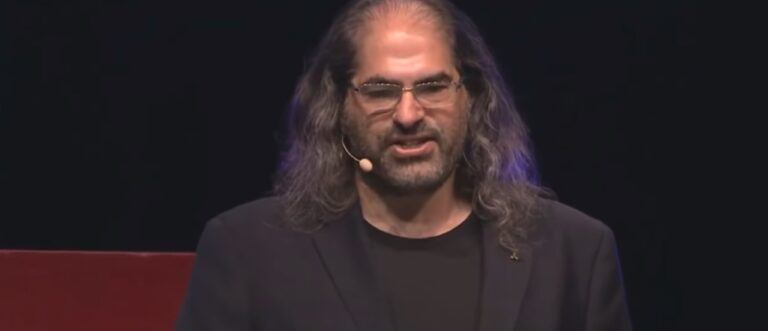

On December 20, 2023, Ripple’s Chief Technology Officer, David Schwartz, shared his predictions for the year 2024 on social media platform X, focusing on the evolving landscape of blockchain technology and its intersection with other sectors. His insights cover a range of topics from AI integration to the rise of stablecoins.

1. AI and Blockchain Convergence: Schwartz predicts that by 2024, the amalgamation of AI and blockchain will be transformative for cybersecurity and financial services. He also says that AI’s role in ensuring blockchain security will be pivotal, enabling precise market insights and automating trading processes. He highlights the use of AI chatbots, like those on the XRP Ledger (XRPL), as tools to simplify development, thereby promoting global innovation and financial inclusion.

2. Real World Asset (RWA) Tokenization: Schwartz thinks that the tokenization of RWAs, particularly in real estate and commodities, is going to drive the blockchain economy significantly. Schwartz foresees tokenized RWAs on the XRPL enhancing collateralized loans, improving interoperability, and attracting institutional adoption. Furthermore, he anticipates this shift to reshape the financial sector, with XRPL positioned as a leading blockchain for these use cases.

3. Decentralized Identity (DID) Adoption: Schwartz envisions a revolution in privacy on the blockchain through the adoption of DIDs. Decentralized Exchanges (DEXes), empowered by DIDs, are expected to see increased institutional volume, which will contribute to growth and liquidity in decentralized finance. According to the Ripple CTO, the proposed XLS-40 amendment, introducing DID capabilities to the XRPL, marks a new era in privacy, security, and financial innovation.

4. Interoperability and Smart Contracts: By 2024, blockchain interoperability is predicted to break down silos, creating a unified and efficient ecosystem. Protocols like the Cross-Chain bridge amendment for the XRPL will spur innovation, fostering new DeFi applications. He expects this development to drive mainstream adoption, unlocking the full potential of blockchain across various industries.

5. Stablecoins in Global Finance: Schwartz believes that stablecoins will reshape global finance by creating new foreign exchange corridors and reducing dependence on the USD. He predicts the Middle East will lead in stablecoin adoption for regional trades. He also mentions that financial institutions standardizing integration with blockchains will pave the way for stablecoins to become a universal tool, streamlining international transactions and unlocking new economic potential.

On 19 December 2023, Monica Long, President of Ripple, provided her crypto predictions for 2024.

Long predicts an end to the crypto industry’s speculative hype cycles, characterized by extreme fluctuations. She anticipates this shift will pave the way for a new ‘crypto summer.’ Her focus is on building a foundation for cryptocurrencies to have real-world utility, addressing challenges in compliance, usability, and integration with existing financial systems.

A key breakthrough for 2024, according to Long, will be in decentralized finance (DeFi) compliance, indicating a move towards more regulated and secure DeFi environments. She views the current market downturn, or ‘crypto winter,’ as an opportunity for developers to solve real-world problems using blockchain technology.

Long emphasizes the need for the crypto industry to prioritize compliance and transparency in 2024 to regain trust. This includes developing compliance tools within a decentralized framework. She also notes the growing trend of traditional financial giants like Fidelity, BlackRock, PayPal, and Visa partnering with crypto-native companies, foreseeing a collaborative relationship where blockchain augments traditional banking.

Highlighting the benefits of blockchain for instant cross-border payments, Long sees this as advantageous for both merchants and consumers. She stresses the importance of user-friendly crypto solutions that don’t require extensive crypto knowledge from users.

Finally, Long recognizes the mainstream recognition of cryptocurrency but believes 2024 could be a pivotal year for institutional adoption, especially if the industry continues to prioritize a compliance-first approach.

Source: Read Full Article

-

European Parliament Passes Resolution on Crypto Tax and Blockchain Use To Make Tax Collection More Efficient

-

Celsius Network approved to convert altcoins into BTC or ETH

-

How Bitcoin ATMs in Greece fare during a record-breaking tourist season

-

Crowd Strike Holdings Warns of New Crypto Jacking Scheme

-

European Union pushes forward with first AI framework: Law Decoded, April 24–May 1