Save articles for later

Add articles to your saved list and come back to them any time.

The corporate watchdog has put Australia’s $3.5 trillion superannuation industry on notice and flagged its intention to crack down on misconduct in the sector over coming months.

The Australian Securities and Investment Commission on Wednesday detailed its regulatory and enforcement work in the September quarter, and reinforced its pledge to hone in on the superannuation industry after finding that most super funds had largely ignored a new legal obligation to help customers prepare for retirement.

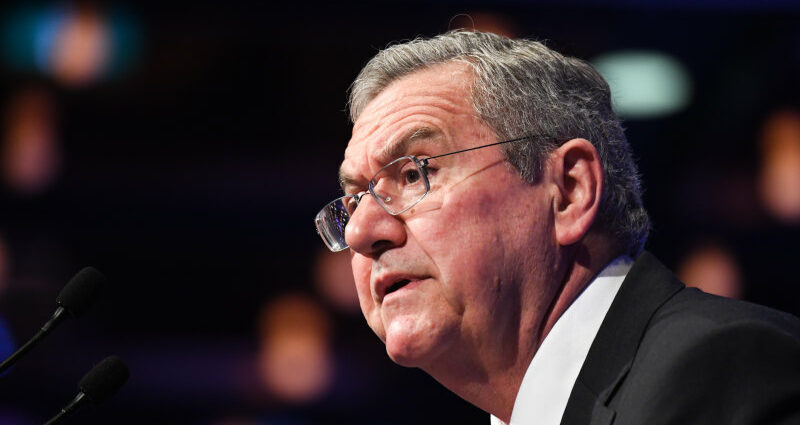

ASIC chair Joe Longo has put the superannuation sector on notice. Credit: Peter Rae

ASIC in September announced it was suing AustralianSuper over its failure to consolidate the accounts of more than 90,000 members.

The regulator has alleged the country’s biggest super fund for 10 years failed to put in place adequate policies and procedures to identify members who held multiple accounts.

“The July to September quarter saw ASIC achieve strong results in court and file significant matters that go toward our ongoing work to protect consumers,” ASIC chair Joe Longo said in a statement.

“Our focus on the best interests of members in the superannuation sector is part of our continuing work to make the financial system fair for all Australians.”

The Albanese government has also set its sights on the industry, warning big super to “urgently lift their game” as 3.6 million Australians prepare to retire over the next decade, meaning at least $750 billion currently invested in the accumulation phase of funds will shift to the retirement phase.

At the Australian Financial Review’s Super and Wealth Summit last month, Financial Services Minister Stephen Jones said the industry needed to improve its customer service.

“The sector must lift its game to help members achieve a dignified retirement,” Jones said. “They must be more responsive and more innovative because members have a right to expect the highest standards from their funds.”

ASIC, in its September quarter update, detailed the greenwashing cases it launched against Active Super and Vanguard Investments Australia; sued PayPal Australia for alleged unfair contract term with small business; and sued Westpac for failing to respond to hardship notices.

Association of Superannuation Funds of Australia interim chief executive Leeanne Turner said the sector was delivering for 17 million members.

“The industry has a strong commitment and focus on delivering the best possible member outcomes while meeting an extensive range of regulatory obligations and continues to engage constructively with regulators,” Turner said.

Market Forces superannuation funds campaigner Brett Morgan said it was great to see super funds put on notice for ineffective “active ownership” strategies that are failing to align with their own climate commitments.

“Between buying tens of millions of shares in Woodside and throwing its full support behind the company’s board, AustralianSuper has endorsed reckless oil and gas expansion plans which would lock in higher emissions for decades,” Morgan said.

“Any super fund with climate commitments that fails to demand an end to the fossil fuel expansion plans of companies like Woodside and Santos is greenwashing and undermining efforts to rein in harmful emissions.”

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.

Most Viewed in Business

From our partners

Source: Read Full Article

-

Coinbase Launches Perpetual Derivates Exchange in Bermuda

-

Gold Futures Settle Lower As Dollar Rises Ahead Of Key Economic Data

-

Trump hit with gag order after lashing out at court clerk in NY fraud case

-

Treasuries See Further Upside On Continued Decline In GDP

-

Earnings Previews: Accenture, Darden Restaurants, KB Home