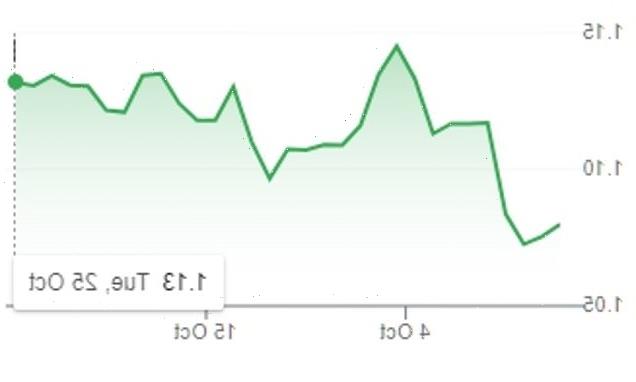

Will markets rally for Rishi? FTSE 100 lags in early trading but pound stabilises $1.12 as gilt yield returns to level before Liz Truss’s mini budget

- One pound at 8am was worth $1.1292 compared to $1.1290 at the previous close

- Meanwhile, the interest rate on a 20-year government bond stood at 3.9 per cent

- Was a more mixed picture on the stock markets, with FTSE 100 down by 250 up

The pound stabilised at $1.12 today and gilt yields returned to the level they were at before Liz Truss’s mini budget as global markets continued to see Rishi Sunak’s premiership as a source of stability.

One pound at 8am was worth $1.1292 compared to $1.1290 at the previous close.

Meanwhile, the interest rate on a 20-year government bond stood at 3.9 per cent this morning, after topping 5 per cent following Kwasi Kwarteng’s unfunded tax cuts. This effectively means it is now cheaper for the government to borrow money.

There was a more mixed picture on the stock markets, with the FTSE 100 at 8.15am down 16.15 at 6997.84, while the more domestically focused FTSE 250 was slightly in the green.

One pound at 8am was worth $1.1292 compared to $1.1290 at the previous close

Reacting to the market moves this morning, Victoria Scholar, Head of Investment at Interactive Investor, said: ‘Some of the political uncertainty has been alleviated, helping to reignite demand for beaten up UK assets like the pound as Rishi Sunak takes over as Prime Minister with a lengthy and challenging to-do list.

‘The pound is trading just shy of $1.13 while the FTSE 100 is trading around the flatline with HSBC and Whitbread at the bottom of the index after releasing results.’

The scale of the economic challenge facing Mr Sunak and Chancellor Jeremy Hunt was laid bare yesterday after data showed the UK was likely in recession.

The economic downturn worsened in October as output in the manufacturing and services sectors shrank at the fastest pace since January 2021, according to the Purchasing Managers’ Index (PMI) from S&P Global.

The closely watched survey showed a reading of 47.2 – well below the 50 mark, which separates contraction from growth – as the cost of living crisis continued to bite. This was a 21-month low, and the third successive month of shrinking output.

The outlook in the eurozone was also grim, as its PMI reading fell to a 23-month low of 48.1.

Germany reported the steepest contraction, while growth in France stalled.

Andrew Kenningham, economist at consultancy Capital Economics, said the data showed the eurozone ‘is sliding into quite a deep recession and that inflationary pressures remain intense’.

Meanwhile in China, national statistics showed its economy expanded by 3.9pc in the third quarter which – though an improvement from the second quarter’s 2.6pc contraction –meant the country was still falling short of its 5.5pc target for the full year.

Victoria Scholar, Head of Investment at Interactive Investor, said markets had welcomed some of the political uncertainty being ‘alleviated’ due to Rishi Sunak becoming PM

Chris Williamson, chief business economist at S&P Global, said the UK data ‘showed the pace of economic decline gathering momentum after the recent political and financial market upheavals’.

He said: ‘The heightened political and economic uncertainty has caused business activity to fall at a rate not seen since the global financial crisis in 2009, if pandemic lockdown months are excluded.’

Economic output ‘looks certain to fall in the fourth quarter after a likely third quarter contraction, meaning the UK is in recession,’ he added. The latest official data showed that economic output fell 0.3pc in the three months to August compared with the previous quarter. The services sector saw its first decline in activity since February 2021, when the UK was just readying to emerge from the final Covid lockdown.

John Glen, chief economist at the Chartered Institute of Procurement & Supply, said: ‘Concerns over rising energy and food bills affected consumer appetite for pubs and restaurants, and demand was scaled back.’

But there was some sign that red-hot inflation was starting to ease, as the latest rise in operating expenses was the least marked for 13 months.

While the Bank of England may be relieved that cost pressures are beginning to lift, as it tries to wrestle down the rise in the cost of living, Williamson said it was unlikely officials would be able to take their foot off the interest rate hike pedal any time soon.

The Bank has been bumping up rates since December to encourage saving rather than spending and keep a lid on prices. Yet cost pressures were still stronger than at any time in the 20 years before the pandemic – and the service sector in particular was struggling with energy bill rises and leaps in staff wages.

Markets are pricing in a 0.75 percentage point hike for the next monetary policy meeting on November 3, set to take rates to 3pc.

‘On top of the collapse in political stability, financial market stress and slump in confidence, these higher borrowing costs will add to speculation of a worryingly deep UK recession,’ Williamson added.

The grim data suppressed any relief in currency markets about Sunak’s appointment yesterday.

While the pound briefly rose following the announcement, by the end of the day it was down 0.3pc against the euro at €1.143 and 0.2pc against the dollar at $1.123.

Economists have estimated that given higher borrowing costs, rising inflation and increased spending on schemes such as the energy bill price cap, the Government will have to find an extra £40bn in spending cuts and tax hikes to get the public finances back on a sustainable footing.

But with lacklustre growth depressing tax receipts, this could prove a difficult task for Sunak and his Chancellor.

Source: Read Full Article

-

Police officer who slapped bottoms gets anonymity for mental health

-

Prince Harry ate Nando’s and got high on laughing gas as Meghan went into labour

-

I KNOW who carried out gut-wrenching ISIS-style beheading of Ukrainian captive, says ex-Wagner Group mercenary | The Sun

-

Italy PM Giorgia Meloni reveals her friend was killed in mass shooting

-

Denver weather: Warm and breezy in the city, snow expected across mountains