Employment in the U.S. increased roughly in line with economist estimates in the month of March, according to a closely watched report released by the Labor Department on Friday.

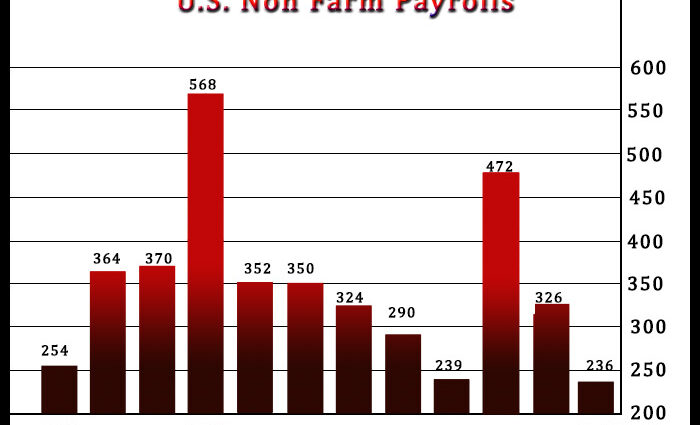

The report said non-farm payroll employment climbed by 236,000 jobs in March after jumping by an upwardly revised 326,000 jobs in February.

Economists had expected employment to rise by about 240,000 jobs compared to the addition of 311,000 jobs originally reported for the previous month.

“The 236,000 gain in non-farm payrolls in March adds to the evidence that the economy‘s strong start to the year was partly a weather-related blip, with momentum now fading again,” said Andrew Hunter, Deputy Chief U.S. Economist at Capital Economics.

He added, “With the sharp fall in job openings and upward trend in jobless claims also pointing to a cooling in labor demand, and the drag from the recent banking turmoil still to feed through, we expect employment growth to slow more sharply soon.”

The job growth in March reflected a continued upward trend in employment in the leisure and hospitality, government, professional and business services, and health care sectors.

Meanwhile, the Labor Department said the unemployment rate edged down to 3.5 percent in March from 3.6 percent in February. The unemployment rate was expected to be unchanged.

The unexpected dip in the unemployment rate came as the household survey measure of employment spiked by 577,000 persons, while the labor force jumped by 480,000 persons.

The report also showed average hourly employee earnings rose by $0.09 or 0.3 percent to $33.18. Annual wage growth slowed to 4.2 percent in March from 4.6 percent in February.

“Overall, the report is a mixed bag as far as the May FOMC meeting goes and the decision is likely to come down to the data next week, most notably the March CPI report,” said Hunter.

He added, “Whether or not the Fed squeezes in a final 25bp rate hike next month, we still think they will be cutting again later this year as the economy falls into recession.”

Source: Read Full Article