It takes less than five minutes and $0 to file taxes in Estonia, the country with the best tax structure in the world, according to the Tax Foundation.

The country’s revenue department developed a web-based system where every citizen has a personal tax account that automatically pre-fills tax information like salary, child-related deductions, and tax liability.

"I really checked it — altogether less than five minutes," Helen Pahapill, the tax policy advisor for the Estonian Ministry of Finance, told Yahoo Finance. "Basically, I just logged in and checked that all the information was correct.”

That’s not what most Americans experience at tax time.

Taxpayers in the U.S. spend an average of 13 hours preparing their tax returns and pay $240 for tax preparation services. Last year, they also waited 22 minutes on average to ask the IRS a question, that is, if they were the 10% of callers who made it through to a live agent at the underfunded and understaffed agency.

In short, our tax system has created an ecosystem where filing taxes is confusing, expensive, and time-consuming. So why is the U.S. tax law and filing system so burdensome on taxpayers and the agency?

Because the U.S. tax system is trying to do more than collect taxes, according to experts. Congress uses the tax system as a tool to achieve economic and social goals and then relies on a beleaguered IRS to execute those plans.

"Congress, in writing the law, tried to build into the code incentives for social benefits. So for example, to enable parents to work … [there’s] the child tax credit," Erin Collins, the National Taxpayer Advocate, told Yahoo Finance. "Once you start supplementing taxable income, that's where it starts getting complex."

The tax code in America wasn’t always this complicated.

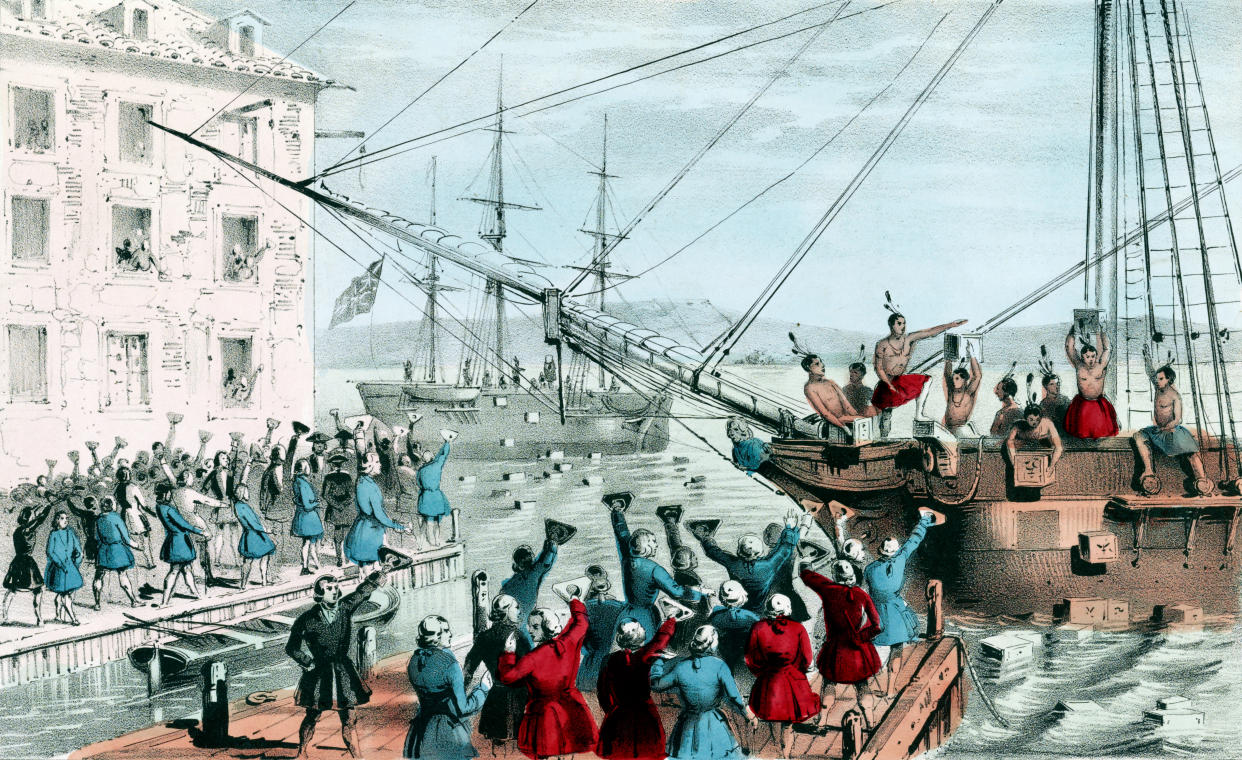

As a country that evolved from an uprising over a tea tax and a rallying cry of "no taxation without representation," the U.S. couldn’t get a federal income tax to stick for a long time.

President Lincoln created the first version of a federal income tax to pay for the Civil War in 1862, according to the IRS, some 86 years after the the country's founding. It was repealed 10 years later, however, and was revived in 1894 under the Wilson Tariff Act, which also created an income tax division within the Bureau of Internal Revenue. But the Supreme Court struck down the income tax a year later.

