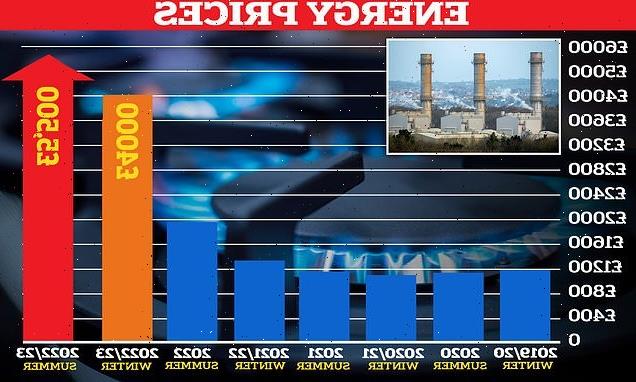

£100-a-WEEK to heat your home: Bills could rocket to £5,500 a year in spring unless action is taken warn experts in bleakest price-cap forecast yet

- Energy bills could hit staggering £104-a-week under new doomsday forecast

- Hard-up Brits would fork out £5,400 annually just to heat and power their homes

- Ofgem expected to deliver a fresh blow to household budgets of stricken families when it raises the price cap to £4,266 at the beginning of January

- Energy consultants Auxilione now warning bills could peak at £5,456 in April

Energy bills could soon hit a staggering £100-a-week as experts offered their bleakest warning yet that households will soon face an unprecedented financial hit.

Doomsday forecasts are now predicting hard-up Brits could fork out £104-a-week just to heat and power their homes from spring 2023.

In yet another dire blow to the budgets of millions of families, energy consultancy Auxilione now warns of annual energy bills of up to £5,456 from April.

Their latest forecast is more than £3,485 higher than it is currently, and smashes all previous highs that Brits have already been told to brace for.

Energy watchdog Ofgem is expected to set the price cap at £4,266 for the average household in the three months from the beginning of January – around £650 higher than its previous forecast issued at the start of August.

It comes as a minister today warned more elderly people could be struck down by flu this winter as polling suggested UK pensioners are preparing to skip out on meals just to be able to afford their new energy tariffs.

Vaccines Minister Maggie Throup said those unable to afford to heat their homes would be left in a more ‘vulnerable’ position and therefore catch disease such as flu more easily.

Energy bills could soon hit a staggering £100-a-week as experts offered their bleakest warning yet that households will soon face an unprecedented financial hit

Doomsday forecasts are now predicting hard-up Brits could fork out £104-a-week just to heat and power their homes from spring 2023. [File image]

Gas prices spiked again on Monday and unless they drop in the coming months, average households could be facing an annual energy bill of £4,650 from January and £5,456 from April.

The price of buying gas for the fourth quarter of this year is now around 100p higher per therm than it was just two week ago, while electricity prices have risen by around £100 per megawatt hour.

One therm cost 563p as markets wrapped up on Monday and a megawatt hour of electricity cost £606.

Families could start to see the first signs of respite come July 2023, with annual bills predicted to fall to £4,811 and then again to £4,446 in September, still likely to leave a large hole in the financial fortunes of millions of families.

The cost of living has become a key issue in the Tory leadership race, with Rishi Sunak vowing direct support to help families get through an ‘extremely tough’ winter.

Frontrunner Liz Truss has vowed to hold an emergency budget within weeks if she is victorious, but allies say she will focus on cutting taxes rather than handouts to cover bills.

Critics have already hit out at outgoing Prime Minister Boris Johnson for taking a back seat on the issue – while others point the blame at ‘profiteering’ energy giants.

It comes as more than 105,000 people have so far pledged via Don’t Pay UK’s website to stop paying their energy bills in response to surging costs.

The protest group, founded in June, is seeking to persuade a million households to cancel their gas and electricity direct debits on October 1 — the day the energy price cap is predicted to soar to more than £3,000 a year. It is essentially proposing an energy bill strike.

The group — whose founders choose to remain anonymous — claims that if people refuse to pay their bills en masse, suppliers will face multi-million-pound losses and be forced into talks with ministers to lower prices to ‘an affordable level’.

But charities, economists and lawyers are cautioning that Don’t Pay UK could lead to struggling families falling into illegality and even worse financial hardship.

