A Stanford MBA has explained why the current Bitcoin cycle was different from the others, and why the next one could end up being bigger.

This Bitcoin Cycle Faced Obstacles That May Not Be There Next Time

A “cycle” for Bitcoin refers to the period between two consecutive halvings. The halvings, events where the rewards miners receive for solving blocks on the network are permanently slashed in half, are chosen as the start and end points for the cycles due to the immense significance they hold for the cryptocurrency.

The rewards miners earn are essentially the only way new supply can be introduced into circulation, so since halvings cut these in half, the production rate of the asset itself gets tightened.

Because of basic supply-demand dynamics, Bitcoin’s post-halving scarcity increases the asset’s valuation. It’s not a coincidence that the bull markets have always followed these special events.

The halvings occur roughly every four years, with the next one being scheduled for next year. As BTC transitions towards a new cycle, Jesse Myers, a Stanford MBA, has released a new post that looks back at this cycle so far and compares it with the previous cycles.

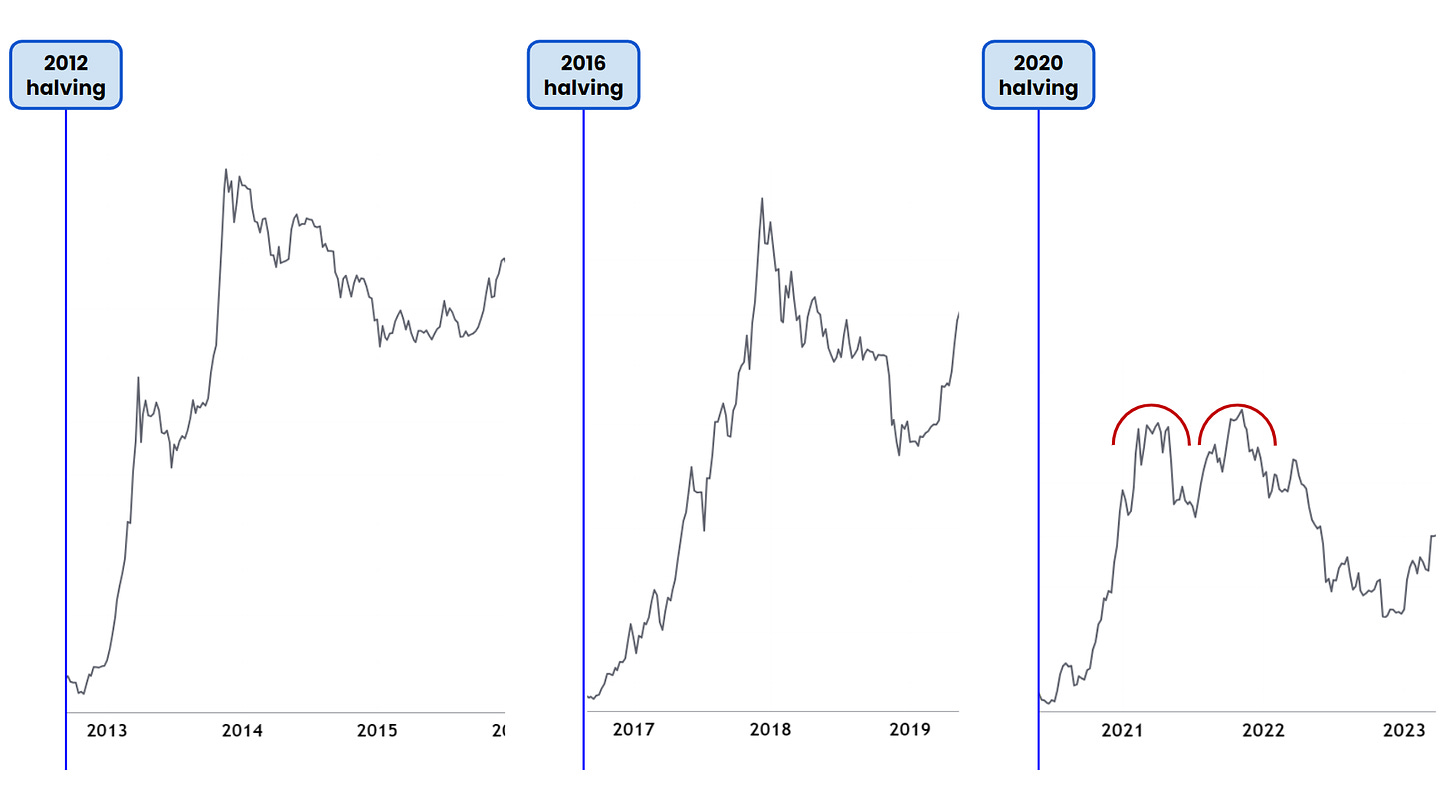

At first sight, one difference becomes immediately clear: the structure of the top during this past bull market wasn’t anything like what the previous cycles displayed.

How the previous halving cycles looked like at the current stage | Source: Once-In-A-Species

“Instead of a parabolic advance culminating in a blow-off top, we got a bi-modal rounded top spread out over six months,” notes Myers. So, why did the BTC price behave differently during this bull market?

Well, there are mainly four factors at play here. The first and undoubtedly the biggest one would be COVID-19 and the US government’s response to it. The onset of the virus and the black swan crash that came with it just preceded the cycle, meaning that the cycle kicked off in anomalous conditions.

