As the cryptocurrency market recovers, institutional investors are growing their bets on crypto investment products, with inflows over the past six weeks now reaching $767 million, the largest figure seen since the 2021 bull market and topping last year’s figures.

According to CoinShares’ latest Digital Asset Fund Flows weekly report, last week’s inflows totaled $261 million, with $228.9 million going to products offering exposure to the flagship cryptocurrency Bitcoin, bringing inflows for BTC-focused products to $842 million.

Products offering exposure to Ethereum’s Ether, the second-largest cryptocurrency by market capitalization, saw $17.5 million in inflows over the past week but over $107 million of outflows for the year so far.

Institutional bets on the cryptocurrency market have increased after BlackRock, the world’s largest asset manager, took a pioneering leap on June 16 with a spot Bitcoin exchange-traded fund application, seemingly igniting a domino effect as peers rushed to file similar applications.

That application has led to major financial powerhouses that collectively manage an astounding $27 trillion in assets to make inroads into the world of Bitcoin and cryptocurrency after a race to list the first spot Bitcoin exchange-traded fund (ETF) in the United States kicked off.

The $27 trillion figure, it’s important to point out, represents a total of assets under management across the aforementioned institutions, and only a minuscule fragment of this gargantuan sum is anticipated to be channeled into cryptocurrency investments

According to CoinShares’ report, the current run of inflows into cryptocurrency investment products “is the largest since the end of the bull market in December 2021,” as U.S. investors are beginning to participate, leading to the “largest inflows of any region” totaling $157 million.

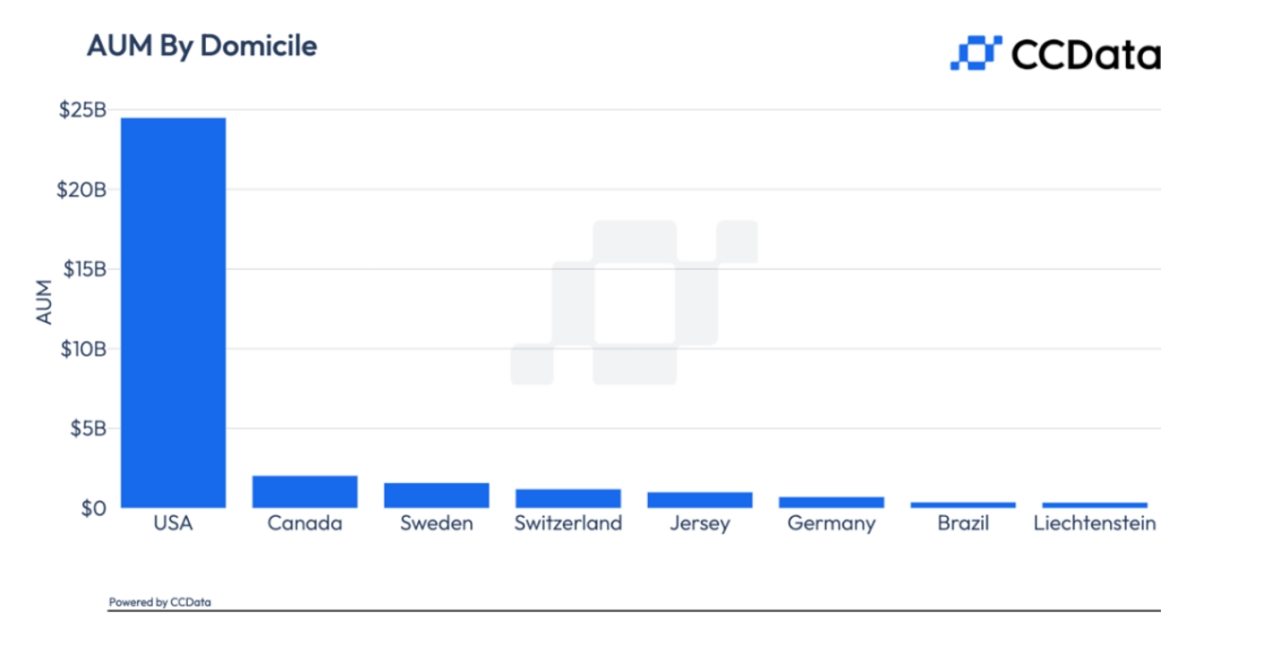

According to CCData’s latest Digital Asset Management Review report, the US has remained the leader in assets under management (AUM) by domicile in October, with a 3.22% increase to reach $24.5 billion and a 77.3% share of the total market.

The report also notes that AUM in Canada grew to $2.03 billion due to the strong performance of products such as Evolve’s EBIT, Purpose Invest’s BTCC, and 3iQ CoinShares’ BTCQ.

Featured image via Pixabay.

Source: Read Full Article

-

Bitcoin Weekly Chart Completes Double Top: Market Shifts Ahead?

-

Vitalik Buterin Wants All Crypto Exchanges to Be Transparent About Their Financials

-

JPMorgan rolls out programmable payments for institutional blockchain platform JPM Coin

-

Coinbase, whose CEO called most politics a 'distraction', launches voter registration tool

-

Ripple's lead engineer to exit after nearly a decade with the firm