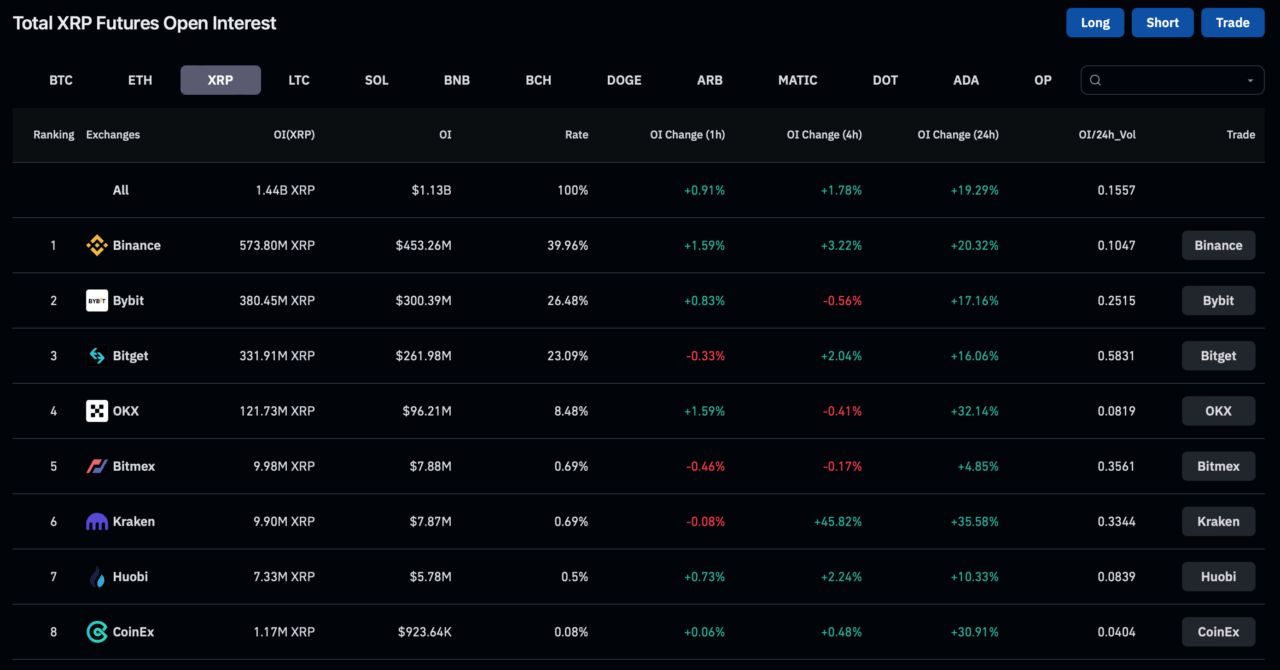

Open interest on XRP-tracked futures has reportedly been climbing above $1.13 billion in the past 24 hours.

According to an article by CoinDesk published earlier today, this figure surpasses the $1 billion level reached last week, setting a new record high for the year. This surge in open interest comes as XRP tokens themselves have seen significant gains, with a 6% increase for a second consecutive day, even as other major cryptocurrencies remained relatively stable.

Before we go any further, it’s important to understand what open interest means in the context of futures contracts. Open interest refers to the total number of outstanding futures contracts that have not been settled. In other words, these are contracts that have been traded but not yet liquidated by an offsetting trade or an associated delivery.

In the context of XRP futures, the rise in open interest indicates an increase in the number of unsettled futures contracts related to XRP. A rise in open interest generally signals that new money is flowing into the marketplace. This is usually interpreted as an expectation that the current trend— in this case, the rising value of XRP— will continue.

The majority of these positions are on crypto exchanges Binance ($453 million), Bybit ($300 million), and Bitget ($262 million).

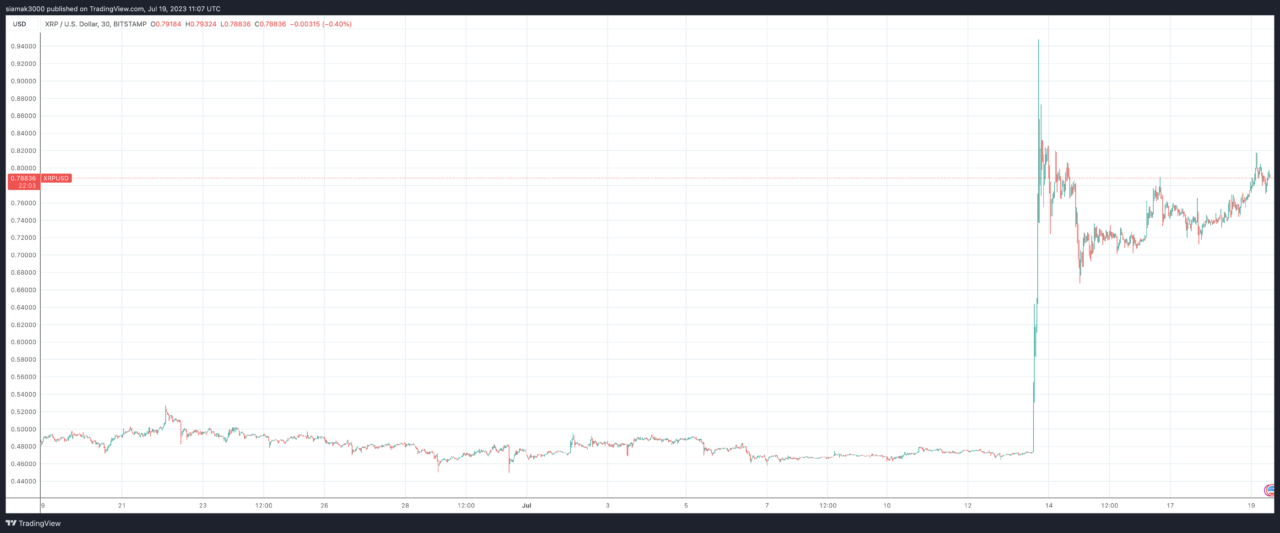

This record high in XRP open interest comes in the wake of last week’s U.S. district court ruling by Judge Torres that the sale of XRP on exchanges did not constitute investment contracts. Following the court order, XRP saw a significant surge, rising as much as 96%, with trading volumes jumping to billions of dollars in the immediate aftermath.

Featured Image Credit: Photo / illustration by vjkombajn via Pixabay

Source: Read Full Article

-

"Finalized" EU MiCA Crypto Regulation Seeks To Police NFTs And Algorithmic Stablecoins

-

PancakeSwap changes its recipe with the launch of Version 3

-

New Pepe the Frog Meme Currency Is Exploding in Price

-

Former Coinbase Product Manager Pleads Guilty To Insider Trading In Landmark U.S. Case

-

Ripple CEO Hails 'Unequivocal Win' for Crypto After XRP Ruling