In a recent series of tweets, Vetle Lunde, Senior Analyst at K33 Research, delved deep into the potential ramifications of the US Bitcoin (BTC) spot ETFs. Lunde’s analysis suggests that the broader market might be significantly underestimating the transformative power of these financial instruments.

Lunde’s assertion is rooted in five core reasons. He began with a bold proclamation: “The market is wrong – and dramatically underestimates the impact of US BTC ETFs (and ETH futures-based ETFs).”

Why The Market Is Wrong On Bitcoin

Firstly, Lunde believes that the current climate is ripe for the approval of US spot ETFs, suggesting that the odds have never been more favorable. As NewsBTC reported, Bloomberg experts Eric Balchunas and James Seyffart recently raised their Bitcoin spot ETF approval odds following the Grayscale judgment to 75% this year, 95% by the end of 2024.

Secondly, Lunde pointed out that BTC price has retraced to pre-BlackRock announcement levels. The third reason revolves around the potential competition and the simultaneous launches of multiple US spot ETFs. Lunde anticipates that these, if approved, could lead to robust inflows, potentially surpassing the initial trading days of both BITO and Purpose.

For context, he highlighted that Purpose saw inflows of 11,141 BTC, and in its wake, subsequent ETF launches in Canada resulted in a whopping 58,000 BTC worth of inflows within a mere four months. Given the vastness of the US market compared to Canada, the inflow potential is considerably higher.

The fourth reason Lunde presented is based on historical data from the past four years. He emphasized a noticeable correlation between strong BTC investment vehicle inflows and appreciating BTC prices. This relationship becomes even more pronounced during periods of extreme inflows, which have historically contributed to significant market uplifts.

The last crucial point for Lunde is that on August 17 the market got rid of from excess leverage, as NewsBTC reported.

