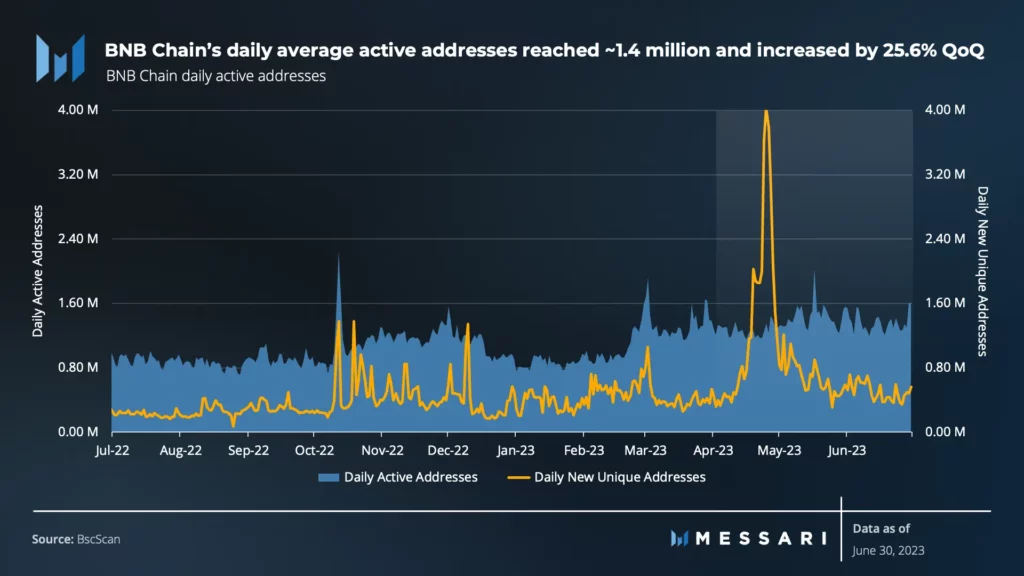

House to more decentralized applications (dApps) than any other L1 blockchain, Q2 was marked by increased new demand for BNB Chain, Messari found. According to the report, the number of average new unique addresses grew significantly by 91.1% during the quarter under review, reaching “all-time highs after a spike in activity in late April.”

