Bitcoin, the leading digital currency, has often seen its fortunes rise with October’s arrival, and historical data points towards the possibility of a similar trend this year.

Over the past decade, Bitcoin’s October performance has been notably bullish, leaving many investors hopeful for a turnaround after recent challenging months. But while the past does offer a ray of optimism, the unpredictable nature of crypto markets means that the future remains uncertain.

A Decade Of October Gains For Bitcoin

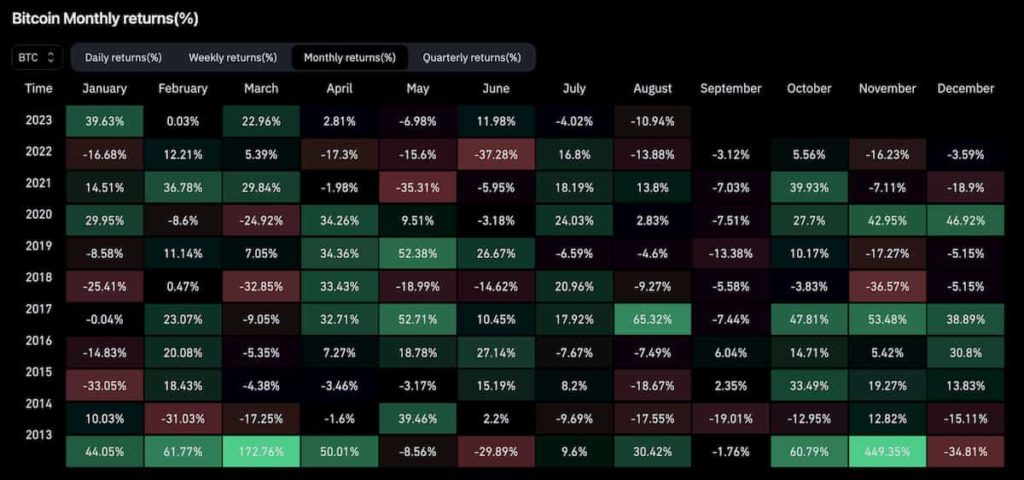

Influencer Crypto Tony recently shed light on Bitcoin’s historically positive performance in October. Sharing a decade-long chart of Bitcoin’s track record, Tony highlighted that eight of the past ten years have seen Bitcoin close October with commendable gains.

8/10 OUT OF 10 OCTOBERS HAVE BEEN BULLISH FOR THE MARKETS

We are still only 4 days in, plenty of time to see a nice bounce in the month and close green pic.twitter.com/xM4EhD7Jrs

— Crypto Tony (@CryptoTony__) October 4, 2023

The data speaks for itself; in 2021, Bitcoin soared by 39.93% in October, while 2020 saw an increase of 27.7%. In 2017, October ended with a bullish surge of 47.81%, and a 60.79% leap in 2013 is the most significant October gain yet.

It is worth noting that this analysis offers more than just numbers. It paints a picture of optimism for many in the crypto community, fostering hope that this October would again be favorable for Bitcoin.

Tony, bullish in his perspective, remarked that although Bitcoin’s current price may not seem overly promising, it’s worth remembering we are in the early days of October. Thus, there’s ample opportunity for the market to rebound.

Past Performance Vs. Future Predictability

However, some in the community advise caution, as with any trend analysis. Relying purely on historical data to forecast future market movement can be a precarious strategy.

An anonymous user on platform X (formerly known as Twitter) voiced such concerns, arguing that while the future often exhibits patterns reminiscent of the past, it doesn’t necessarily mirror it. “Skeptical about predicting the future based solely on past results. The future often rhymes with the past but isn’t an exact repeat,” they commented.

Notably, despite these reservations, investors often consider the historical positivity Bitcoin showcased in October. Whether or not the crypto will adhere to its previous patterns remains to be seen. Meanwhile, Bitcoin has shown quite an upward trajectory over the past week.

Notably, the top crypto has surged by 5.2% in the past 7 days and 1% in the past 24 hours, bringing its current market price to trade at $27,699 at the time of writing with a market capitalization of $9.6 billion.

Featured image from iStock, Chart from TradingView

Source: Read Full Article

-

Is Ethereum Set to Rally After Shanghai? Data Suggests Bullish Sentiment

-

Binance, CZ paid for defying financial, political status quo — Arthur Hayes

-

XRP Price Could Regain Strength If It Clears This Resistance

-

How to strike a balance between blockchain transparency and privacy: Nansen CEO

-

Ark Invest sells more Coinbase shares, eyes Meta platforms, Robinhood