Energy bills has rocketed in recent months due to the rising price of natural gas, partly as a result of the war in Ukraine.

Earlier this month Ofgem announced significant changes to how it will calculate the price cap on energy bills going forward.

‘While our price cap forecasts have been steadily rising since the summer 2022 cap was set in April, an increase of over £650 in the January predictions comes as a fresh shock,’ said Craig Lowrey, principal consultant at Cornwall Insight.

‘The cost-of-living crisis was already top of the news agenda as more and more people face fuel poverty – this will only compound the concerns.

‘Many may consider the changes made by Ofgem to the hedging formula, which have contributed to the predicted increase in bills, to be unwise at a time when so many people are already struggling.’

How energy bills have increased over time

2018 – £1,300

2019 – £1,353

2020 – £1,295

2021 – £1,339

(Average household bill – House of Commons Library)

January 2022 – £1,309

August 2022 – £1,971

(Ofgem price cap)

October 2022 – £3,582

January 2023 – £4,266

(Cornwall Insight forecasts)

v its forecasts last week

October 2022 – £3,359

January 2023 – £3,616

(Auxilione forecasts)

January 2023 – £4,650

April 2023 – £5,456

Hard-pressed customers across the country insisted fat cat bosses were ‘holding them to ransom’ amid uncertainty over whether prices could rise even higher in the new year.

And MoneySavingExpert’s Martin Lewis described Ofgem’s planned rise as ‘tragic news’ and warned the increased cost would be ‘unaffordable for millions’.

He urged the Government to launch an immediate ‘action plan’, suggesting the implementation of any new mitigating schemes could not wait until the end of the current Conservative leadership contest.

The Government has already promised £400 to every household, and extra help for the more vulnerable.

Last week energy bosses were hauled to Downing Street today for an emergency meeting attended by Boris Johnson and senior ministers – which concluded with no plan being agreed amid warnings bills could hit £5,000 next year and stay high for a decade.

During the meeting, Chancellor Nadhim Zahawi made clear ministers would continue to evaluate the ‘extraordinary profits’ of energy firms and the ‘appropriate and proportionate steps to take’, according to a Treasury read-out.

However, Mr Johnson told the companies that any ‘significant fiscal decisions’ would be for the next prime minister to take.

Ministers had vowed to ‘bang heads together to find a solution to the crisis, but the gathering ended with vague promises that companies would continue ‘working together’ with the government to help struggling households.

Mr Zahawi is said to be using the threat of toughened up windfall tax to persuade energy firms to invest more in renewable energy.

On Monday the Labour Party called for the price cap to be frozen at its current level of £1,971 until April to help struggling families through an otherwise disastrous winter.

It is the latest pressure to be put on the Government to add to its £400 help for households with bills that will be paid in six instalments starting in October.

The support was announced in May when experts thought the price cap would only reach £2,800 in October.

On Monday the Guardian reported that four major energy suppliers – ScottishPower, E.on, Octopus Energy and British Gas-owner Centrica – are in favour of a fund that could freeze bills for two years.

The two first suppliers have suggested a so-called tariff deficit fund to ministers. Banks would supply the cash under a Government guarantee that would let bills be frozen for the period.

The banks would then be paid back over 10 to 15 years.

The rocketing cost of feeding your family: Groceries bill is set to soar by £533 this year, research reveals

By Callum Muirhead, City reporter for the Daily Mail

Shoppers can expect their supermarket bills to rise by more than £500 this year as the cost of food continues to rocket.

Prices have surged by 11.6 per cent over the past four weeks, the fastest increase since the global financial crisis in 2008, according to research firm Kantar.

It means the average household grocery bill will shoot up by £533 this year – the equivalent to £10.25 every week.

The rise was attributed to sharp increases in essential products such as milk and butter, which have risen by 25 per cent and 23.5 per cent since last year respectively.

As a result of soaring costs, Kantar’s head of retail and consumer insight Fraser McKevitt said struggling families were starting to make lifestyle changes to cope with the ‘extra demands’ placed on their budgets. Part of this was shoppers turning to supermarket own-label ranges, which are often cheaper than branded items.