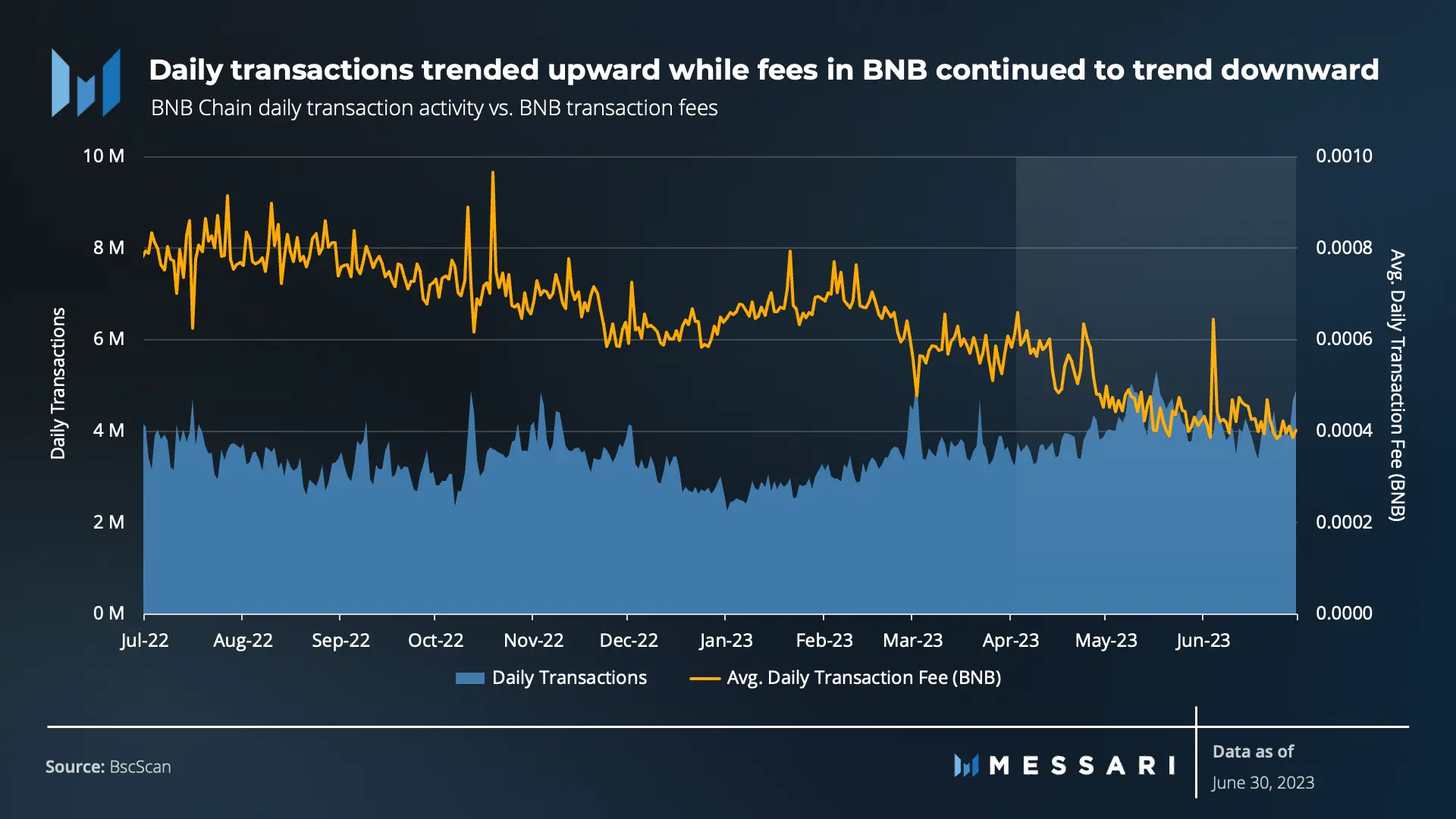

The uptick in new demand for BNB Chain in Q2 was due to the decline in network transaction fees. BNB Chain gas fees were reduced drastically after BSC validators voted in favor of a 40% reduction in transaction fees from 5 to 3 Gwei. The average daily transaction fee on the chain fell by 26% in Q2.

As a result of the transaction fee decrease, daily transactions on BNB Chain increased. Daily transactions count on the chain grew by 24% between April and June, Messari found. The growth in transactions count was “largely tied to increased activity from LayerZero.”

“After LayerZero announced its $120 million Series B fundraising on April 4, activity spiked on many of its supported networks. By June, BNB Chain was hosting 200,000-250,000 LayerZero and Stargate daily transactions and 50,000-60,000 daily unique addresses from those transactions. In addition to Stargate, activity also stemmed from Radiant Capital, an omnichain money market built on LayerZero that deployed on BNB Chain in Q1,” the report stated.

