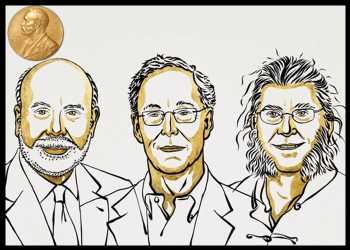

Three American economists have won the Nobel Prize in economics for their research on banks and financial crises.

Former Federal Reserve Chair Ben Bernanke, Prof. Douglas Diamond and Prof. Philip Dybvig have significantly improved the understanding of the role of banks in the economy, particularly during financial crises, The Royal Swedish Academy of Sciences said on Monday. An important finding in their research is why avoiding bank collapses is vital.

“Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises,” the award committee said in a press release.

Bernanke, who was the head of the US central bank during the 2008 financial crisis, was considered for the award for his analysis of the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.

Depositors want instant access to their money in case of unexpected bank outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely. In their theory, Diamond and Dybvig show how banks offer an optimal solution to this problem. By acting as intermediaries that accept deposits from many savers, banks can allow depositors to access their money when they wish, while also offering long-term loans to borrowers.

However, their analysis also showed how the combination of these two activities makes banks vulnerable to rumors about their imminent collapse. If a large number of savers simultaneously run to the bank to withdraw their money, the rumor may become a self-fulfilling prophecy – a bank run occurs and the bank collapses. These dangerous dynamics can be prevented through the government providing deposit insurance and acting as a lender of last resort to banks.

Diamond demonstrated how banks perform another societally important function. As intermediaries between many savers and borrowers, banks are better suited to assess borrowers’ creditworthiness and ensuring that loans are used for good investments.

“The laureates’ insights have improved our ability to avoid both serious crises and expensive bailouts,” says Tore Ellingsen, Chair of the Committee for the Prize in Economic Sciences.

Ben S. Bernanke, 69, is a Distinguished Senior Fellow in Economic Studies at The Brookings Institution, Washington.

Douglas Diamond, 69, is a Professor of Finance at University of Chicago’s Booth School of Business.

Philip Dybvig, 67, is a Professor of Banking and Finance at the Olin Business School of Washington University in St. Louis.

The prize amount of 10 million Swedish kronor, or $0.88 million, will be shared equally among the laureates.

Source: Read Full Article

-

Peacock To Add Live 24/7 Access To Local NBC Affiliates In 210 Markets For Premium Subscribers

-

Trade settlement in rupee: Govt, RBI devise country-specific plan

-

Key mantra for India’s pharma sector in 2023

-

A+E Studios & Range Media Partners Secure Film & TV Rights To Christoffer Carlsson’s International Bestseller ‘Blaze Me A Sun’ And Its Follow-Up ‘Under The Storm’

-

Airline industry to post $9.8 bn net profit this year: IATA