Save articles for later

Add articles to your saved list and come back to them any time.

A key associate of a global investment scheme that has embroiled potentially thousands of investors has been issued a life-long ban from providing any financial services after being on the corporate regulator’s radar for years.

On Monday, the Australian Securities and Investments Commission (ASIC) announced it had banned Sydney-based director David Henty Sutton from involvement in financial services including “any function involved in the carrying on of a financial services business” and “controlling an entity that carries on a financial services business”.

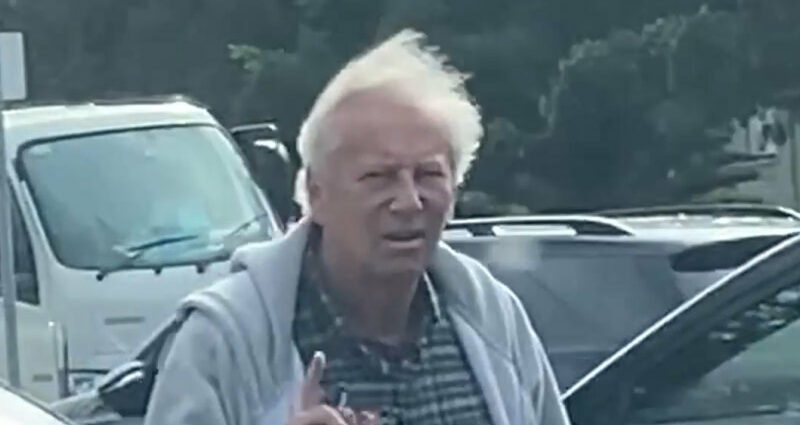

David Sutton has been banned from providing any financial services.

The ban comes after an investigation by this masthead uncovered a number of Australian financial advisers who used their trusted positions to convince clients to buy dubious investments in an investment scheme supposedly backed by billions of dollars in assets.

Sutton was a director of the unlisted Australian-registered company ALT Financial Group. Under his McFaddens Securities business, Sutton promoted and did the administration for a scheme in which shares sold to investors were never listed.

He was also involved in and facilitated misconduct by Brisbane-based former financial adviser Kristofer Ridgway, who was permanently banned from having any involvement in financial services in April.

ASIC has also disqualified Sutton from managing corporations for five years and cancelled the Australian financial services (AFS) licence of Sutton’s company McFaddens, now known by its previous name, APC Securities.

McFaddens is a financial services firm based in Sydney which had held an Australian financial services licence since September 2009. Sutton became director of the firm in July 2009 and has been the key person on the licence since September 2009.

The regulator said its concerns arose out of Sutton’s conduct in making offers of investment in unlisted shares via McFaddens to Australian and overseas investors in companies including Steppes Alternative Asset Management, Trinus Impact Capital, Avalon Pacific Group Limited and ASAF Critical Metals.

ASIC said Sutton was not a fit and proper person to provide financial services because of actions including inducing another person to deal in financial products by making a statement that is misleading, false or deceptive, or by a dishonest concealment of material facts.

The regulator also said Sutton made misleading or deceptive representations in his capacity as a director of McFaddens and APG, engaged in conduct regarding a financial product that was misleading and deceptive or was likely to mislead and deceive; and did not taking reasonable steps to ensure McFaddens’ representatives did not accept conflicted remuneration.

ASIC further found that Sutton failed to exercise his power and discharge his duty with care and diligence relating to his directorships of Paltar Petroleum and Aus Streaming.

McFaddens and Sutton have the right to appeal to the Administrative Appeals Tribunal for a review of ASIC’s decision.

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.

Most Viewed in Business

From our partners

Source: Read Full Article

-

Nasdaq Plans to Launch a Crypto Custody Platform This Year: Report

-

Short-Bitcoin Funds Saw $23M in Net Outflows Last Week

-

How Project DAMA Can Disrupt Digital Asset Fund Management

-

Q3 Earnings Season Starts With a Bang: Analysts Upgrade or Downgrade Apple, Opendoor, Petrobras and More

-

Valuation and Dividend Safety Analysis: Pfizer (PFE)