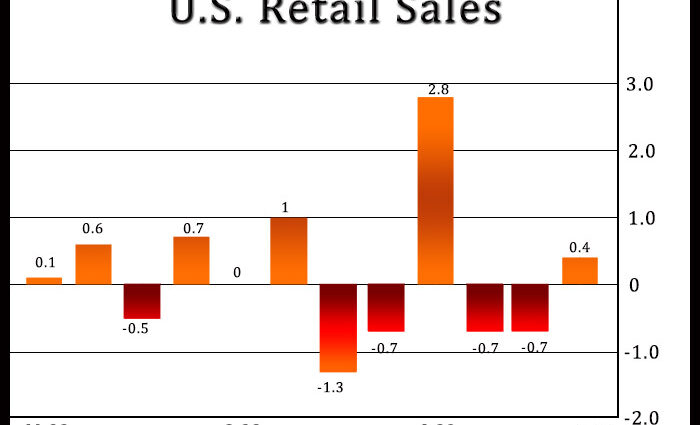

Retail sales in the U.S. rebounded by less than expected in the month of April, according to a report released by the Commerce Department on Tuesday.

The Commerce Department said retail sales rose by 0.4 percent in April after falling by a revised 0.7 percent in March.

Economists had expected retail sales to climb by 0.7 percent compared to the 1.0 percent slump originally reported for the previous month.

“With storm clouds gathering on the horizon, we think consumer spending will soon run out of steam,” said Oren Klachkin, Lead U.S. Economist at Oxford Economics.

He added, “We expect a weaker labor market, depleted excess savings buffers, tighter credit standards, and high prices will make consumers less inclined to spend in H2.”

The report also showed a rebound in sales by motor vehicle and parts dealers, which increased by 0.4 percent in April after tumbling by 1.4 percent in March.

Excluding the increase in auto sales, retail sales still rose by 0.4 percent in April after sliding by 0.5 percent in March. The rebound in ex-auto sales matched economist estimates.

Substantial growth in sales by miscellaneous store retailers and non-store retailers contributed to the advance by ex-auto sales.

Health and personal care stores and general merchandise stores also saw significant sales growth during the month.

Meanwhile, the report said sales by sporting goods, hobby, musical instrument and book stores plummeted by 3.3 percent.

Sales by gas stations, furniture and home furnishing stores and electronics and appliance stores also saw notable declines.

Closely watched core retail sales, which exclude automobiles, gasoline, building materials and food services, advanced by 0.7 percent in April after falling by 0.4 percent in March.

Source: Read Full Article