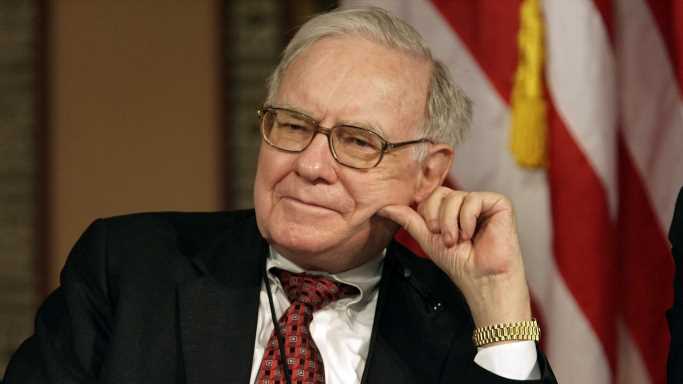

For those looking to find strong Finance stocks, it is prudent to search for companies in the group that are outperforming their peers. Has Berkshire Hathaway B (BRK.B) been one of those stocks this year? A quick glance at the company’s year-to-date performance in comparison to the rest of the Finance sector should help us answer this question.

Berkshire Hathaway B is a member of the Finance sector. This group includes 854 individual stocks and currently holds a Zacks Sector Rank of #14. The Zacks Sector Rank gauges the strength of our 16 individual sector groups by measuring the average Zacks Rank of the individual stocks within the groups.

The Zacks Rank emphasizes earnings estimates and estimate revisions to find stocks with improving earnings outlooks. This system has a long record of success, and these stocks tend to be on track to beat the market over the next one to three months. Berkshire Hathaway B is currently sporting a Zacks Rank of #2 (Buy).

Over the past three months, the Zacks Consensus Estimate for BRK.B’s full-year earnings has moved 2.6% higher. This shows that analyst sentiment has improved and the company’s earnings outlook is stronger.

Our latest available data shows that BRK.B has returned about 14.3% since the start of the calendar year. Meanwhile, the Finance sector has returned an average of 5.3% on a year-to-date basis. This shows that Berkshire Hathaway B is outperforming its peers so far this year.

One other Finance stock that has outperformed the sector so far this year is Kinsale Capital Group, Inc. (KNSL). The stock is up 41.7% year-to-date.

In Kinsale Capital Group, Inc.’s case, the consensus EPS estimate for the current year increased 11.2% over the past three months. The stock currently has a Zacks Rank #1 (Strong Buy).

Looking more specifically, Berkshire Hathaway B belongs to the Insurance – Property and Casualty industry, which includes 40 individual stocks and currently sits at #54 in the Zacks Industry Rank. This group has gained an average of 9.8% so far this year, so BRK.B is performing better in this area. Kinsale Capital Group, Inc. is also part of the same industry.

Going forward, investors interested in Finance stocks should continue to pay close attention to Berkshire Hathaway B and Kinsale Capital Group, Inc. as they could maintain their solid performance.

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

This article originally appeared on Zacks

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Source: Read Full Article

-

Explosions rock Ukrainian cities as Russia launches 'more than 100 missiles' in waves

-

North Korea fires two missiles into sea as South Korea wraps up drills

-

Earnings Previews: Applied Materials, Deere, Foot Locker, Ross Stores

-

How You Can Still Claim the Third Federal Stimulus Check In 2023

-

Democrats keep control of U.S. Senate, crush Republican 'red wave' hopes