesla's share of the EV market fell from 72% to 54% — and it will likely slide below 50% in the next month or two, says Tom Libby, associate director of industry analysis at S&P Global Mobility.

- Tesla's Model S sedan, in particular, has been struggling. Registrations for the S plummeted 75% in January 2023, while those of Mercedes-Benz's new EQS sedan quadrupled.

Where it stands: Tesla's Model Y and Model 3 hold the largest market share and are still growing, but rival cars are quickly gaining ground.

- General Motors' Chevrolet Bolt is the most popular non-Tesla EV, with a 10% share — due in part to a $6,000 price cut following a damaging battery recall.

- Volkswagen's ID.4 and Ford's Mustang Mach-E rounded out the top five EVs registered in January by market share.

Reality check: Less than 1% of the 279 million cars and light trucks on American roads are electric.

- Even in California, the country's leading EV market, they represent just 2.6% of all registered automobiles.

- It will take a couple of decades for the slow transition from gasoline to electric vehicles to be complete.

Driving the news: Existing consumer tax credits for EV purchases are being reworked — again — in part to bolster U.S. manufacturing and reduce reliance on China.

- Changes to the existing $7,500 tax credit will likely affect the pace of adoption.

- The U.S. Treasury Department on March 31 spelled out how new sourcing requirements for battery components and critical minerals under the Inflation Reduction Act will be implemented — rules that affect which vehicles will qualify for tax credits moving forward.

- A list of qualifying vehicles will be announced in mid-April, but few of today's EVs are expected to meet the new standards.

The intrigue: Anyone racing to snag the $7,500 tax break before the rules get stricter is likely to find EVs in short supply.

- Inventories are tight because of ongoing supply chain issues and a price war triggered by Tesla price cuts in January.

What we're watching: Whether EV leasing ticks up, especially for foreign models.

- There's a loophole in the Inflation Reduction Act that allows commercial vehicle owners — like leasing companies — to bypass the domestic content requirements for EVs.

Source: Read Full Article

-

Trump attacks judge’s family, laments the country is ‘going to hell’

-

Teen arrested as suspect in series of burglaries and sex crimes on Boulder’s University Hill.

-

Plantlife is becoming more of a draw for bars, restaurants and cafes

-

What’s Your Favorite Late-Summer Meal?

-

Wagner chief 'holed up in hotel room with no windows' in Belarus