During the cycle itself, the Fed was giving out stimulus checks as a way to mitigate the economic impacts of COVID. “That Quantitative Easing (QE) undoubtedly helped fuel the 2021 Bitcoin bull market,” explains the Stanford MBA.

The problem came, however, when the Fed changed its policy and switched to Quantitative Tightening (QT). Interestingly, this switch appears to be what marked the Bitcoin top in November 2021.

In the middle of all this, another factor was also at play: the May 2021 China ban on Bitcoin mining. Back then, China was the biggest hub of cryptocurrency mining, so the ban naturally delivered a significant shock to the sector.

The resulting selling pressure crashed the market, leading to the bull rally prematurely halting. It wasn’t until three months later that bullish winds once again returned for the asset.

While these factors have been quite influential for BTC, it’s apparent that they are unlikely to repeat, meaning they shouldn’t have any presence in the next cycle.

On the contrary, the other two factors that made this cycle different are likely to appear in the next cycle as well. This previous bull market was the first one where investors widely used leveraged futures trading. Probably, leverage would again come into play in the next bull market.

Lastly, there is the fact that platforms like FTX issue a lot of “paper Bitcoin.” Supply equivalent to 25% of the mined BTC that year was owned by FTX’s customers, but this BTC didn’t exist; it was only there on “paper.” The analyst believes that such fudging will likely be present during the upcoming cycle.

While there had been some developments in this cycle that ultimately shortened the bull market, some changes can be favorable for the next cycle.

The Bitcoin supply is quickly moving off exchanges, and the HODLers getting hold of the majority of the supply has often been making the news recently. Still, there is another super exciting factor.

