Russian President Vladimir Putin had a virtual meeting with his Chinese counterpart Xi Jinping on Friday. Xi said China is ready to increase political cooperation with Russia.

Ukraine said it shot down 16 drones from Russia on Thursday night. On Wednesday Russia hit several energy infrastructures in Ukraine with drones.

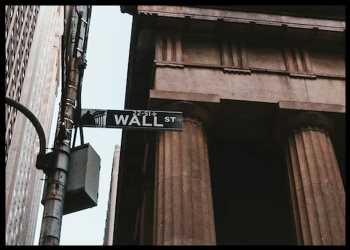

As of 7.00 am ET, the Dow futures were down 105.00 points, the S&P 500 futures were declining 14.75 points and the Nasdaq 100 futures were sliding 52.75 points.

The U.S. major averages gained on Thursday’s closing. The Nasdaq spiked 264.80 points or 2.6 percent to 10,478.09, the S&P 500 surged 66.06 points or 1.8 percent to 3,849.28 and the Dow jumped 345.09 points or 1.1 percent to 33,220.80.

On the economic front, the Market News International’s Chicago PMI for December will be published at 9.45 am ET. The consensus is 41.0, while it was up 37.2 in the previous month.

The Baker Hughes Rig Count for the week will be issued at 1.00 pm ET. In the prior week, the North America rig count was 875, while the U.S. rig count was 779.

The Agriculture Department’s Farm Prices for November will be released at 3.00 pm ET. In October the farm prices were down at 3.00 pm ET.

Asian stocks closed mostly higher on their last trading session of the year despite lingering inflation concerns and soaring COVID-19 cases in China.

The dollar index weakened a little bit after the latest U.S. jobless claims data signaled a softening labor market. Gold and oil prices traded higher in Asian trade on dollar weakness.

China’s Shanghai Composite index rose 0.51 percent to 3,089.26 but ended 2022 down more than 14 percent, hit by harsh anti-coronavirus curbs and a crackdown on corporate debt. Hong Kong’s Hang Seng index gained 0.20 percent to 19,781.41.

Japanese shares ended on a flat note due to many uncertainties in overseas markets. The Nikkei average finished marginally higher at 26,094.50 but posted its first annual loss in four years.

The broader Topix index edged down 0.19 percent to close at 1,891.71 – losing 5 percent for the year. Heavyweight Fast Retailing and shipping firms were among the top gainers of the day while energy stocks underperformed.

The yen extended its rebound as the Bank of Japan announced a third day of unscheduled bond purchases.

Seoul markets were closed for a holiday. The Kospi average fell nearly 25 percent in 2022.

Australian markets eked out modest gains but ended the year deep in the red. The benchmark S&P ASX 200 rose 0.26 percent to 7,038.70, with financials, energy and tech stocks pacing the gainers. The index lost over 5 percent for the year.

Across the Tasman, New Zealand’s benchmark S&P NZX-50 index dropped 0.57 percent to 11,473.24.

U.S. stocks rallied overnight as investors sought to snap up bargains in the tech sector, looking past worries that new variants could emerge from China’s continuing COVID outbreak.

Investors also digested data showing that jobless claims rose slightly in the week ended December 24 but held near historic lows.

The tech-heavy Nasdaq Composite index surged 2.6 percent, the S&P 500 climbed 1.8 percent and the Dow added 1.1 percent.

European shares are trading lower. CAC 40 of France is down 44.43 points or 0.68 percent. DAX of Germany is declining 104.28 points or 0.75 percent. FTSE 100 of England is sliding 36.47 points or 0.49 percent. The Swiss Market Index is down 47.32 points or 0.44 percent.

Euro Stoxx 50 which provides a Blue-chip representation of supersector leaders in the Eurozone, is down 0.81 percent.

Source: Read Full Article

-

Imagine Dragons Show Support For Writers During WGA Strike By Performing At Netflix Picket Line

-

'Worse than we anticipated:' CNN reporter breaks down inflation data

-

Rescue for tourist stranded after expiry date nightmare – The Crusader

-

In-N-Out eyes location along Tower Road in Denver

-

Asian Shares Rise On China Recovery Hopes