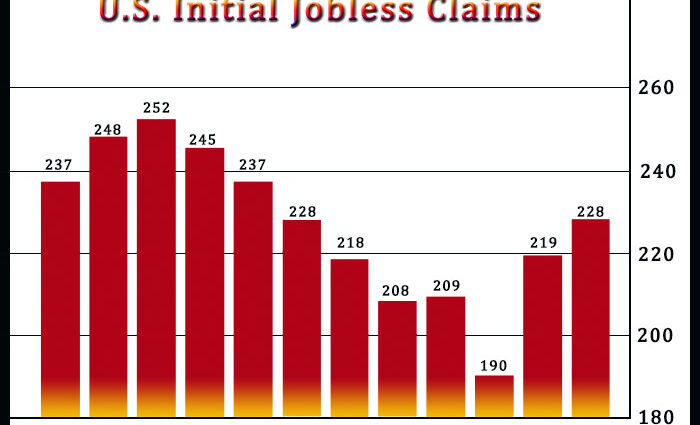

A report released by the Labor Department on Thursday showed a modest increase in first-time claims for U.S. unemployment benefits in the week ended October 8th.

The Labor Department said initial jobless claims rose to 228,000, an increase of 9,000 from the previous week’s unrevised level of 219,000. Economists had expected jobless claims to inch up to 225,000.

The slightly bigger than expected increase in jobless claims reflected a jump in claims in Florida in the wake of Hurricane Ian.

The report showed the less volatile four-week moving average also crept up to 211,500, an increase of 5,000 from the previous week’s unrevised average of 206,500.

Continuing claims, a reading on the number of people receiving ongoing unemployment assistance, also ticked up by 3,000 to 1.368 million in the week ended October 1st.

The four-week moving average of continuing claims still dipped to 1,363,750, a decrease of 8,000 from the previous week’s revised average of 1,371,750.

“While there have been some signs of a slight loosening in labor market conditions, the job market overall remains tight,” said Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics.

“Even as the economy slows, employers appear to be reluctant to lay off workers that they have struggled to hire and retain,” she added. “We expect only a modest rise in unemployment and jobless claims as we head toward a mild recession in 2023.”

Last Friday, the Labor Department released its closely watched monthly jobs report, showing U.S. job growth slowed in the month of September but still came in slightly stronger than economists had anticipated.

The report showed non-farm payroll employment jumped by 263,000 jobs in September after surging by an unrevised 315,000 jobs in August and spiking by an upwardly revised 537,000 jobs in July. Economists had expected employment to leap by 250,000 jobs.

The Labor Department also said the unemployment rate dipped to 3.5 percent in September from 3.7 percent in August, while economists expected the unemployment rate to come in unchanged.

The unemployment rate matched its lowest level since just before Covid-19 lockdowns began to take effect in February of 2020, which was also matched in July. Unemployment has not been lower in over fifty years.

Source: Read Full Article

-

‘Hunt for deductions’ as tax refunds will be smaller this year

-

These 7 Stocks Touched New Highs Yesterday – Did You Ride The Momentum?

-

Hands off our super! There are better ways to make housing affordable

-

RM Plc Posts Prelim. FY22 Pre-Tax Loss; Annual Revenue Climbs

-

Eurozone Record High Core Inflation Confirmed; Labor Costs Rise Faster