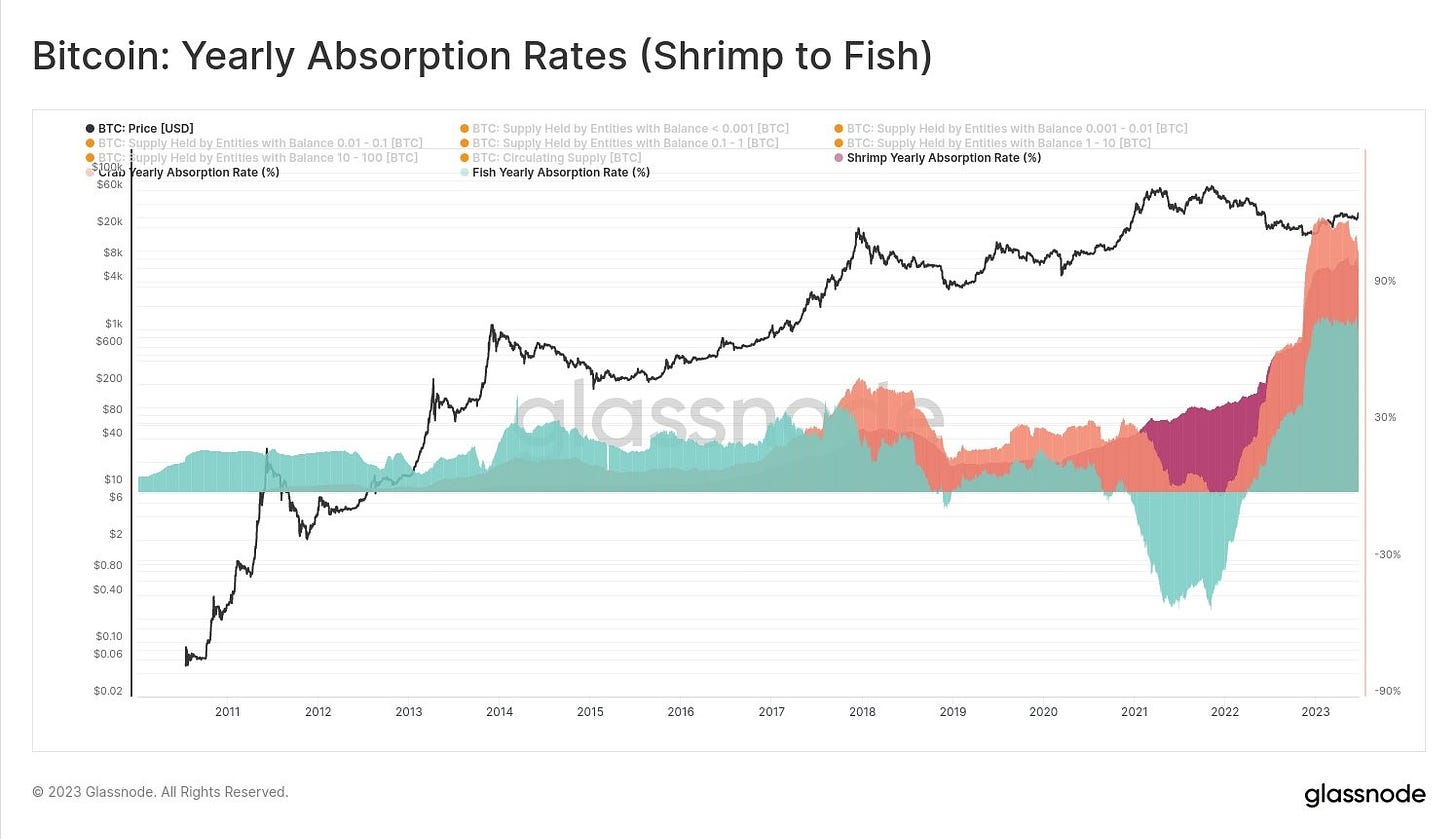

Accumulation from the small investors | Source: Once-In-A-Species

According to this chart from Glassnode, the relatively small entities on the network (holding less than 100 BTC) have been accumulating 275% of all Bitcoin being mined.

The fact that this rate is more than 100% suggests that the smaller investors are taking coins off the likes of whales. “This has never happened before. We have reached some kind of inflection point,” says Mjers.

Soon the halving will occur, and this supply shock brewing in the market will only get tighter. Perhaps the smaller investors are looking to get in before this happens.

Mjers mentions, however, that these individuals aren’t the only ones catching on; asset managers like Blackrock are also coming around and pushing to get themselves into the industry.

As mentioned before, the QT policy proved disastrous for BTC in this cycle, but a shift back towards QE may be imminent, which would naturally boost the market instead. The analyst thinks this event might coincide with the upcoming halving of the cryptocurrency.

Now, based on all these factors, these are probabilities that Mjers has assigned to the different price range predictions for the next cycle:

The likeliness of each price range | Source: Once-In-A-Species

The Stanford MBA believes that a growth of more than 8x, a multiplier higher than what the current cycle saw, is the second most probable scenario, given all the potentially positive developments.

A cycle outperforming the previous has never happened in the cryptocurrency’s history, so if this scenario happens, it would be a first.

BTC Price

At the time of writing, Bitcoin is trading around $29,300, down 2% in the last week.

Source: Read Full Article

-

TRON Is In A Positive Move, But Risks Rejection At $0.074

-

The Ascending Trajectory of $RON: Setting the Pace for Years to Come

-

Coinbase app is ‘broken’ for UX, admits CEO Brian Armstrong

-

Bitcoin Cash Analysis: Rally Seems Unstoppable above $130

-

Midjourney, other AI devs strike back in court, claiming their material is not similar to artists