The Consumer Price Index (CPI) data for June, released by the Bureau of Labor Statistics today, has sent ripples of optimism throughout the Bitcoin and crypto market. The latest figures reveal a surprising cooling in inflation, which has ignited hopes of a positive outlook.

According to the data, the headline CPI year-over-year (YoY) inflation fell to 3.0%, coming in below expectations of 3.1%. This represents a noteworthy decline from the previous month’s 4.0% figure.

Even more encouraging is the fact that core CPI YoY inflation dropped to 4.8%, surpassing market expectations of 5.0%. Notably, this is the first time the core CPI has fallen below 5.0% since December 2021, leading analysts at The Kobeissi Letter to remark, “The 26-month battle against inflation may finally be nearing its end.”

On a month-on-month (m/m) basis, headline CPI came in at 0.3%, picking up slightly compared to May (+0.1%). Meanwhile, core CPI m/m came in lower than expected, landing at 0.3% instead of 0.4%.

BREAKING: US inflation below expectations #Bitcoin

Headline CPI YoY 3.0% (forecast 3.1%, last 4.0%)

Headline CPI MoM 0.2% (forecast 0.3%, last 0.1%)

Core CPI YoY 4.8% (forecast 5.0%, last 5.3%)

Core CPI MoM 0.2% (forecast 0.3%, last 0.4%)

— Jake Simmons (@realJakeSimmons) July 12, 2023

Why The CPI Data Is Crucial For Bitcoin And Crypto

The Fed has raised interest rates by 5.0 basis points since March 2022 to bring down the highest inflation in the US in four decades. During the June meeting, the Federal Open Market Committee (FOMC) announced a pause for the first time in this cycle to give itself time to assess the still-evolving impact of the previous hikes. Fed Chair Jerome Powell, as always, stressed data dependency.

Prior to the release of the CPI and core CPI, the market was expecting a 92% probability (according to the CME Fed Watch Tool) that Fed policymakers would decide in favor of a 0.25 basis points rate hike at their July 25-26 meeting, which would bring the policy rate into the 5.25% to 5.50% range. Today’s figures are likely to influence the decision by the Fed. However,

San Francisco Fed President Mary Daly recently said at a Brookings Institution event that the Fed “may end up doing less because we have to do less; we may end up doing just that; we may end up doing more. The data will tell us.”

Despite that, 20 minutes after the CPI release, the CME Fed Watch Tool still displayed a 89% of a 25 basis point hike at the end of July. Renowned journalist Walter Bloomberg, citing “The Economists,” stated that the surprisingly good CPI reading is unlikely to deter the Fed from raising interest rates by a quarter point later this month. But, he notes that this rate hike could potentially be the last one in the current cycle.

