By CHRISTOPHER RUGABER (AP Economics Writer)

WASHINGTON (AP) — The Federal Reserve kept its key interest rate unchanged Wednesday after having raised it 10 straight times to combat high inflation. But in a surprise move, the Fed signaled that it may raise rates twice more this year, beginning as soon as next month.

The Fed’s move to leave its benchmark rate at about 5.1%, its highest level in 16 years, suggests that it believes the much higher borrowing rates it’s engineered have made some progress in taming inflation. But top Fed officials want to take time to more fully assess how their rate hikes have affected inflation and the economy.

The central bank’s 18 policymakers envision raising their key rate by an additional half-point this year, to about 5.6%, according to economic forecasts they issued Wednesday.

The economic projections revealed a more hawkish Fed than many analysts had expected. Twelve of the 18 policymakers forecast at least two more quarter-point rate increases. Four supported a quarter-point increase. Only two envisioned keeping rates unchanged. The policymakers also predicted that their benchmark rate will stay higher for longer than they did three months ago.

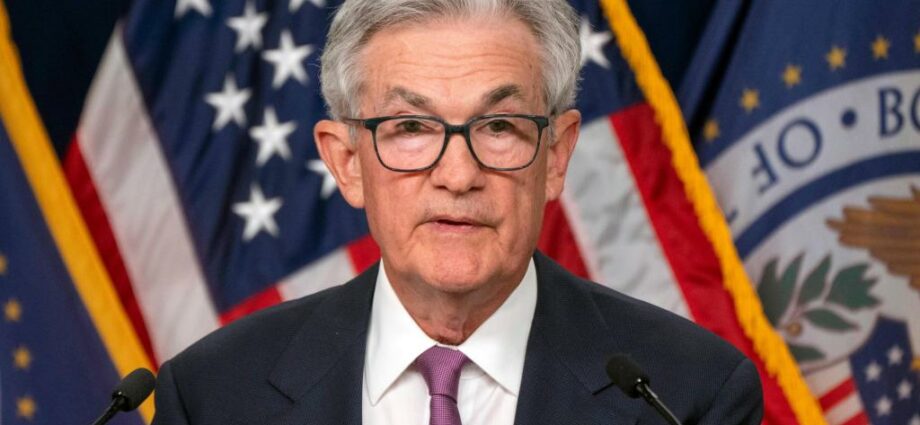

“We understand the hardship that high inflation is causing, and we remain strongly committed to bring inflation back down to our 2% goal,” Fed Chair Jerome Powell said at a news conference. “The process of getting inflation down is going to be a gradual one — it’s going to take some time.”

One reason why the officials may be predicting additional rate hikes is that they foresee a modestly healthier economy and more persistent inflation that might require higher rates to cool. Their updated forecasts show them predicting economic growth of 1% for 2023, an upgrade from a meager 0.4% forecast in March. And they expect “core” inflation, which excludes volatile food and energy prices, of 3.9% by year’s end, higher than they expected three months ago.

At his news conference, Powell made clear that the Fed still regards the still-robust job market and the wage growth that has accompanied it as contributing to high inflation. At the same time, he expressed optimism that lower apartment rental costs, among other items, may help slow inflation in the coming months. He stressed that the Fed wants to see an inflation slowdown actually materialize before holding off on further rate hikes.

“We want to see inflation coming down decisively,” he said.

Immediately after the Fed’s announcement, which followed its latest policy meeting, stocks sank and Treasury yields surged. The yield on the two-year Treasury note, which tends to track market expectations for future Fed actions, jumped from 4.62% to 4.77%.

The Fed’s aggressive streak of rate hikes, which have made mortgages, auto loans, credit cards and business borrowing costlier, have been intended to slow spending and defeat the worst bout of inflation in four decades. Average credit card rates have surpassed 20% to a record high.

The central bank’s rate hikes have coincided with a steady drop in consumer inflation, from a peak of 9.1% last June to 4% as of May. But core inflation remains chronically high. Core inflation clocked in at 5.3% in May compared with 12 months earlier, well above the Fed’s 2% target.

Powell and other top policymakers have also indicated that they want to assess how much a pullback in bank lending might be weakening the economy. Banks have been slowing their lending — and demand for loans has fallen — as interest rates have risen. Some analysts have expressed concern that the collapse of three large banks last spring could cause nervous lenders to sharply tighten their loan qualifications.

The Fed has raised its benchmark rate by a substantial 5 percentage points since March of last year — the fastest pace of increases in 40 years. “Skipping” a rate hike now might have been the most effective way for Powell to unite a fractious policymaking committee.

The 18 members of the committee have appeared divided between those who favor one or two more rate hikes and those who would like to leave the Fed’s key rate where it is for at least a few months and see whether inflation further moderates. This group is concerned that hiking too aggressively would heighten the risk of causing a deep recession.

In an encouraging sign, inflation data that the government issued this week showed that most of the rise in core prices reflected high rents and used car prices. Those costs are expected to ease later this year.

Wholesale used car prices, for example, fell in May, raising the prospect that retail prices will follow suit. And rents are expected to ease in the coming months as new leases are signed with milder price increases. Those lower prices, though, will take time to feed into the government’s measure.

The economy has so far fared better than the central bank and most economists had expected at the beginning of the year. Companies are still hiring at a robust pace, which has helped encourage many people to keep spending, particularly on travel, dining out and entertainment.

Source: Read Full Article

-

Melbourne swingers club founder charged with rape

-

Police sergeant Matt Ratana's murderer to challenge life sentence

-

Parents, students ‘blindsided’ as private school announces snap closure

-

Fishermen somehow land super-rare 14ft hammerhead shark after 90 minute battle

-

Flood warnings after the UK is battered by torrential rain and thunder