Save articles for later

Add articles to your saved list and come back to them any time.

Treasurer Jim Chalmers has said the federal government is prepared to take further action against PwC if necessary over a leak of confidential government tax plans, but has declined to clarify whether criminal charges are being considered.

“I’ve indicated to the Treasury and to the regulators if there are more steps that are necessary, I’m prepared to take them,” Chalmers said at a press conference on Thursday.

Treasurer Jim Chalmers says further action will be taken against PwC if necessary. Credit: Alex Ellinghausen

“I consider what happened there to be completely inappropriate. I’ve said that publicly, I’ve said that privately to the company as well.”

Peter Collins, the former PwC partner who leaked confidential government tax plans, has been banned until next year from acting as a tax practitioner. The Tax Practitioner Board (TPB) has ordered PwC to improve its management of conflicts of interest with training sessions for staff, ensuring the co-ordination of registration of conflicts, and a better governance and reporting system within the firm.

In response to questions from Greens senator Nick McKim at a Senate estimates inquiry in March, Treasury confirmed it did not originally refer the matter to the Australian Federal Police, but added that “legal advice has been sought in relation to this matter”.

Treasury has since declined to clarify this statement or reports that it only sought legal advice this week on potential criminal charges.

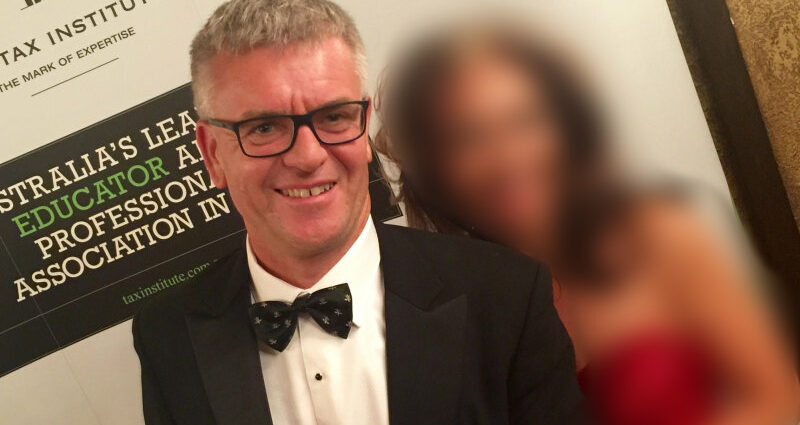

Former PwC partner Peter Collins has been banned as a tax practitioner.

The TPB has said it received intelligence on the PwC matter in April 2020 and in December 2022 informed Treasury of the outcome of its investigation. The board released some of the damning evidence that led to a former PwC partner being banned for leaking confidential government plans.

The 148-page document, which was submitted by the TPB to Senate estimates in response to queries from senator Deborah O’Neill, includes heavily redacted internal emails revealing that the sensitive information on plans to combat tax avoidance was widely shared among other staff and partners within the multinational firm.

A Senate inquiry was told this week there are clear precedents for potential criminal charges being laid and a prison sentence for leaking confidential government information.

They referred to the insider trading case in 2014, in which Australian Bureau of Statistics employee Christopher Hill was jailed for passing confidential information to his university friend, Lukas Kamay.

This masthead is not suggesting that Collins has engaged in criminal conduct, only that Treasury is considering whether to take any further steps against him and/or PwC relating to the leaking of confidential information.

Collins has not been reachable for comment since the ban became public in January.

“There is an asymmetry there,” University of Sydney Professor Jane Andrew told the inquiry. She was one of three academics who appeared.

“It shouldn’t be the fact that [if] you’re a public servant, you then bear much more substantial consequences for the same kind of activity.”

O’Neill, who chairs the Corporations and Financial Services Committee, said further action was needed but cautioned against undue haste.

“I don’t think an overnight knee-jerk reaction to this is going to be sufficient to deal with what has been revealed as a deep cultural reality within PwC,” she said.

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.

Most Viewed in Business

From our partners

Source: Read Full Article

-

Compulsory super only really benefits one group of workers

-

Cheetos and a fancy croissant: What a fashion designer on $90,000 spends in a week

-

The ‘five families’ threatening to shut down the US government

-

Why China’s confidence could turn out to be a weakness

-

UK House Prices Fall Most Since 2009; Mortgage Approvals Decline