With a sharp pullback in gasoline prices offsetting higher prices for food and shelter, the Labor Department released a report on Wednesday showing U.S. consumer prices came in flat in the month of July.

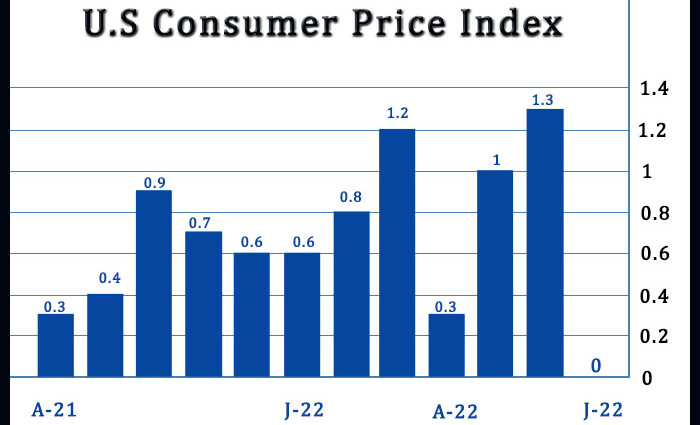

The Labor Department said its consumer price index was unchanged in July after jumping by 1.3 percent in June. Economists had expected consumer prices to edge up by 0.2 percent.

The unchanged reading on consumer prices came as gasoline prices plunged by 7.7 percent in July after spiking by 11.2 percent in June.

The pullback in gas prices helped offset a continued surge in food prices, which shot up by 1.1 percent in July after jumping by 1.0 percent in June.

Prices for food at home leapt by 1.3 percent, while prices for food away from home increased by 0.7 percent.

“The surge in food at home prices has been unusually broad based, with cereal and dairy prices leading the way in July,” said Paul Ashworth, Chief U.S. Economist at Capital Economics.

“Nevertheless, in recent weeks there has been a collapse in not just agricultural crop prices, but dairy, egg and chicken futures prices too,” he added. “There is now a good chance that CPI food at home prices will be falling outright by the time the fall arrives.”

Compared to the same month a year ago, consumer prices in July were up by 8.5 percent, reflecting a bigger than expected slowdown from the 9.1 percent spike in June.

The annual rate of price growth was expected to slow to 8.7 percent from the four-decade high seen in the previous month.

Meanwhile, the report said core consumer prices, which exclude food and energy prices, rose by 0.3 percent in July after climbing by 0.7 percent in June. Core prices were expected to increase by 0.5 percent.

The uptick in core prices reflected higher prices for shelter, medical care, motor vehicle insurance, household furnishings and operations, new vehicles, and recreation.

The Labor Department noted there were some indexes that declined in July, however, including those for airline fares, used cars and trucks, communication, and apparel.

The annual rate of core consumer price growth was unchanged at 5.9 percent, while economists had expected an acceleration to 6.1 percent.

“Overall, with headline inflation still at 8.5% and core inflation at 5.9%, this is not yet the meaningful decline in inflation the Fed is looking for,” Ashworth said. “But it’s a start and we expect to see broader signs of easing price pressures over the next few months.”

Source: Read Full Article