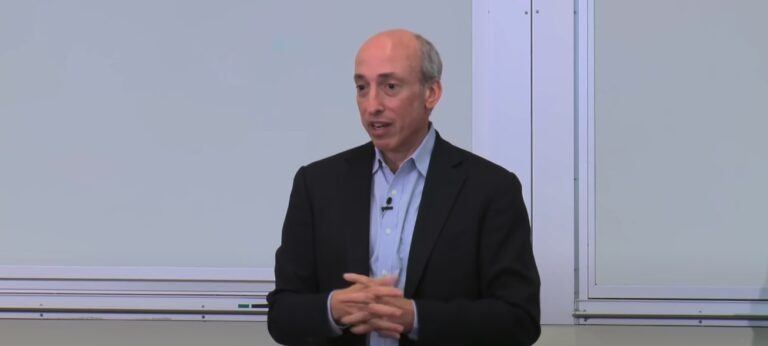

In a recent CNBC interview, Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), explained why the SEC forced crypto exchange Kraken to end its crypto staking services for U.S. clients.

Last Friday (10 February 2023), Gensler told Andrew Ross Sorkin, co-anchor of CNBC’s “Squawk Box” that any crypto firm that is offering any kind of yield service — whereby the customers hand over their crypto tokens to that firm to earn some kind of profit — needs to approach the SEC and register those services as securities so that the American public is better protected:

“Kraken… was… saying, ‘I’ll give you a return — four percent to 21 percent returns.’ And the problem was they were not disclosing to the investing public the risk that the investing public was entering into.

“And we have had a basic bargain in the United States since the 1930s. You can take whatever risk you want. Companies like Kraken can offer investment contracts and investment schemes, but they have to have full, fair, and truthful disclosure. And this puts the investors who watch your program in a better position. That’s our basic bargain. They were not complying with that basic law.“

Sorkin then asked how does this affect other firms, such as Coinbase, that are offering yield products. Gensler replied:

“The labels don’t matter. Long ago, Supreme Court Justice Marshall said this so eloquently. It’s not about the labels. It’s about the underlying economics. And this really should put everyone on notice in this marketplace, whether you call it Lend, whether you call it Earn, whether you call it Yield, whether you offer what’s called an annual percentage yield (APY), that doesn’t matter.

“If somebody’s taking their tokens and transferring it to that platform, the platform controls it. And guess what happens if they go bankrupt? You stand in line at the bankruptcy court. There’s a saying in crypto that says ‘not your keys, not your coins.’ So, those other platforms should take note of this and seek to come into compliance, do the proper disclosures and registration, and the like.“

Later that day, Kraken Co-Founder and CEO Jesse Powell mocked Gensler for making it sound like it was really easy for crypto companies to register such offerings with the SEC:

On 9 February 2023, Kraken announced in a blog post that it had agreed to shut down its crypto staking services for U.S. clients:

“Today, two Kraken subsidiaries announced a settlement with the U.S. Securities and Exchange Commission (SEC) concerning Kraken’s on-chain staking program. Because of this settlement, Kraken has agreed to end its on-chain staking services for U.S. clients.

“Starting today, Kraken will automatically unstake all U.S. client assets enrolled in the on-chain staking program. These assets will no longer earn staking rewards. This applies to all staked assets except for staked ether (ETH), which will be unstaked after the Shanghai upgrade. U.S. clients will not be able to stake any additional assets, including ETH. Kraken will continue to offer staking services for non-U.S. clients through a separate Kraken subsidiary… Staking services for non-U.S. clients will continue uninterrupted. Non-U.S. clients can continue to stake and unstake assets, as well as automatically earn and stake rewards, as usual.“

On the same day, the SEC issued a press release about Kraken that stated:

“The Securities and Exchange Commission today charged Payward Ventures, Inc. and Payward Trading Ltd., both commonly known as Kraken, with failing to register the offer and sale of their crypto asset staking-as-a-service program, whereby investors transfer crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21 percent.

“To settle the SEC’s charges, the two Kraken entities agreed to immediately cease offering or selling securities through crypto asset staking services or staking programs and pay $30 million in disgorgement, prejudgment interest, and civil penalties.“

Source: Read Full Article

-

Litecoin Price Prediction: LTC Rallies 10% as The Bulls Aim $110

-

Google launches blockchain node engine for Web 3.0 developers

-

Inspector General wants FDIC to refine crypto risk assessment process, guidance

-

Who Holds the Key to Sam Bankman-Fried's Fate? Court to Unveil Co-Signers of $250 Million Bail Bond – Coinpedia Fintech News

-

Crypto community responds to Kraken lawsuit, Deaton slams ‘dishonorable’ Gensler