The price of Uniswap (UNI) is breaking below its moving average lines, signaling the resumption of a downtrend. After encountering resistance at the recent high, the altcoin quickly fell to the lower price range.

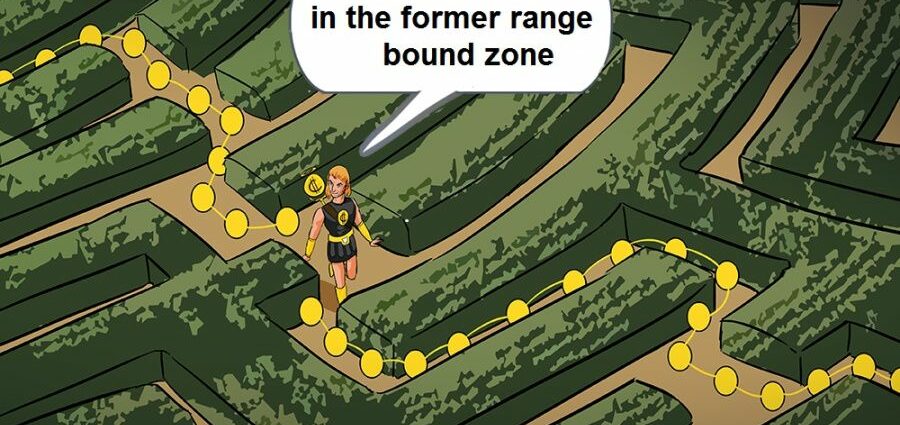

The recent slump began after the November 5 uptrend was broken near $8.00 resistance. UNI is now in the former range bound zone. Uniswap has been restricted to a price range between $5.00 and $7.00 since August 19. If the rangebound levels are broken, the cryptocurrency will reenter the trend. As the market has entered the overbought zone, the current breakdown has been averted. At the time of writing, the cryptocurrency is trading at $5.55.

Uniswap indicator reading

The Relative Strength Index for the 14 period is at 40. After a recent breakdown, the altcoin has now entered the bearish trend zone. With the price bars below the moving average lines, it is likely to fall further. With the stochastic on the daily chart below 40, the altcoin has bearish momentum.

Technical indicators:

Major Resistance Levels – $18.00 and $20.00

Major Support Levels – $8.00 and $6.00

What is the next direction for Uniswap

After rejecting the $8.00 resistance zone, UNI is currently in a downtrend. The altcoin briefly corrected upwards and reached a high of $6.00. The altcoin will continue to fall as it faces resistance at the $6.00 high. On the other hand, the bulls will buy the dips when the price drops to the lower price area of $4.75.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coin Idol. Readers should do their own research before investing in funds.

Source: Read Full Article

-

Award-Winning UK Bank ‘Starling’ Says ‘We Consider Crypto Activity To Be High Risk’

-

Perfect storm for undervalued ASICs: Blockstream plans $50M raise to buy miners

-

Binance still serving Russians while seeking clarity on EU crypto sanctions

-

Bitcoin Ordinals surpass 10M inscriptions as creator Rodarmor steps down

-

Shiba Inu Holds Above $0.00000850, Bulls And Bears Show Indifference