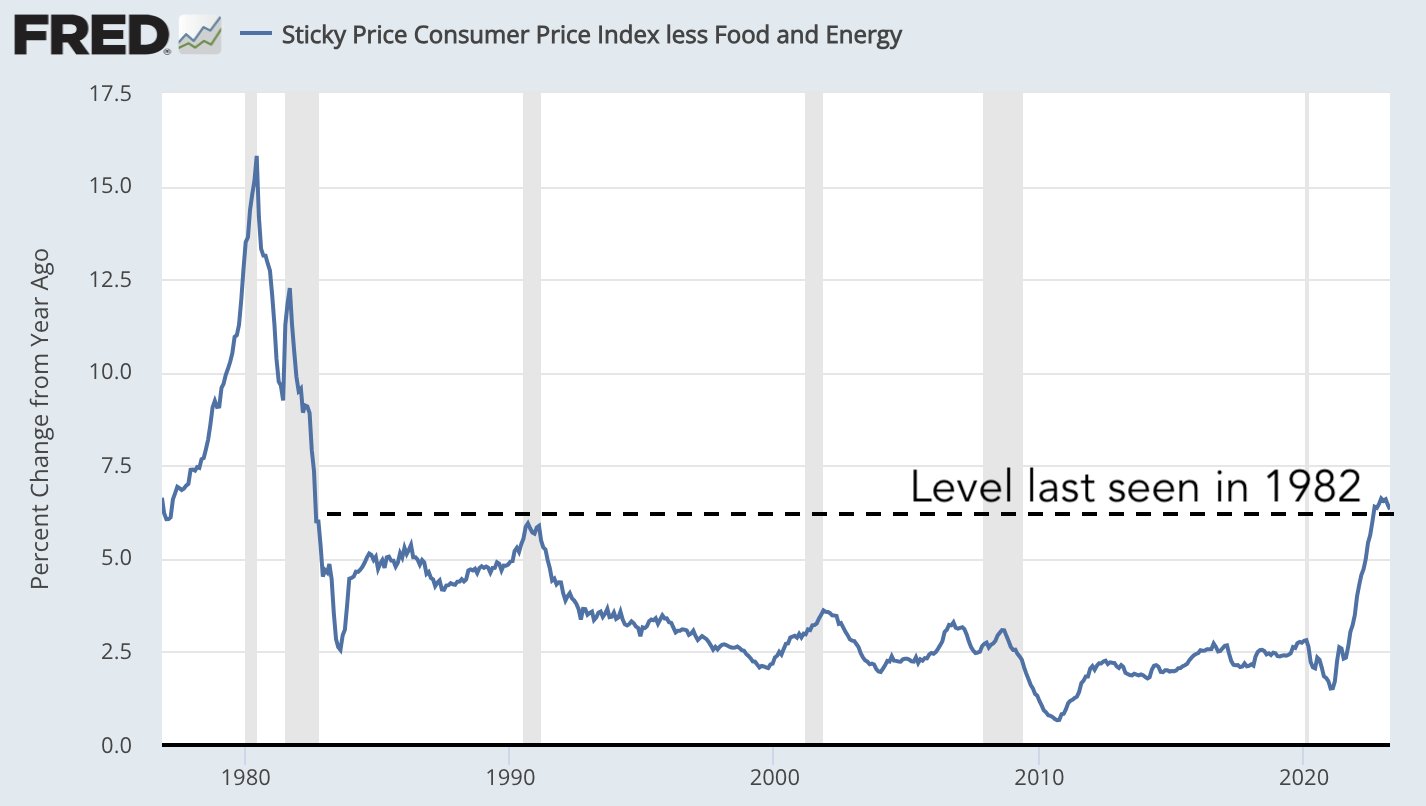

In that vein, it’s important to note that he Fed’s inflation job might not be done yet. Despite headline inflation trending lower and approaching the 2% target fast, sticky inflation is still at levels last seen in 1982, as the following chart shows. The sticky price consumer price index less food and energy is still highly elevated, causing fear of a re-emergence of higher headline inflation.

Fed research published two days ago by economist Michael Kiley showed that core CPI data in 2022 and early 2023 were consistent with models showing greater persistence. “Updating forecasts from these models suggests core CPI inflation is likely to remain above 3.5% thru 2024,” writes Kiley.

BTC Price Reacts Cautiously

At press time, the Bitcoin price quickly jumped above $31,000 before retracing under $30,800. In the coming hours, the market’s true valuation of the data remains to be seen.

As analyst Daan explained via Twitter, there is often an initial positive market reaction to positive CPI releases. This rally often lasts between 5 and 15 minutes, after which it begins to roll over. The price then tends to look for liquidity just below the “data release candle”.

Source: Read Full Article

-

Telegram Founder Is Consider Using NFTs to Sell Reserved Telegram Addresses

-

PEPE Surpasses Local Highs In Surprise Comeback

-

Crypto Biz: Ripple’s expensive battle, Bittrex bankruptcy and a new blockchain network

-

Police in Kosovo Seize Crypto Mining Rigs From Serbs – Mining Bitcoin News

-

Analyst Foresees $ADA Hitting $0.90 Within Next 6 Months