It wasn’t until Wyoming finally ratified the 16th Amendment in 1913 as the first world war loomed that Congress had the power to collect income taxes from individuals and corporations. The U.S. later enacted a 1% tax on net personal income of more than $3,000 and a surtax of 6% on incomes of more than $500,000.

Next, the first Form 1040 debuted, ushering in the start of tax filing as we know it today. Then came the expansion of the tax system.

President Roosevelt’s "Victory Tax" in 1942 created a progressive tax system by introducing a "wealth tax," increasing the number of taxpayers by lowering exemptions, and launching provisions for medical and dental expenses. The highest marginal tax rate reached 94% in 1944.

Subsequent administrations seesawed between different — and sometimes conflicting — policies.

The Economic Recovery Tax Act of 1981 under President Ronald Reagan reduced individual tax rates, then President Bill Clinton raised the top tax rate for high-income earners and expanded the earned income tax credit. The Tax Cuts and Jobs Act under President Donald Trump lowered statutory rates and increased the standard deduction. Then, most recently, the Inflation Reduction Act under President Joe Biden provided clean energy tax breaks.

"As messy as the Democratic political process is these days, we also have a messy tax system," Daniel Bunn, president and CEO of the Tax Foundation, said. "Everybody agrees that you should tax your enemies and subsidize your friends."

Taxes and policy goals

In the U.S., policymakers rely on the progressive tax system to achieve many goals, such as encouraging retirement saving, subsidizing child care, or pushing forward environmental initiatives through an array of deductions and credits.

"So the challenge is if you're going to use the code for many purposes, that's where you lose the simplicity," Collins said.

"It's a delicate balancing act that Congress or the Internal Revenue Code is trying to do," Collins said.

However, cutting out credits and deductions to simplify the tax code is far from easy. Strong interest groups would battle to keep what works for their constituents. The powerful real estate lobby kept the mortgage interest deduction off the chopping block for many years.

Competing lobbying groups have also added a layer of complication to the tax code as they campaign for "dozens and dozens of separate policies," according to Bunn.

For instance, when the corporate tax rate was slashed under the Tax Cuts and Jobs Act in 2017, the reform could have encouraged different business entities to incorporate due to the beneficial new, lower tax rate.

The decreased rate should have flushed out a host of business entities that would want to convert to corporations and take advantage of the new rate. But instead interest groups representing S corporations and pass-through entities asked for — and received — special deductions.

"We also have a lot of policies that are either meant to encourage certain activity or discourage certain activity and it's not clear at all points what you're trying to do," Bunn added.

The complex tax system has also spawned an entire industry of tax software companies, accused of lobbying to keep tax-filing expensive and complicated.

The struggle between complexity and resources

In addition to a complex tax system is an agency ill-prepared to fulfill its many responsibilities.

"One of the most frustrating aspects of the tax-filing system is challenges and contacting the IRS for assistance," said Eric Bronnenkant, a CPA and CFP with more than 20 years of experience. "A big area of challenge for taxpayers is resolving problems."

In stark contrast to the average U.S. taxpayer’s experience with the IRS, Estonians expect calls to their tax service to be picked up right away. "We had one case when a person complained to the ministry that he's called, but wasn't answered in a minute," Pahapill said.

But the problem is that the IRS is more than just a tax revenue collector. It is also a welfare provider, a stimulus distributor, and a tax cop.

Most recently, the underfunded IRS carried the brunt of disbursing three stimulus checks under two different administrations while still continuing with its regular tasks. The tax agency also had to administer new, temporary tax provisions in the middle of the tax-filing season.

"It might make more sense for the IRS or for the tax system to be primarily focused on raising revenue and then distributing benefits through other parts of the federal government," Bunn said. "A lot of times, the IRS is tasked with bringing in the money and cutting the checks, and it leaves a lot of burden, both for tax compliance and tax administration."

"It is sort of a jack of all trades," Collins agreed.

The IRS has also suffered from insufficient funding, resources, and technology for at least a decade, which became especially apparent throughout the pandemic when taxpayers were frustrated by the slow processes and bad service.

The IRS is poised to change for the better with $80 billion in new funding provided by the Inflation Reduction Act.

"I do think that the IRS, especially with this additional funding, they really are going to try and focus more on the service aspect and be more proactive to prevent problems," Collins said.

That should help taxpayers. But it won’t do much to simplify the U.S. tax code.

Rebecca is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Click here for the latest personal finance news to help you with investing, paying off debt, buying a home, retirement, and more

Read the latest financial and business news from Yahoo Finance

Source: Read Full Article

-

Queen, 96, POSTPONES her meeting with Privy Council to rest

-

Chaos breaks out on Paris streets as riot police clash with protestors

-

Evil killer who stabbed her boyfriend in the heart gets life for murder

-

Shocking moment OAP is brutally attacked after he's falsely accused of being a paedophile weeks before dying in hospital | The Sun

-

Dad almost missed flurry of calls telling him he had won £3.5m mansion in raffle