By The Numbers

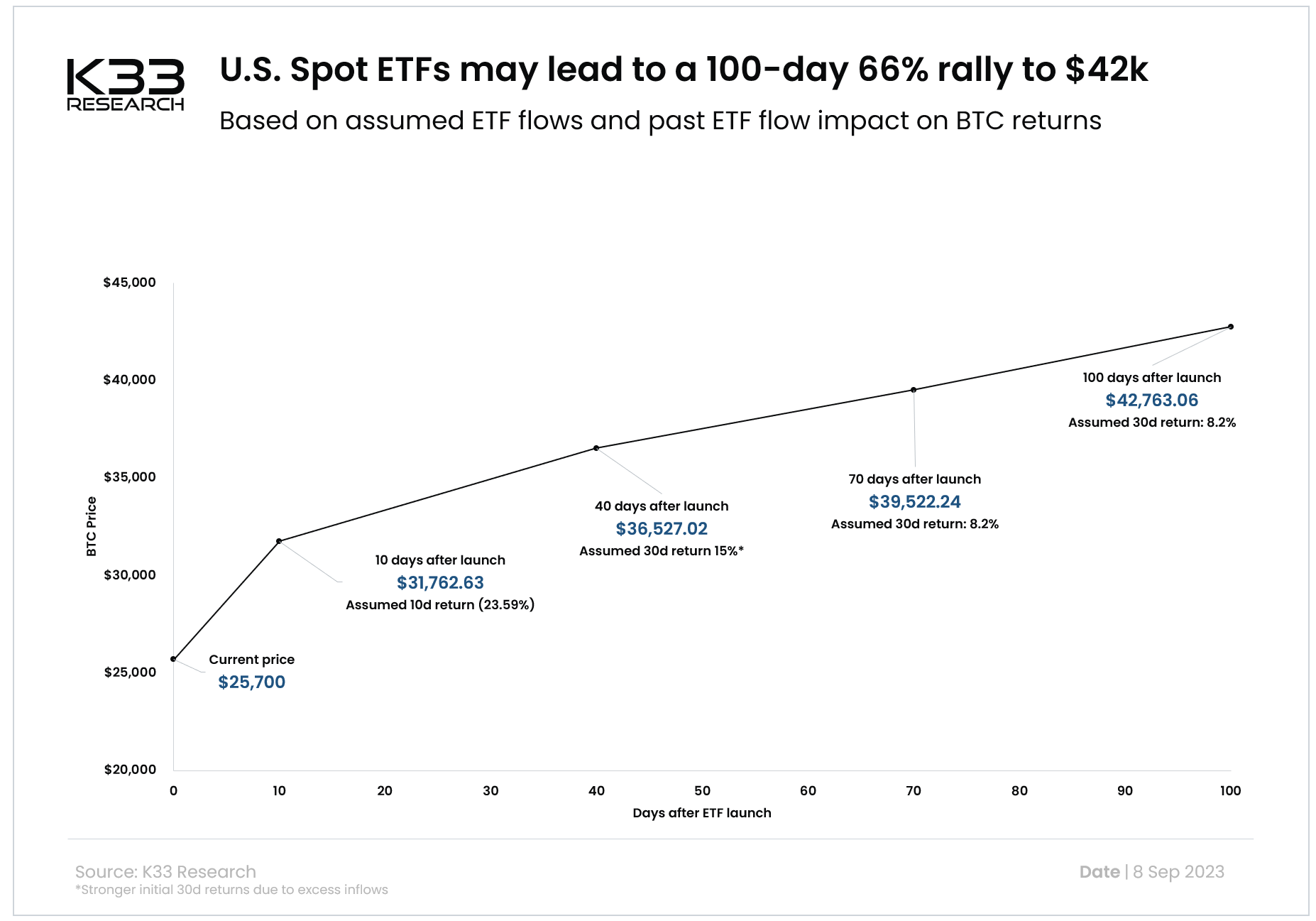

In conclusion, the research firm posits that US BTC spot ETFs could see at least 30,000 BTC worth of inflows in their first 10 days. Over a span of four months, the combined inflows into BTC investment vehicles could range between 70,000 to 100,000 BTC, driven by US spot ETFs and growing inflows to ETPs in other countries.

Based on these flow assumptions and data from the past four years, Lunde suggests a potential 66% BTC rally, targeting a price of $42,000. However, he also cautioned that this projection is based on a “naïve assumption” and doesn’t account for other market-moving events.

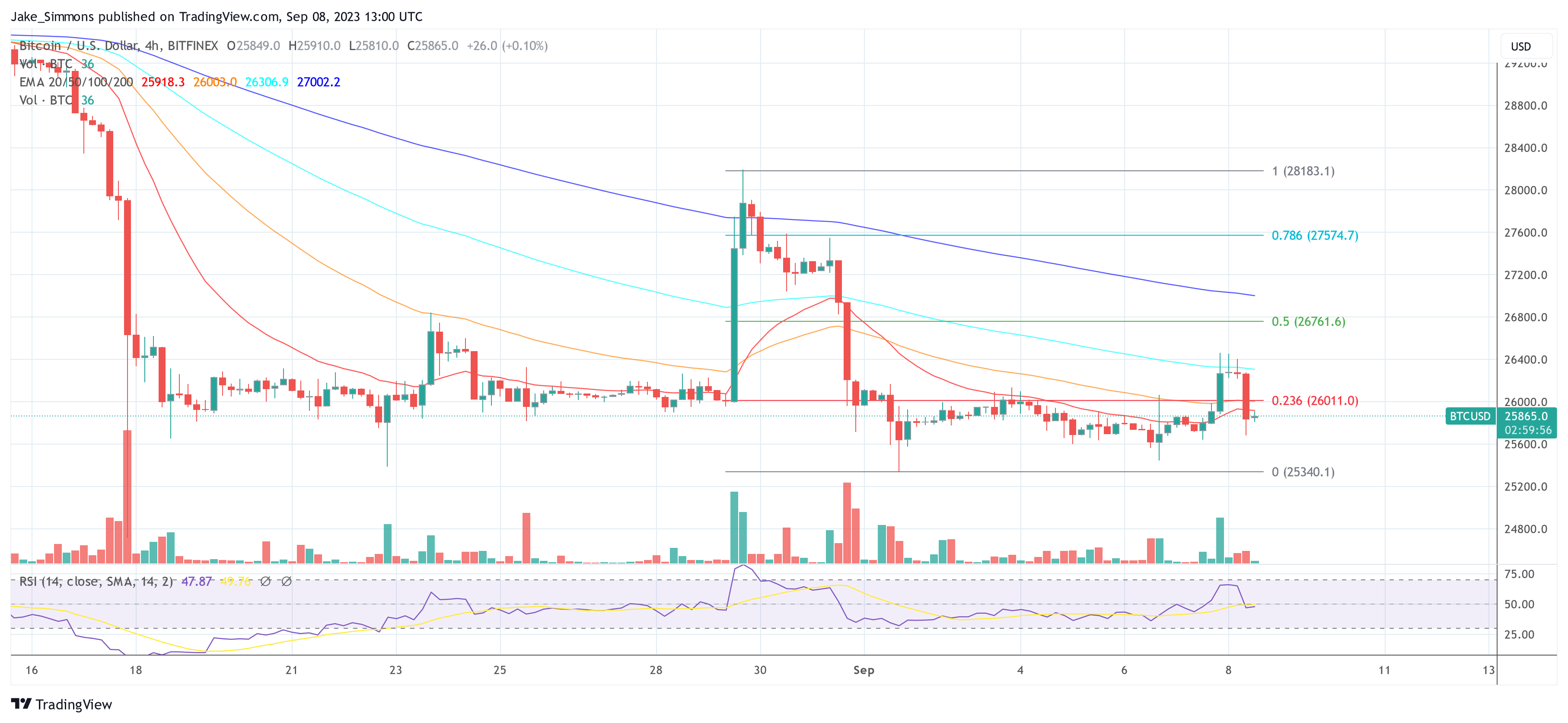

At press time, BTC traded at $25,865.

Source: Read Full Article