Since the first Aadhaar number was issued in September 2010, more than 1.33 billion Aadhaar cards have been generated till June 2022.

With the Aadhaar enrolment of adult Indians nearing 100 per cent, the main objective of the Unique Identity Authority of India (UIDAI), which was to give Unique Identification numbers (UID) to all residents of India, is almost achieved, said a senior government official.

“Enrolment will now be much more update-based, because people keep updating their mobile numbers and addresses.

“If you look at last year’s data, Aadhaar had about 200 million enrolments, of which 160 million were updates and just around 35 to 40 million were new enrolments.

“Adult enrolments were hardly 2-3 million,” said the official, adding that “the vision for the next five to 10 years is how Aadhaar can help in the ease of living of people.”

Hence, the focus has now turned to Aadhaar’s next big offering — Aadhaar-enabled payment systems (AePS), which was launched in 2016 to facilitate banking services in rural and unbanked areas.

As per official data, the UIDAI records seven to eight crore Aadhaar authentications every day, and AePS currently comprises nearly 40 per cent of them.

The total number of authentications related to banking and financial solutions stand at around 35 million, which include verifications done at the time of eKYCs, the opening of new accounts, approval of loans, and so on.

AePS can be of huge help in many ways. Take Madgani, a remote village in Maharashtra’s Satara district, for example.

The entire commerce of Madgani is limited to a grocery shop.

But the grocery shop accepts only cash.

Apps such as Paytm, PhonePe and others have not yet reached the remote village.

So villagers have to walk 1.5-hours to reach the nearest bank and withdraw cash.

AePS-enabled banking solutions in a village like Madgani can be a new chapter in the journey of Aadhaar.

Government officials say that with AePS, a village shop can become an ATM, where people can use the payment system to deposit and withdraw money, and check their balance.

The system operates on Point of Sale (PoS) machines developed by the UIDAI and the National Payments Corporation of India.

These machines are normal card readers with a biometric reader attached to them.

A person can input his or her number, and through fingerprint, confirm access to their account.

After entering the amount, they can send it to the account of the grocery shop owner, who may provide them with cash.

There are about 5 million such AePS-enabled “micro ATMs” serving in areas where brick-and-mortar banks cannot operate. Banking and financial services experts say that the impact of AePS is already visible in the growing volume of transactions.

“Doorstep banking combined with AePS has been a boon for the unbanked population.

“The reach of AePS has been further expanded by the postal services who are bringing the service to the user’s door,” said Nanda Mohan Shenoy, chairman and managing director at Bestfit Business Solutions, a firm which deals with information and cyber security.

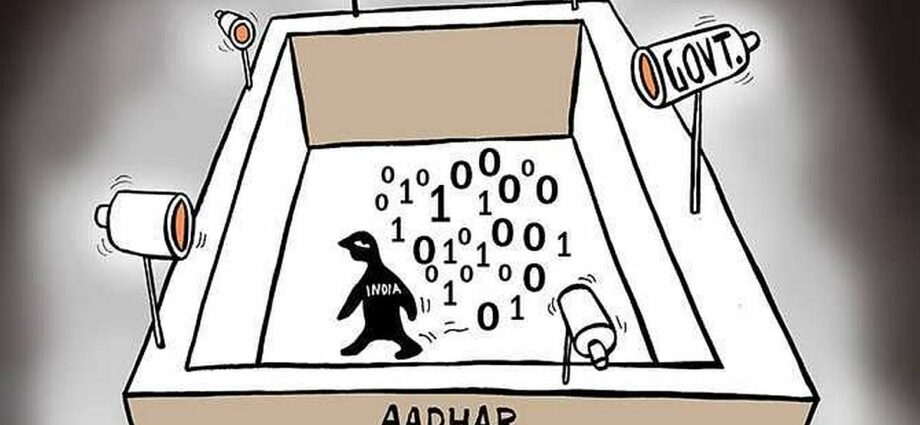

Aadhaar authentication is the process wherein the Aadhaar number, along with the Aadhaar holder’s identity data, such as biometric or demographic information, is submitted to the UIDAI for matching.

The UIDAI verifies if the number matches the Aadhaar holder’s information.

Apart from AePS and other financial authentications, around 1,000 government schemes — 650 from state governments and 315 from the Centre — use Aadhaar authentications to avoid duplication and for the removal of ghost beneficiaries.

The Public Distribution System accounts for 20 per cent of the total authentication, the telecom sector 6 per cent, while the Mahatma Gandhi National Rural Employment Guarantee Scheme accounts for 2 per cent of the authentications.

“We are continuously looking for new use-cases of the PoS machines and ways to improve their user-friendliness.

“The best thing is that we use an encrypted QR code, which enables secure authentication.

“It ensures that no duplicate or photoshopped card is used.

“It also asks that person to verify themselves using a biometric — either fingerprint or iris or face,” the official quoted above said.

However, Shenoy cautioned that there was a need to build awareness to maintain security during AePS transactions.

“Awareness creation among the bottom of the pyramid regarding locking the biometrics after the transaction and unlocking the same before transactions is crucial.

“Even the Aadhaar number can be locked.

“I wonder how many of us know about this functionality,” he said.

Source: Read Full Article