Prices have surged by 11.6 per cent over the past four weeks, the fastest increase since the global financial crisis in 2008, according to research firm Kantar. Pictured: How products have gone up in price

Mr McKevitt said as shoppers looked to make savings, own-label products were now ‘at record levels of popularity’, with sales having risen 7.3 per cent since last year to nearly 52 per cent of all grocery shopping, the biggest share Kantar had ever recorded.

He added that people were ‘shopping around’ between supermarkets to find the best value food and drink.

‘Over the past month we’ve really seen retailers expand and advertise their own value ranges across the store to reflect demand,’ Mr McKevitt said.

This trend has proved a boon for German supermarket Aldi, which saw its share of the UK grocery market rise to 9.1 per cent in the last four weeks from 8.2 per cent last year, as cost-conscious customers were drawn to its cheaper product lines.

The rise was attributed to sharp increases in essential products such as milk and butter, which have risen by 25 per cent and 23.5 per cent since last year respectively (stock image)

Fellow discounter Lidl also gained ground, attracting 7 per cent of the market compared to 6.1 per cent last year.

But Morrisons saw its share drop to 9.3 per cent from 10 per cent, and upmarket Waitrose declined from 4.9 per cent to 4.6 per cent.

The data came as overall supermarket sales increased by 2.2 per cent over the last four weeks, which was boosted by a surge in demand for drinks, ice cream and summer clothes as shoppers sought ways to cool off during the heatwave.

Kantar noted that sales of mineral water had jumped 23 per cent, while soft drinks climbed by 10 per cent and ice cream rose by 18 per cent compared to last year.

The rising cost of groceries is likely to pile further pressure on household budgets at a time when pay packets are withering in the face of soaring inflation.

Data from the Office for National Statistics showed wages excluding bonuses fell by 3 per cent in real terms in the three months to June, the fastest decline since records began in 2001.

Rocketing power bills are fuelling protest group Don’t Pay UK… But those who cancel direct debits could be cut off – and end up in court

By Steve Boggan for the Daily Mail

Railway signaller Kim Eldridge seems nervous as she talks about her hopes of bringing Britain’s energy giants to their knees.

‘I’ve never been involved in any kind of protest in my life,’ she says. ‘I’m just not like that. But when you see millions of people having to choose between food and heating while the likes of Shell and BP are making record profits, it makes you want to do something.’

Kim, 27, from Essex, is among more than 100,000 people who have signed up to the Don’t Pay UK movement in recent weeks.

Joining the battle: Kim Eldridge is among more than 100,000 people who have signed up to the Don’t Pay UK movement in recent weeks

The protest group, founded in June, is seeking to persuade a million households to cancel their gas and electricity direct debits on October 1 — the day the energy price cap is predicted to soar to more than £3,000 a year. It is essentially proposing an energy bill strike.

The group — whose founders choose to remain anonymous — claims that if people refuse to pay their bills en masse, suppliers will face multi-million-pound losses and be forced into talks with ministers to lower prices to ‘an affordable level’.

It is an idea, organisers say, borne out of desperate times, as inflation hits double digits and mortgage payments rocket.

But charities, economists and lawyers are cautioning that Don’t Pay UK could lead to struggling families falling into illegality and even worse financial hardship.

‘We hear from people every single day facing desperate choices because they’re struggling to pay their energy bills — many are simply running out of options,’ says Gillian Cooper, head of energy policy at Citizens Advice.

‘But it’s important to know that there can be serious consequences if you build up arrears. Your energy supplier can move you on to a pre-payment meter [which is more expensive than direct debit payments] or, in rare cases, even disconnect you.’

Others point out that not paying bills could damage protesters’ credit ratings and result in county court judgments — both of which would affect a person’s chances of securing loans and mortgages in the future. Nevertheless, every day thousands of people are pledging to press ahead undeterred.

The price cap, set by energy watchdog Ofgem, has already jumped by more than 50 pc this year, taking the average bill to £1,971. Consultancy firm Cornwall Insight now predicts a typical household will be paying £3,582 a year after the next increase in October, with the price cap set to tip over the £4,000 mark in January.

So it’s little wonder that such frightening price hikes are turning reluctant protesters such as Kim Eldridge into determined activists ready to break the rules.

