Over the past decade, China, the world’s second-largest economy, has been methodically reducing its holdings of US government-backed securities. This strategic move has resulted in China’s holdings of Treasury securities dropping to a level not seen in over 14 years, according to the latest data from the U.S. Treasury Department.

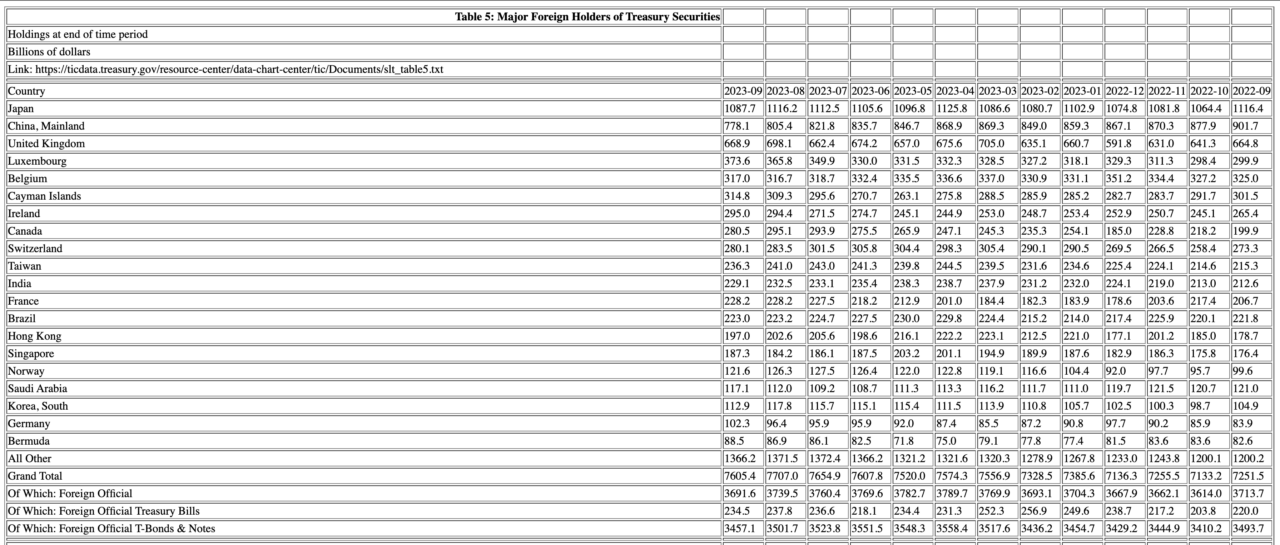

According to an article by Jenry Kanapi for The Daily Hodl, China’s accumulation of US Treasuries peaked in May 2013, reaching an all-time high of $1.297 trillion. This period marked the zenith of China’s investment in US government debt. Since that peak, China has been consistently divesting its Treasury holdings. As of September 2023, these holdings have been pared down to $778.1 billion. This represents a significant decrease of over $518.9 billion from the 2013 peak.

The reduction in Treasury holdings by China is not just a financial maneuver but also reflects broader geopolitical and economic shifts. This divestment could be interpreted as a strategic repositioning by China in the global financial landscape.

According to a report by CNBC, on 10 November 2023, Moody’s Investor Services, a prominent risk assessment agency, revised the U.S. government’s credit rating outlook from “stable” to “negative.” This change is primarily attributed to the increasing political polarization in Congress. The U.S. still retains its highest AAA credit rating from Moody’s, despite Fitch Rating and Standard & Poor’s having previously downgraded their ratings.

As CNBC points out, a change in the actual credit rating, as opposed to just the outlook, could limit the US government’s borrowing capacity or increase borrowing costs. This might impact the government’s ability to pay workers and provide essential services like Social Security.

CNBC also mentions that the shift in outlook is linked to declining fiscal stability, exemplified by the risk of a default on government debt due to Congress’s failure to raise the debt ceiling. Additional factors include the threat of a government shutdown and the ousting of Republican Speaker of the House Kevin McCarthy, which Moody’s views as signs of political instability.

Even the possibility of a downgrade can affect the stock market and interest rates. Past downgrades by other agencies have led to significant drops in major stock indices. Consumers might face higher interest rates on loans, including mortgages and credit cards. The perceived riskiness of government debt assets like Treasury bills could also increase.

Featured Image via Pixabay

Source: Read Full Article

-

CoinShares' Butterfill suggests 'continued hesitancy' among investors

-

Binance, CZ paid for defying financial, political status quo — Arthur Hayes

-

Cardano (ADA) Price Analysis: Recovery Possible Above This Resistance

-

SEC serves suit to evasive Richard Heart in Finland, but not in person

-

Here’s Why US Banking Crisis Is The Best Marketing Campaign For Bitcoin In History – Coinpedia Fintech News