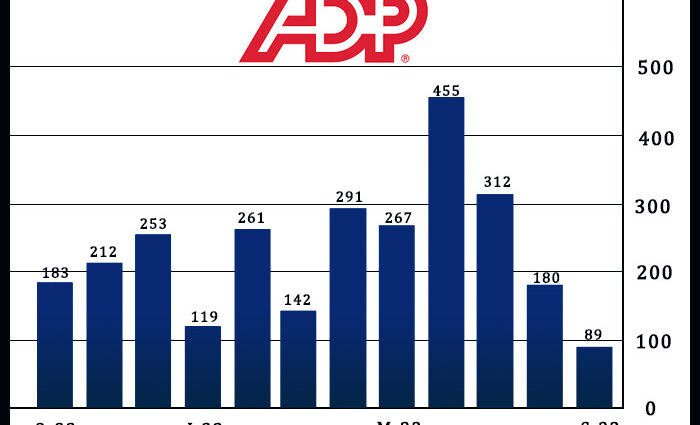

Private sector job growth in the U.S. slowed by much more than expected in the month of September, payroll processor ADP revealed in a report released on Wednesday.

ADP said private sector employment rose by 89,000 jobs in September after climbing by an upwardly revised 180,000 jobs in August.

Economists had expected private sector employment to advance by 153,000 jobs compared to the addition of 177,000 jobs originally reported for the previous month.

The increase in September reflected the slowest pace of job growth since January 2021, when private employers shed jobs.

The bigger than expected slowdown was driven by large establishments, which cut 83,000 jobs in September, wiping out the jobs they added in August.

Meanwhile, ADP said employment at small and medium establishments climbed by 95,000 jobs and 72,000 jobs, respectively.

The report also said employment in the service-providing sector rose by 81,000 jobs, as a continued increase in leisure/hospitality jobs was partly offset by the loss of professional/business services and trade/transportation/utilities jobs.

Employment in the goods-producing sector crept up by 8,000 jobs, as upticks in construction and natural resource/mining jobs were partly offset by a dip in manufacturing jobs.

ADP also said job stayers saw a 5.9 percent year-over-year pay increase in September, marking the 12th straight month of slowing growth. Pay growth for job changers also shrank to 9.0 percent in September from 9.7 percent in August.

“The labor market is cooling and is taking pressure off the Fed concerned with the risk of a second wave of inflation,” said Jeffrey Roach, Chief Economist for LPL Financial. “Businesses should get some respite as inflation decelerates and the labor market comes into balance.”

On Friday, the Labor Department is scheduled to release its more closely watched report on employment in the month of September.

Economists expect employment to increase by 170,000 jobs in September after climbing by 187,000 jobs in August, while the unemployment rate is expected to edge down to 3.7 percent from 3.8 percent.

Source: Read Full Article

-

Treasury seeks legal advice on PwC tax leaker

-

Australians the world’s richest people as property prices supercharge wealth

-

Verizon Q3 Adj. Profit Declines; Reaffirms 2022 Guidance

-

Should we use our inheritance to pay off our mortgage?

-

U.S. Consumer Sentiment Improves Modestly In October, Inflation Expectations Rebound