She says she became a supporter of the movement after watching friends and family slip into financial difficulties because of rising fuel bills — and she expects her own £70-a-month charge to quadruple by January.

‘My mum, Emma [51], and my grandfather, John [73], are both disabled with arthritis,’ she says. ‘They’re now so worried about not being able to pay their bills that they are talking about moving in together just so they can keep warm this winter.

‘Near where I live, people are on low wages and fixed incomes, and they’re terrified of how they will heat their homes and feed their kids. The queues for food banks around here are horrendous.’

Not paying bills could damage protesters’ credit ratings and result in county court judgments — both of which would affect a person’s chances of securing loans and mortgages in the future

Like so many of these novice protesters, Kim has a highly responsible job, ensuring the safe movement of goods and passengers on our rail network. ‘I’m fortunate in that I receive a decent wage,’ she says. ‘But, like millions of others, I’m really starting to feel the pinch with fuel bills and interest rates going up at the same time.

‘I have a five-year fixed-rate mortgage that’s coming to an end in November, and so my mortgage will go up, too, by more than £200 a month.

‘I just think that if I’m worried about all this, what must it be like for pensioners, single parents or people on low incomes?’

Doesn’t she worry that if they do not pay their bills, they could be cut off, put on to costly pre-payment meters and have their credit ratings ruined?

‘Yes, and when I’ve been talking to friends and family about joining the Don’t Pay UK movement, I always tell them not to act unilaterally but to wait until there are a million other people who have also pledged to withhold money from the fuel companies,’ she says.

‘I believe that once you reach a critical mass like that, then there are too many people for them to take action against, and they will have to come to the table and talk about better ways of helping their customers.’

Don’t Pay UK, which won’t call for anyone to cancel their direct debit unless it receives a million pledges first, says it is gaining support from people from all professions, all political colours, and all classes.

On its website, it is seeking volunteers to help build up the campaign ‘street by street, estate by estate and city by city’.

Those who join its list of organisers will be put in contact with like-minded people in their area, and encouraged to recruit supporters by putting leaflets through letter boxes and distributing flyers at football grounds, festivals, pubs and schools.

It is also calling for donations to help fund the campaign, claiming £4,000 would buy 500,000 leaflets. Nearly £23,000 has been raised so far.

Data analyst Jake Cable, 26, fears he will soon have to give up his home and find something cheaper to heat

Last week, our sister newspaper The Mail on Sunday revealed that veteran anarchist Alessio Lunghi had been linked to the movement. In a YouTube video, he said: ‘It’s been a very intense five weeks since we launched Don’t Pay UK.’

One of the organisers, ‘Ben’, a 35-year-old engineer from Derby, agrees to talk to me via email. I ask why the organisers are anonymous — is it because they are associated with other well-known and controversial campaign groups such as Extinction Rebellion or Insulate Britain?

Ben says: ‘Neither of those groups are involved and we don’t take a position on them or anyone else. The organisers chose to remain anonymous because they are worried about any retribution from energy companies if this took off.

‘They also didn’t want to be a face of the movement. We have seen people join from all walks of life and from all political backgrounds — teachers, pub managers, vicars, hairdressers, tradespeople and office workers.

Judging from the thousands of comments on social media, many would previously never have dreamed of not paying their bills, but it shows their absolute anger and despair that they feel action like this is the only choice.’

Yet if no one is in charge, who is managing all the money donated by the public?

Ben says: ‘Hundreds of people are involved in organising Don’t Pay UK at a national level in support of local groups and organisers. This includes a dedicated finance and accounts team to handle donations.

‘We’re establishing an open accounting system ahead of incorporating into a limited company with directors and audited records. This limited company will have an asset lock to prevent directors withdrawing funds.

‘Donations are used to subsidise the cost of materials for local organisers and providing online infrastructure for the campaign.

More than two million leaflets have been sent out across the country at subsidised cost or free for those who can’t afford them.’

And what about the potential repercussions for supporters? According to Ben, the real worst-case scenario is doing nothing.

Don’t Pay UK is seeking to persuade a million households to cancel their gas and electricity direct debits on October 1 — the day the energy price cap is predicted to soar

‘Hundreds of thousands are already facing defaults, rising debt, missed payments and ruined credit scores. Tens of thousands may even freeze to death this winter,’ he adds.

