Consumers with low credit scores are falling behind on their auto loans at a record rate.

Why it matters: The upsurge shows that despite the strength of the job market, cash-strapped American households are under pressure from two years of cost-of-living increases and the end of pandemic-related benefits.

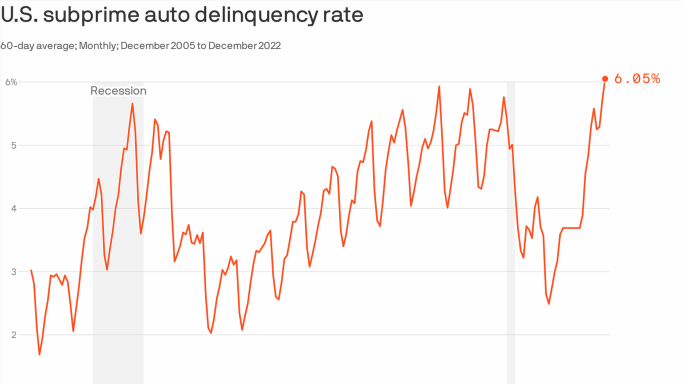

State of play: The share of payments on so-called "subprime" auto loans that were at least 60 days late rose to more than 6% in December. Subprime loans have high interest rates and are typically made to people with low credit scores.

- Delinquent payments — basically unpaid monthly bills — are the first step toward default and the car being repossessed.

- The December delinquency rate is a record, eking past prior peaks just before the pandemic, according to data from S&P Global.

The big picture: The uptick reflects a steady weakening of the finances of poorer American households.

- For one, the cost of living has surged — just look at the Consumer Price Index, which has jumped more than 14% over the last two years.

- Meanwhile, key COVID-era federal aid to households, like the Child Tax Credit and expanded unemployment benefits, are in the rearview mirror.

- Savings levels have slumped.

- And Americans are increasingly pulling out the plastic — credit card usage is rising, even as interest rates on these borrowings hits record highs.

Zoom in: Used vehicle prices skyrocketed during the pandemic. That drove up borrowing activity sharply, especially among people with low credit scores who predominantly buy used cars, rather than new ones, an analysis by the Consumer Financial Protection Bureau (CFPB) found.

- Now, those higher borrowing costs are getting tougher to manage.

Worth noting: The subprime sectors of both mortgage and auto finance tend to have a higher incidence of practices perceived as predatory. That’s when lenders offer customers expensive or fee-laden loans that they know the customers may not be able to repay.

- Case in point: Just last month the CFPB and the New York Attorney General sued one of the largest subprime auto lenders, Credit Acceptance Corp (CAC).

- The complaint accuses CAC of making "predatory loans to millions of financially vulnerable consumers," by charging "exorbitant" interest rates and socking on expensive add-on products — resulting in "debts that even CAC believes the borrowers often cannot afford to repay." (The company says the suit is without merit.)

What to watch: Whether these cost pressures begin to spread to a larger share of Americans, pushing delinquencies up even further.

Source: Read Full Article

-

Chechen warlord urges Putin to launch nuclear strike as Russia pushed back

-

Heart-stopping video shows enormous great white shark circling man’s kayak after spate of maulings off California coast | The Sun

-

Man, 30, arrested as Gabriela Kosilko, 26, vanishes after going food shopping – as cops launch water searches | The Sun

-

Pic shows lightning strike on easyJet plane forcing emergency landing | The Sun

-

Pub bosses warn beer prices will soar after support is cut