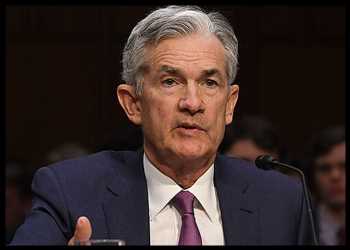

Federal Reserve Chair Jerome Powell addressed the outlook for U.S. monetary policy during remarks on Thursday, saying the central bank “will not hesitate” to resume raising interest rates if it becomes appropriate.

Participating in a policy panel at the 24th Jacques Polak Annual Research Conference in Washington, D.C., Powell acknowledged that U.S. inflation has slowed over the past year but pointed out it remains well above the Fed’s 2 percent target.

“My colleagues and I are gratified by this progress but expect that the process of getting inflation sustainably down to 2 percent has a long way to go,” Powell said.

The Fed chief noted GDP growth is expected to moderate in coming quarters after a strong third quarter but warned stronger growth “could undermine further progress in restoring balance to the labor market and in bringing inflation down, which could warrant a response from monetary policy.”

Powell also said the Fed is “not confident” a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time has been achieved.

“We know that ongoing progress toward our 2 percent goal is not assured: Inflation has given us a few head fakes,” Powell said. “If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

He added, “We will continue to move carefully, however, allowing us to address both the risk of being misled by a few good months of data, and the risk of overtightening.”

Powell indicated the Fed will make future monetary policy decisions “meeting by meeting” based on the totality of incoming data and the implications for the outlook for economic activity and inflation.

He reiterated the central bank’s commitment to bringing down inflation, stating the Fed will “keep at it until the job is done.”

Powell’s comments came a little over a week after the Fed left interest rates unchanged for the third time in the past four meetings.

The Fed’s next monetary policy meeting is scheduled for December 12-13, with CME Group’s FedWatch Tool currently indicating an 88.1 percent chance the central bank will once again leave interest rates unchanged.

The FedWatch Tool currently suggests rates are likely to remain unchanged in the coming months until the Fed lowers rates in mid-2024.

Source: Read Full Article

-

Kingspan H1 Profit Climbs, Margin Down; Lifts Dividend; Retains Outlook – Quick Facts

-

‘Tortuous’: Alarm bells are ringing as China faces reality

-

Beware unregulated ‘quick fix’ pay advances

-

Time to ditch petrol? Electric vehicles now more affordable and available

-

Russia Central Bank Signals Rate Hikes Ahead