In a surprising development, Max Keiser, a well-known Bitcoin evangelist and advisor to the president of El Salvador, has expressed a less optimistic view on the future trajectory of Bitcoin. Historically a staunch supporter of the flagship cryptocurrency, Keiser’s recent comments have left many in the crypto community taken aback.

Max Keiser is a television presenter, radio host, entrepreneur, and broadcaster. He is best known for his work on the financial program “Keiser Report” on RT, where he and his co-host (and wife) Stacy Herbert discuss international markets, economic trends, and the role of cryptocurrency in the global financial system. Over the years, Keiser has been a vocal advocate for Bitcoin and has frequently commented on its potential to disrupt traditional financial systems. He is known for his passionate and sometimes controversial views on finance, economics, and cryptocurrencies.

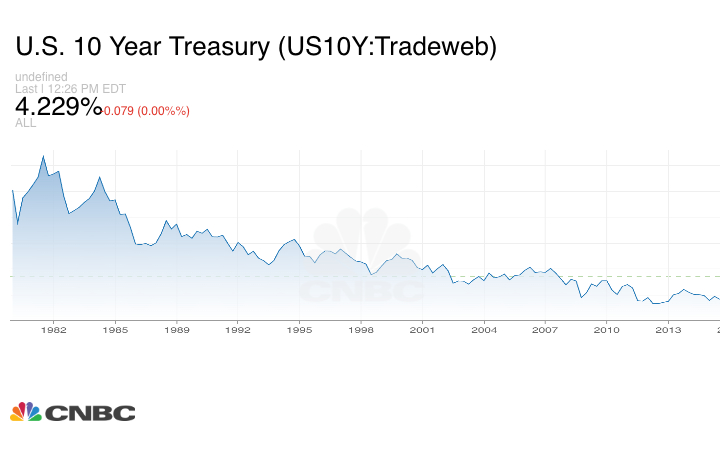

The root of Keiser’s concerns lies in the escalating yields on 10-year U.S. Treasuries, which have surged to levels not witnessed since April 2008.

Typically bullish about Bitcoin’s prospects, Keiser recently voiced apprehensions regarding the potential impact of these rising rates on the cryptocurrency market. In a tweet that resonated widely, Keiser remarked, “Rising rates will continue to challenge the Bitcoin price as more capital flows into high-yielding instruments.”

This bearish sentiment is notably out of character for Keiser, who is recognized as a fervent Bitcoin maximalist. His recent statements starkly contrast his earlier predictions, where he foresaw Bitcoin reaching anywhere between $220,000 to a staggering $1 million. This sudden shift has left many of his followers puzzled, trying to make sense of his seemingly contradictory views.

https://youtube.com/watch?v=CqmtTNr4xw4%3Ffeature%3Doembed

Adding to the complexity is the broader economic context. According to a report by The Crypto Basic, recent deliberations by the Federal Reserve’s open committee members underscored the prevailing uncertainties surrounding U.S. inflation and interest rates. While there has been a noted decrease in both general and core inflation rates, the consensus is that inflation remains persistently high. Committee members emphasized that current inflation rates surpass the FOMC’s 2% target. During their latest meeting, this unwavering commitment to bring inflation back within desired limits has sparked discussions about potentially raising the target range for the federal funds rate to between 5.25% and 5.5%.

Source: Read Full Article

-

$940 Million in Bitcoin Move off Coinbase, Fueling Speculation a Whale Is Accumulating $BTC

-

Michael Saylor: ‘Bitcoin Must Be Understood As Something Outside This Crypto Industry’

-

ARK’s Cathie Wood Says Bitcoin’s Upsurge As Global Banks Roil Will Attract New Institutional Investors In Droves

-

Cryptos In Demand Amidst ETF Frenzy, Bitcoin Tops $37k

-

Bitcoin Holds Steady Above $22K Even As Elon Musk's Tesla Dumps 75% Of Its BTC Holdings