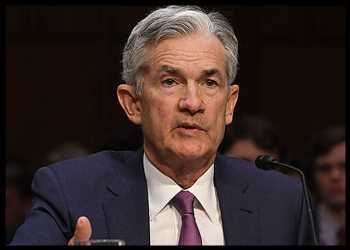

While forecasts suggest the U.S. central bank could start cutting interest rates as soon as March, Federal Reserve Chair Jerome Powell called such speculation “premature” during remarks at Spelman College on Friday.

Powell acknowledged recent signs of slowing price growth but said the Fed is committed to keeping monetary policy restrictive until officials are confident inflation is on a path to 2 percent.

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease,” Powell said.

Powell stressed the Fed is prepared to tighten policy further if it becomes appropriate, although most economists believe the central bank is done raising rates.

“We are making decisions meeting by meeting, based on the totality of the incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks,” he added.

A report released by the Commerce Department on Thursday showed consumer price growth in the U.S. slowed in line with economist estimates in the month of October.

The report said the annual rate of consumer price growth decelerated to 3.0 percent in October from 3.4 percent in September. The slowdown matched expectations.

Core consumer price growth also slowed in line with estimates, slipping to 3.5 percent in October from 3.7 percent in September. Core consumer prices exclude food and energy prices.

The inflation readings, which are said to be preferred by the Fed, were included in the Commerce Department’s report on personal income and spending during the month.

Powell called the lower inflation readings of the past few months “welcome” but said that progress must continue if the Fed is to reach its 2 percent objective.

The Fed’s final monetary policy meeting of the year is scheduled for December 12-13, with CME Group’s FedWatch Tool currently indicating a 99.6 percent chance interest rates will remain unchanged.

The central bank is expected to once again leave rates unchanged at its subsequent meeting in late January, while the FedWatch Tool suggests there is a 53.1 percent chance the Fed will cut rates by a quarter point in March.

Source: Read Full Article