On Sunday (September 11), Bitcoin is trading around $21,506, up 8.58% in the past five-day period.

According to data by TradingView, on Friday (September 9), Bitcoin started a mini rally that saw its price go above the psychologically important $20K level by 1:10 a.m. UTC, and it has stayed above that level since then.

Friday was an interesting day for two other reasons.

First, FTX Ventures, which is a multi-stage venture capital fund, announced that it will acquire a 30% stake in global alternative investment firm SkyBridge Capital (“SkyBridge”), which was founded by former White House Director of Communications Anthony Scaramucci.

The press release stated that “FTX Ventures’ investment will provide SkyBridge additional working capital to fund growth initiatives and new product launches.” It also mentioned that “SkyBridge will use a portion of the proceeds to purchase $40 million in cryptocurrencies to hold on its corporate balance sheet as a long-term investment.”

Second, Nasdaq-listed business intelligence company MicroStrategy Inc. (NASDAQ: MSTR) revealed in a Prospectus Supplement (To Prospectus Dated June 14, 2021) filing with the the U.S. Securities and Exchange Commission (SEC) that it planned to sell up to $500 million of class A common stock, the proceeds of which it intends to use for for “general corporate purposes, including the acquisition of bitcoin.”

FTX Co-Founder and CEO Sam Bankman-Fried (“SBF”) had this to say:

“After working with Anthony and his team following our SALT conference partnership, we saw there was an opportunity to work closer together in ways that could complement both our businesses. We look forward to collaborating closely with SkyBridge on its crypto investment activity and also working alongside them on promising non-crypto-related investments.”

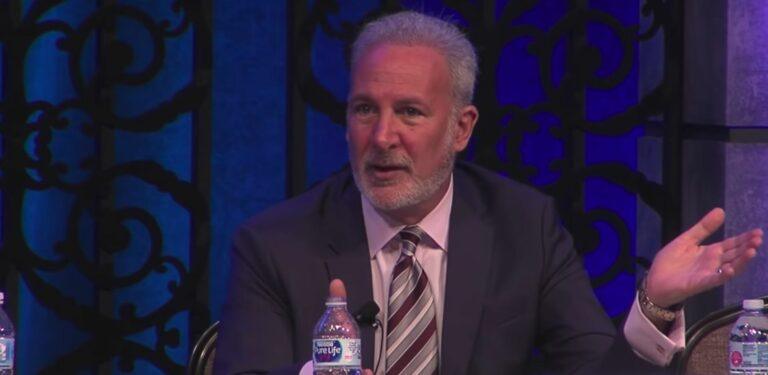

The FTX announcement led Bitcoin perma-bear Peter Schiff — who is the CEO of Euro Pacific Capital, a full-service, registered broker/dealer specializing in foreign markets and securities, as well as also Founder and Chairman of SchiffGold, a full-service, discount precious metals dealer — to say that SVF’s investment in SkyBridge would not have a material impact on Bitcoin, and that he considered Bitcoin’s most recent price surge a “sucker’s rally.”

On August 28, Bitcoiner Spencer Schiff found an interesting way to express his frustration with his father’s hatred of crypto in general and Bitcoin in particular.

Peter ran a Twitter poll to find out how the crypto community on Twitter feels about Bitcoin trading around the $20K level. Of the 17,360 people who voted, 52.6% seem to believe that the Bitcoin market “runs out of buyers before it runs out of sellers.” Spencer replied to his father’s tweet and accused of him of suffering from Bitcoin Derangement Syndrome since Peter seems more obsessed with Bitcoin than gold.

Source: Read Full Article

-

Grayscale Files 'Final' Briefs In ETF Lawsuit Against SEC

-

Centerra Gold Up 10% Following EIA Approval For Oksut Mine

-

CureVac Rallies On Positive Data From Its COVID-19, Flu Vaccine Candidates

-

Bitcoin Skeptic U.S. Senator Charged with Bribery

-

Michael Saylor: ‘Bitcoin Must Be Understood As Something Outside This Crypto Industry’