Solana, one of the largest “Ethereum Killers”, has surpassed the latter to become the network with the most transactions.

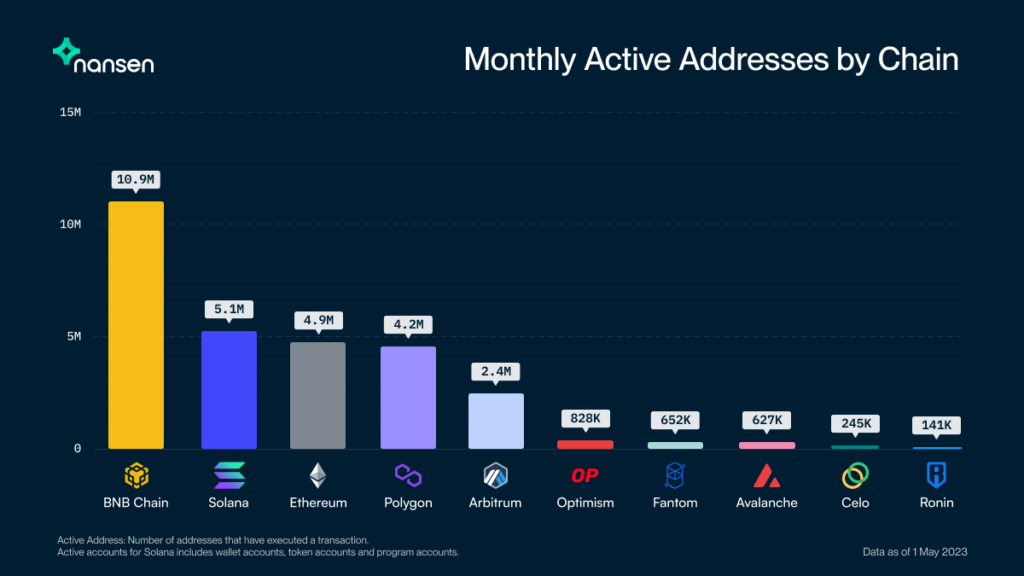

On Wednesday, Nansen shared a tweet comparing April’s most active on-chain addresses. According to the firm, Solana came in second after BNB Chain, becoming the network with the most active address by chain at 5.1 million in April.

And despite that figure dropping by around 12% from March, the cryptocurrency network still managed to outdo Ethereum, which had 4.9 million active addresses in April.

Solana also surpassed Ethereum by non-vote transactions last month. Non-vote transactions are transactions that do not involve any voting or decision-making by token holders. They typically involve the transfer of cryptocurrency between wallets or accounts and are the most common type of transaction on most blockchain networks due to their simplicity. According to Nansen data, as of April 30, Solana’s total non-vote transactions stood at 24.3 million compared to Ethereum’s 974,972.

Solana’s attractive growth can be attributed to various factors, including a surge in developers and users due to its attractive transaction speeds and costs. Apart from announcing various developments that go into improving the network, including a Chat GPT plugin and a web3 phone, Solana’s ballooning transactions have also been propelled by NFTs.

Recently, Mad Lads, a new project launched on Solana, became the most traded collection generating $17 million compared with $11 million for Yuga Labs’ Bored Ape Yacht Club collection during the last week of April. This is despite the Solana facing a major setback following the exit of y00ts and DeGods, two of its most popular collections, earlier this year.

Launched roughly a month ago, Mad Lads is a unique type of NFT that falls in a category called xNFTs. Ideally, xNFTs combine the features of traditional NFTs and executable code, meaning users can use them to conduct other activities such as gaming and chatting.

That said, Solana’s native token SOL has also performed well, soaring by over 116% since January 1. This is compared to Bitcoin, up 70%, and Ether, up just over 50% year-to-date.

At press time, SOL was trading at $21.47, down 3.36% in the past 24 hours, according to CoinMarketCap data. On the other hand, Ether rose by 1.66% in the same period and was exchanging hands at $1,851.

Source: Read Full Article

-

Emojis count as financial advice and have legal consequences, judge rules

-

Crypto Lawyer Responds to Onlooker Who Predicts That Ripple Will Lose to the US SEC

-

Many NFT projects lack adequate smart contract testing, says nameless founder

-

Binance creates smart contract to refund users affected by $3M rug pull

-

Floki Launches TokenFi: Aiming for Leadership in the $16 Trillion Asset Tokenization Industry