-

70% of Bitcoin has been dormant for a whole year, a new record.

-

Long-term Bitcoin investors are holding strong despite the price doubling this year.

-

The entrance of new financial products like spot-based ETFs and cash-settled futures could change Bitcoin’s inactive supply.

Recent data shows something quite remarkable about Bitcoin. A whopping 70% of Bitcoin has just been chilling, not moving at all, for a whole year – a new record! It seems like people holding Bitcoin are super committed and don’t want to let go, especially with today’s prices.

Here are some more interesting insights.

Bitcoin Supply at Its Peak

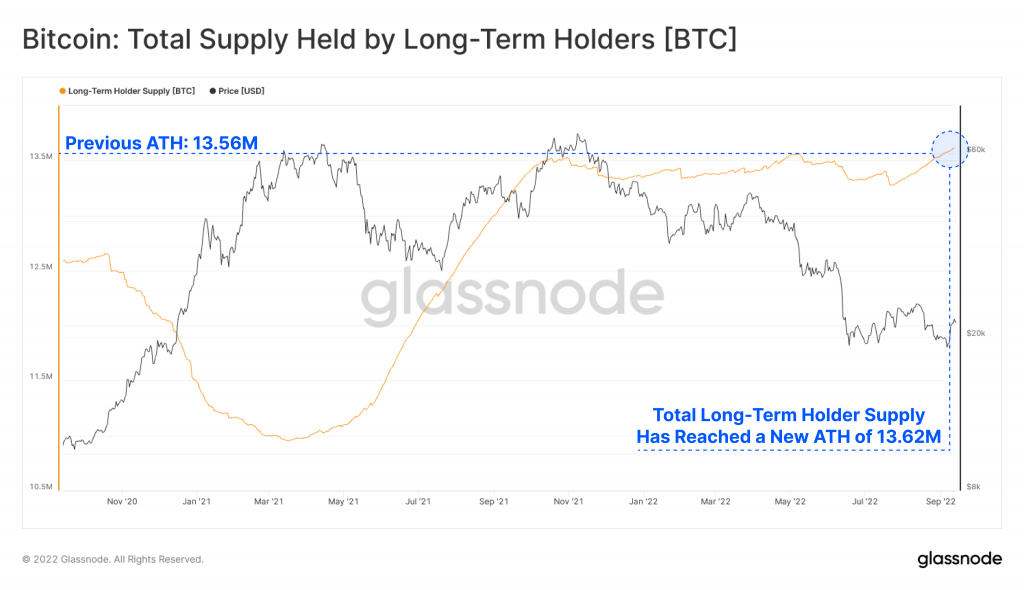

In the wild world of crypto ups and downs, Bitcoin holders are standing tall with rock-solid confidence. Surprisingly, the percentage of supply dormant for two, three, and five years has simultaneously reached lifetime highs.

This determination from investors is pretty mind-blowing, considering Bitcoin’s crazy ride up to $37,000 this year. Even though the value doubled, long-term investors were not interested in selling. Shockingly, 70.35% of Bitcoin’s supply hasn’t moved for at least a year, beating the last record of 69.35% in July.

This is the first time in Bitcoin’s history that so much of it has stayed put – more than 70%! Think about it – almost three out of four bitcoins just stayed in one place, even as the value went from $15,700 to around $37,000.

Read More: Crypto Winter Ends: Bitcoin Price Hits 18-Month High!

Long-Term Investors Unfazed

Despite Bitcoin’s price doubling to $37,000 this year, the data indicates that long-term investors are holding strong to their assets. The percentage of supply inactive for two, three, and five years has also hit lifetime highs, showcasing unwavering confidence among Bitcoin holders.

Bitcoin’s recent performance, more than doubling in value, hasn’t prompted these investors to sell. Meanwhile, Reflexivity Research suggests that the holders are not showing any intention of offloading their inventory at the current price levels or in the near future.

Changes Might Be Coming!

While these numbers show a clear picture of committed HODLers (those who hold onto their crypto), things might shift with more financial stuff happening with Bitcoin. There are new things like spot-based ETFs and cash-settled futures entering the scene. As cryptocurrency explores new paths, Bitcoin’s inactive supply could change because of new market trends.

Also Read: Bitcoin Price Analysis: Crypto Expert Peter Brandt Suggests $43,000 as Next Target

The journey of Bitcoin continues to be pretty interesting and full of surprises!

Source: Read Full Article

-

CZ denies report Binance is considering major breakup with US business partners

-

Bitcoin miner Canaan's net loss slightly improved in Q1 amid market turbulence

-

‘ Ripple Is Not Going To Abandon XRP’: John Deaton – Coinpedia Fintech News

-

Who is Emmett Shear, OpenAI’s new CEO?

-

Worldcoin Plunges Over 50% Amid Global Data Privacy Concerns