Save articles for later

Add articles to your saved list and come back to them any time.

The Australian Tax Office has confirmed it met with PwC’s then-chief executive, Carlton Football Club president Luke Sayers, in August 2019 – nearly two years after it suspected former PwC partner Peter Collins had leaked Treasury’s confidential tax plans.

The information was released Monday afternoon in a response to queries from Labor senator Deborah O’Neill, via senate estimates. It raises further questions about what Sayers knew about the scandal.

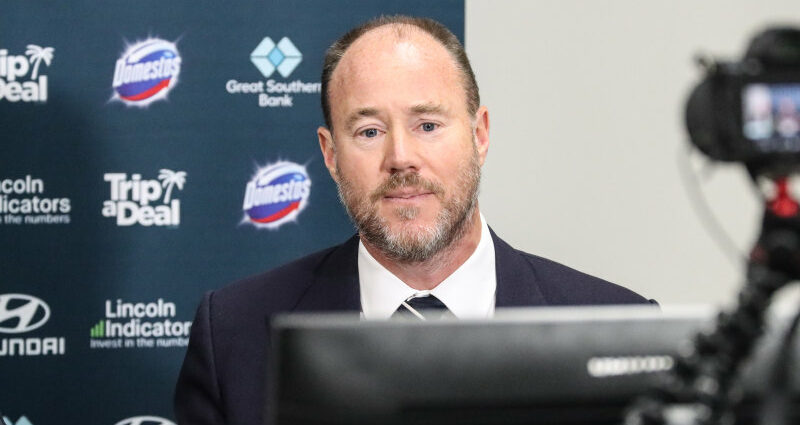

Carlton president and former PwC CEO Luke Sayers. He has previously indicated that he had no knowledge of PwC’s use of the confidential tax information that triggered multiple investigations.

Sayers has previously indicated that he had no knowledge of PwC’s use of the confidential tax information that has triggered multiple investigations, including a criminal probe by the Australian Federal Police. Sayers has been approached for comment.

The ATO response to O’Neill’s query also reveals that the Tax Office looked at potentially charging PwC with criminal offences in relation to its use of legal claims that served to block the ATO’s access to information about the firm’s tax schemes and clients.

The ATO document reveals a detailed timeline that includes a meeting between Sayers and the ATO’s second commissioner, Jeremy Hirschhorn, on August 29, 2019, and reports that: “The meeting covered a range of ATO concerns related to PwC conduct and the formal notice process.”

It said Hirschhorn suggested that Sayers “personally review the internal emails”.

The document does not state whether Collins or the confidential information leak were discussed at this meeting. This meeting was held months after the AFP determined that the ATO had not provided sufficient information to support a referral for a criminal investigation.

That changed in May this year when Treasury referred the matter to AFP for a criminal investigation, following the release of more than 140 pages of damning emails detailing the scale of PwC’s attempts to profit from the confidential government plans.

The ATO document reveals a later meeting between Hirschhorn and Sayers in February 2020, ahead of the firm’s election of a new CEO.

“The PwC board should ensure that it is full abreast of the range of concerns the ATO has had with PwC Tax Group’s behaviour,” Hirschhorn told Sayers.

The meeting was held months after the AFP determined that the ATO had not provided sufficient information to support a referral for a criminal investigation.Credit: Bloomberg

There was a final meeting between Sayers and Hirschhorn in April 2020 – just weeks after the Tax Office referred the Collins matter to the Tax Practitioners Board (TPB) over the potential confidentiality breach. It was just before Sayers retired from PwC and set up his own firm.

The document does not reveal what was discussed at this meeting.

The information released by the Tax Office also details its escalating legal battle with PwC over the firm’s controversial claims of legal professional privilege (LPP) to try and shield the tax schemes and clients that used them.

“As the ATO considered many LPP claims baseless, it wished to explore whether this constituted criminal non-compliance with the formal notices,” the ATO said.

The ATO was advised by the Commonwealth Director of Public Prosecutions (CDPP) that there was insufficient evidence to instigate a prosecution.

The ATO has been questioned by senate committees about its communications with the AFP, which led to the original pursuit of criminal charges being dropped in 2019.

It said this response on Monday was designed to provide some transparency without jeopardising the current AFP investigation.

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.

Most Viewed in Business

From our partners

Source: Read Full Article

-

Powell Says Fed 'Will Not Hesitate' To Resume Raising Interest Rates

-

Alnylam Q2 Loss Widens, SGEN Boosts Revenue Outlook, NVCR To Report LUNAR Study Data In Q1

-

U.S. Homebuilder Confidence Inches Up To Highest Level In Over A Year

-

UK Economy Stalls In Q3 As High Inflation Hurt

-

China Exports Log Slower Growth; Imports Decline