PEPE has recently made a stunning comeback by surpassing its local highs with a remarkable 20% weekly surge. This unexpected turn of events have provided some relief to investors who thought the frog-themed coin will never be able to get back on its feet again.

What has propelled this sudden comeback, and what does it signify for the future of this meme coin?

PEPE Maintains Bullish Pace As Open Interest Rises

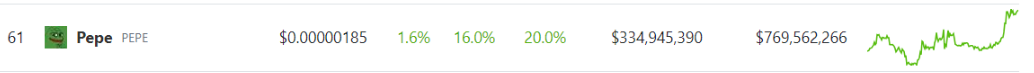

PEPE, currently priced at $0.00000185 according to CoinGecko, has recently experienced a remarkable surge in its value. Over the course of 24 hours, the asset witnessed a notable rally of 16%, and within the span of just seven days, it soared by an impressive 20%.

Source: Coingecko

Upon analyzing the OI (Open Interest) chart from Coinglass, it becomes evident that the surge in PEPE prices was accompanied by a simultaneous increase in Open Interest. This indicates that speculators in the Futures market were not only convinced of a bullish move but were also willing to bid on the asset, expressing their confidence in its potential.

The Open Interest chart indicated that speculator sentiment continued to be robust. Source: Coinglass

Furthermore, a PEPE price report revealed that the Relative Strength Index (RSI) displayed bullish momentum. Prior to the rally, PEPE came close to testing the 50% retracement level at $0.00000135.

This observation suggests that the asset is likely to approach and potentially surpass the 23.6% and 61.8% extension levels at $0.000002 and $0.00000233, respectively.

Such indications further fuel the optimism surrounding PEPE’s recent surge and raise questions about the asset’s future growth potential.

BTC’s Role Remains Key

The recent surge in PEPE, accompanied by positive indicators and price action, has bolstered expectations of continued gains for the asset. However, it is important to consider the potential impact of Bitcoin’s price movement, as a rejection from the $30.8k-zone could potentially shift market sentiment toward the sellers.

The influence of Bitcoin, as the leading cryptocurrency, cannot be overlooked. Bitcoin often sets the tone for the overall cryptocurrency market sentiment.

Bitcoin breaches the $31K territory. Chart: TradingView.com

Should Bitcoin face a rejection near the $30.8k-zone, it could create a cautious atmosphere and shift sentiment toward sellers in the market. This scenario would likely impact PEPE and other altcoins, potentially hindering their upward momentum.

As traders and investors continue to monitor PEPE’s performance, keeping a close eye on the Bitcoin price movements becomes crucial. The interplay between these two assets could play a significant role in shaping the market sentiment and determining the future trajectory of PEPE’s price.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Answers in Genesis

Source: Read Full Article

-

Unleashing the Bull Call Spread: A Profitable Option Strategy

-

Polkadot Breaks the Initial Resistance but Fails to Sustain Above $10 High

-

$MATIC: Brazilian Financial Powerhouse ‘BTG Pactual’ Launches Polygon-Powered Stablecoin

-

Blockchain is the answer to Russia’s settlement issues, banking exec says

-

Vessel Capital secures $55M to invest in Web3 infrastructure: Report