This commercial-stage biotechnology company developing next-generation, targeted antibody drug conjugates is aiming to achieve double-digit year-over-year revenue growth for its lead drug.

The company we are profiling today is ADC Therapeutics SA (ADCT) and the drug in focus is Zynlonta.

Zynlonta, a CD19-directed antibody and alkylating agent conjugate, received FDA approval for the treatment of adult patients with relapsed or refractory large B-cell lymphoma in April 2021.

Launched in the U.S. in May 2021, Zynlonta has been performing well in the market, driven by positive reception from the medical community.

The drug generated net sales of $33.9 million in 2021 and $55.11 million for the first nine months of 2022.

The European Commission granted conditional marketing authorization to Zynlonta only as recently as last month for the treatment of relapsed or refractory diffuse large B-cell lymphoma.

ADC Therapeutics has an exclusive license agreement with Sobi to develop and commercialize Zynlonta in Europe and select international territories. The European Commission approval of Zynlonta triggers a $50 million milestone payment from Sobi to ADC Therapeutics.

Sobi is expected to launch Zynlonta in Europe in the first half of this year.

Zynlonta is also being studied in the following trials:

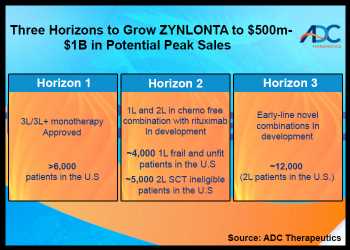

— A confirmatory phase III global clinical trial of Zynlonta in combination with rituximab compared to standard immunochemotherapy in second-line or later, transplant ineligible patients with diffuse large B-cell lymphoma, dubbed LOTIS-5. Enrolment in this study is expected to be completed next year.

— A phase Ib clinical trial evaluating Zynlonta in combination with other approved anti-cancer agents like Roche’s Polivy in patients with relapsed or refractory B-cell non-Hodgkin lymphoma, dubbed LOTIS-7.

— A phase II clinical trial evaluating Zynlonta in combination with rituximab in unfit and frail patients with previously untreated diffuse large B-cell lymphoma, dubbed LOTIS-9.

Preliminary safety and efficacy data from the LOTIS-7 and LOTIS-9 trials are anticipated in 2024.

Also in the pipeline are the following drug candidates in clinical development:

— ADCT-602: under a phase I/II trial in patients with relapsed or refractory acute lymphoblastic leukaemia.

— ADCT-901: under a phase I study in patients with selected advanced solid tumors with high unmet medical needs.

— ADCT-601: under a phase Ib clinical trial as a single agent in patients with AXL gene amplification and in combination with gemcitabine in patients with sarcoma.

Cash position:

The company ended Sep.30, 2022, with cash and cash equivalents of $380.9 million.

ADC Therapeutics shares began trading on the New York Stock Exchange on May 15, 2020, under the ticker symbol “ADCT”, priced at $19 each.

ADCT has traded in a range of $2.69 to $17.89 in the last 1 year. The stock closed Tuesday’s trading at $5.00.

Source: Read Full Article

-

Utica, NY, Had the Largest Increase in Car Thefts During the COVID Pandemic

-

Donald Trump Tells Fox News’ Bret Baier Why He Didn’t Just Return ALL Classified Documents: “I Was Very Busy” To Sort Through Boxes

-

‘You should have a mix of equity, gold, fixed income’

-

Nissan recalls over 800K SUVs; key defect can cut off engine

-

A Towering, Terrifying Demon Horse Isn’t Even the Weirdest Part