Revenue shortfall and a drop in BNB value

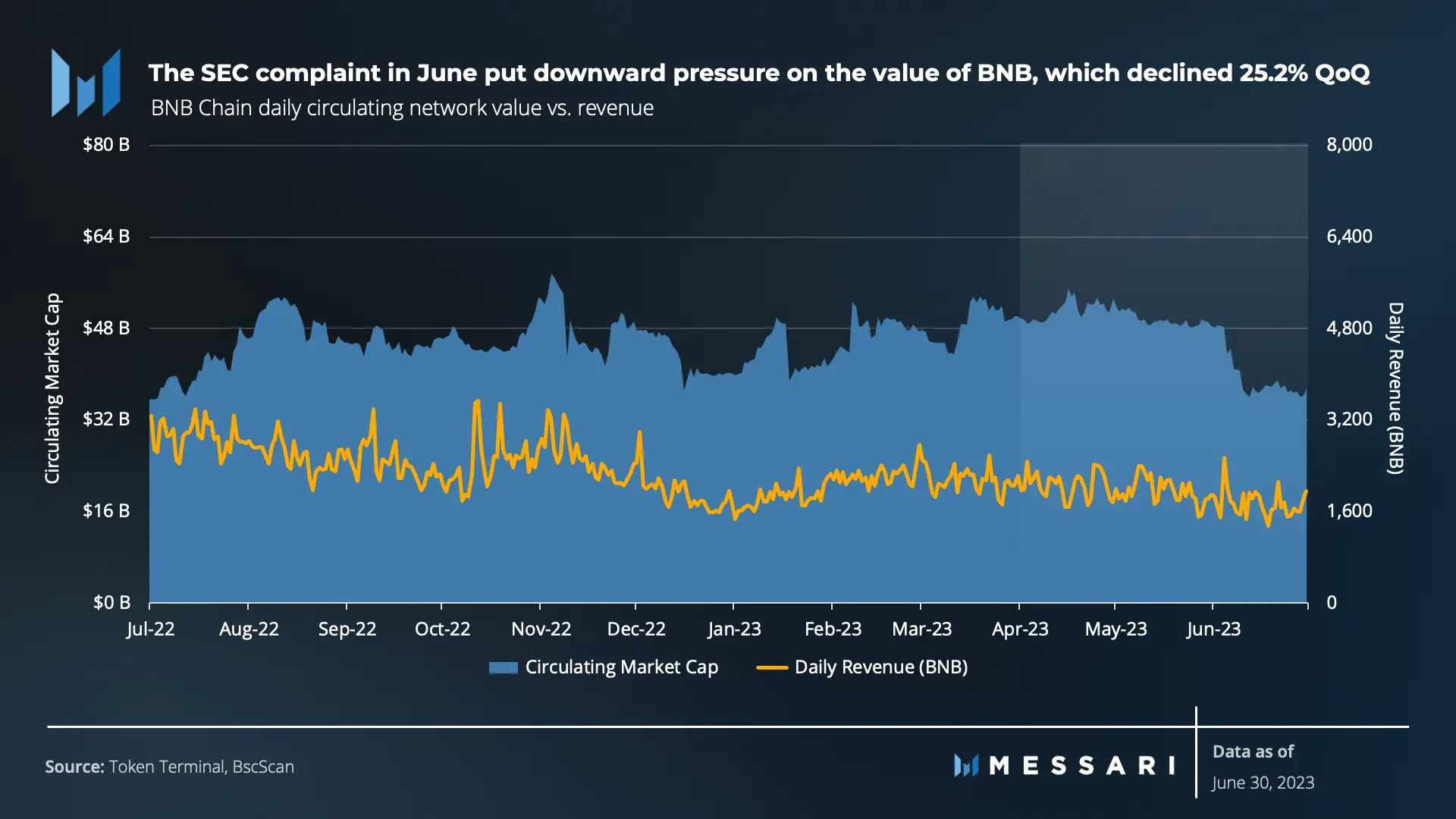

Despite the growth in user activity on BNB Chain, the network’s revenue took a beating in Q2. With a quarterly revenue of $52.24 million recorded, a 6.1% decline was recorded QoQ.

Likewise, the Securities and Exchange Commission (SEC) regulatory activity against Binance put some pressure on the network’s native coin BNB. In June, the regulator filed a complaint against Binance and its CEO Changpeng Zhao (CZ), alleging that it engaged in the sale and offering of unregistered securities.

“The SEC complaint in June coincided with downward pressure on the value of BNB, which declined 25.2%. In contrast, the total crypto market cap increased by 2% QoQ, which was primarily driven by BTC and ETH, rising 7% and 6%, respectively. Alt-L1 tokens tended to decrease more than ETH due to the SEC’s regulatory complaints. BNB concluded the quarter as the fourth largest cryptoasset by market capitalization, reaching $37.5 billion, Messari found.”

Source: Read Full Article

-

$XRP Holders to Receive Airdropped Tokens From Upcoming Sidechain Launch

-

Who Created Shiba Inu ($SHIB)?

-

Burger King in Paris Starts Accepting Payments in $BTC, $SHIB, and More via Binance and Alchemy Pay

-

Dogecoin Investors Accuse Elon Musk Of Insider Trading

-

The Mega Bull Market Secret: ADA Founder Charles Hoskinson Believes The US Financial Innovation Act Can Trigger A Massive Bull Market Run