Introduction to Jupiter

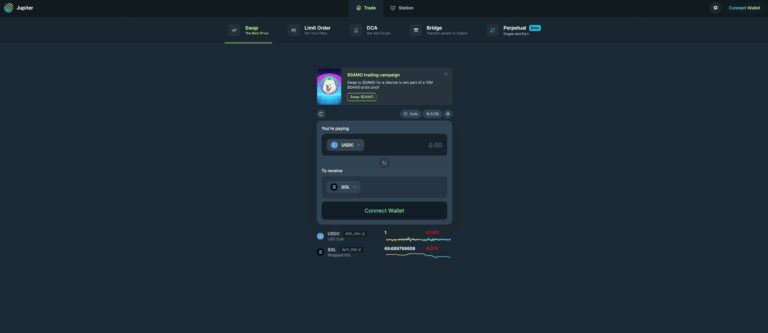

Jupiter is a liquidity aggregator on the Solana blockchain.

A liquidity aggregator in the context of decentralized finance (DeFi) is a tool or platform that consolidates liquidity from various sources, typically across multiple decentralized exchanges (DEXs) and Automated Market Maker (AMM) pools. This aggregation serves several important functions:

- Pooling Liquidity: It combines the available liquidity from different DEXs and AMM pools. This is particularly useful in the DeFi space, where liquidity can be fragmented across many platforms. By pooling these sources, a liquidity aggregator creates a more unified and deeper pool of assets.

- Optimizing Trade Execution: With access to a broader range of liquidity sources, a liquidity aggregator can find and offer the best available trading prices for users. It compares prices across its network of DEXs and AMMs to ensure that users can execute trades at the most favorable rates.

- Reducing Slippage: In trading, especially in less liquid markets, large orders can significantly impact the market price of an asset, a phenomenon known as slippage. Aggregators help mitigate this by distributing orders across multiple sources, allowing for larger trades to be executed with minimal impact on the asset’s price.

- Smart Order Routing: These platforms often employ algorithms to intelligently route orders. This can involve splitting a large order into smaller parts to be executed across different liquidity sources, optimizing for factors like price, speed, and the likelihood of order fulfillment.

- Enhancing Market Efficiency: By consolidating liquidity and offering improved price discovery, liquidity aggregators contribute to the overall efficiency of the market. They help to even out price discrepancies across different platforms, leading to more consistent and fair pricing for assets.

- User Convenience: For users, aggregators provide a single interface to access a wide range of liquidity sources, simplifying the trading process. Instead of having to manually check and trade on multiple DEXs, users can rely on the aggregator to find the best trade execution.

Insights from “One of Jupiter’s Founders

In a comprehensive post on social media platform X, “meow,” a pseudonymous founder of Jupiter, shared the platform’s strategic vision and tokenomics. The plan includes airdropping 4 billion JUP tokens, starting in January 2024, spread over multiple rounds. This initiative is part of a broader strategy to deepen community involvement in Jupiter’s ecosystem and the wider Solana network.

Meow highlighted that Jupiter’s tokenomics are designed to reflect a 50-50 split between the team’s management and community distribution. This structure aims to create a harmonious balance, ensuring that the community’s voice acts as a counterweight and fact-checker to the team’s decisions. The absence of a traditional token sale redirects 20% of the tokens towards liquidity provision and community contributors. This decision underscores Jupiter’s focus on community-driven growth and decentralized governance.

Token Distribution and Community Involvement

The founder elaborated on the token distribution strategy. For the team-managed portion, 10% will be used for liquidity in the first year, while 20% allocated to the current team will begin vesting after a year over a two-year period. The remaining 20% will serve as a strategic reserve for future team members, strategic investors, and past Mercurial stakeholders, locked for at least a year with a six-month notice required before any liquidity event.

For the community portion, 40% of the tokens are planned for distribution over four rounds of “growing the pie” airdrops. An additional 10% is earmarked for community contributors and grants, likely to be managed by a Decentralized Autonomous Organization (DAO). This allocation is intended to incentivize community participation in Jupiter’s growth and the broader Solana ecosystem.

Long-Term Vision and Ethos

Meow articulated a long-term strategy that involves leveraging Jupiter to drive the decentralized meta forward, particularly within the Solana ecosystem. This includes fostering a secure, independent team capable of making strategic decisions for the platform’s future. The ethos is centered around growing the decentralized meta, building a robust team, and supporting the broader Solana and crypto ecosystem.

Featured Image via Jupiter

Source: Read Full Article

-

OKX launches crypto exchange, wallet services in Brazil

-

How Ripple's Monthly XRP Sales Link to Potential Price Suppression, According to Expert – Coinpedia Fintech News

-

Coinbase cites SEC action against Kraken in push for crypto rulemaking

-

Ripple's XRP Price At $10 Now As Nigh As Ever After Yet Another Landmark Win Against The SEC

-

I'm the captain now: Musk chops Twitter board, becomes sole director