The Commerce Department released a report on Tuesday showing a decrease in new residential construction in the U.S. in the month of November.

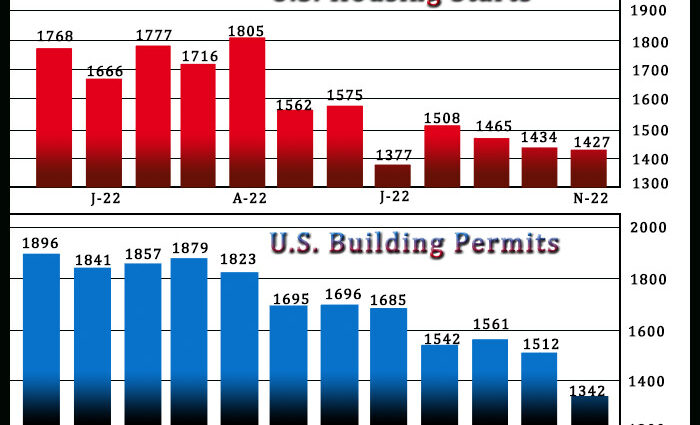

The report said housing starts fell by 0.5 percent to an annual rate of 1.427 million in November after tumbling by 2.1 percent to a revised rate of 1.434 million in October.

Economists had expected housing starts to decline by 0.7 percent to a rate of 1.415 million from the 1.425 million originally reported for the previous month.

The decrease in housing starts came as single-family starts dove by 4.1 percent to a rate of 828,000, more than offsetting a 4.9 percent surge in multi-family starts to a rate of 599,000.

The Commerce Department also said building permits plunged by 11.2 percent to an annual rate of 1.342 million in November after slumping by 3.3 percent to a revised rate of 1.512 million in October.

Building permits, an indicator of future housing demand, were expected to dive by 3.7 percent to 1.470 million from the 1.526 million originally reported for the previous month.

Single-family permits tumbled by 7.1 percent to a rate of 781,000, while multi-family permits plummeted by 16.4 percent to a rate of 561,000.

“The drop in permits, along with pessimistic homebuilder sentiment, point to further weakness in housing construction in the months ahead as high interest rates side-line many buyers,” said Nancy Vanden Houten, U.S. Lead Economist at Oxford Economics.

On Monday, the National Association of Home Builders released a separate report unexpectedly showing a continued deterioration in homebuilder confidence in the month of December.

The report showed the NAHB/Wells Fargo Housing Market Index fell to 31 in December from 33 in November. The decreased surprised economists, who had expected the index to rise to 36.

The housing market index declined for the twelfth straight month, falling to its lowest reading since mid-2012, with the exception of the onset of the pandemic in the spring of 2020.

Source: Read Full Article

-

Eurozone Private Sector Downturn Softens In December

-

Our homes are not our castles: Property losing its lustre for Australians

-

Social Security Benefits About to Surge

-

Alnylam Q2 Loss Widens, SGEN Boosts Revenue Outlook, NVCR To Report LUNAR Study Data In Q1

-

Eurozone Industrial Production Declines For First Time In 4 Months