Don’t Pay UK supporter Jake Cable, 26, a data analyst at a Central London university, shares a house in Hammersmith with three friends — but even with four incomes coming in, he fears they will soon have to give up their home and find something cheaper.

‘It’s a poorly insulated house but that wasn’t such a problem last winter when the monthly energy bill was around £200,’ he says.

‘We could heat it to a comfortable level, which is important because there is more working from home now. But come January, it will be just under £800 a month. That’s extortionate and we simply can’t afford it.’

Jake and his housemates, who don’t want to be named, have decided as a group to cancel their direct debit on October 1 and face the consequences. ‘We’re going in with our eyes open and of course we’re worried about court proceedings or our credit ratings being affected,’ he says.

‘For me, what I do on October 1 will be a choice. But come January it wouldn’t be a choice at all because the bill will be unpayable.

‘I don’t want to break the law for disobedience’s sake. I’ve never been the sort of person to protest or cause trouble for others. I generally like to keep my head down, so, for me, this feels uncomfortable but justified.

But Citizens Advice’s Gillian Cooper warns that it’s a risky move. ‘If you don’t come to an agreement with your supplier to pay off your energy debt, they can apply to a court for a warrant to enter your home to disconnect your supply,’ she says.

‘Unpaid bills could also be passed to debt collection agencies or companies could take non-payers to court, where they could be issued with county court judgments.’

Charities, economists and lawyers are cautioning that Don’t Pay could lead to struggling families falling into illegality

But, clearly, these are risks some people are willing to take. Among them is Lewis Ford, 31, from Hull. The IT consultant signed up to Don’t Pay UK two weeks ago after learning his monthly bill was predicted to rise to £985.72 in January.

‘It is terrifying,’ he says. ‘Last January, our bill was £254 and now it’s £350 month. I’ve already been told that in October the monthly payment will go up to a minimum of £550.’

Lewis, who is married with two children aged five and two, is trying to save for a house deposit, but rising prices are making this increasingly unlikely.

‘I earn a good wage and recently received a pay rise, but it will all be taken up by the increase in our bills. It’s like running to stand still,’ he says.

‘I’m not an activist. I’ve been on two marches in my whole life, and one of those was a gay pride march when I was a student.

‘I’ve always been opposed to strike action and the kind of protests that have a negative effect on people who don’t have the power to give the protesters what they want. But the increases in energy bills are too high and I feel I have to do something about it.

‘I know it could have a negative effect on my credit rating — but what’s the point of having a good credit rating if you can’t afford to buy a house or heat your home?’

Most of the protesters’ anger is aimed at ‘profiteering’ by energy companies such as Shell, which recorded a record £9.5 billion profit for the second quarter of the year, and BP, which netted £6.9 billion between April and June. The Mail asked BP and Shell to explain how they were making so much money and for a comment. Neither responded.

A spokesman for trade body Energy UK says: ‘Energy bills have reached record levels because of the unprecedented cost of gas on the wholesale market.

‘Suppliers need to be able to cover the costs of buying energy, otherwise we could see even more of them go out of business. Thirty suppliers have exited the market since last August which Citizens Advice estimated could add £4.6 billion to customers’ bills.’

It urged anyone who is struggling to contact their supplier and ask for help.

No one yet knows whether Don’t Pay UK will reach the million pledges it needs to trigger the big direct debit cancellation day.

But with a month-and-a-half still to go, and the fact that so many hard-working professional people who have never protested before are joining in their droves, it’s certainly a rapidly growing possibility.

Only then will the protesters find out if their risky tactics will pay off, or if even more people will be sucked into a poorer future with wrecked credit ratings and more pain to come.

Source: Read Full Article

-

Woman who believes she’s Madeleine McCann ‘meets The Rock’ as DNA submitted

-

Heartwarming video shows busker OAP raising cash for Ukraine before he was stabbed to death on his mobility scooter | The Sun

-

Fierce street battles erupt in Gaza as Hamas attacks IDF ‘at point blank range’

-

Terrifying moment shark leaps from water just metres away from surfers

-

Armed police swoop on Devon holiday park after 'significant disorder'