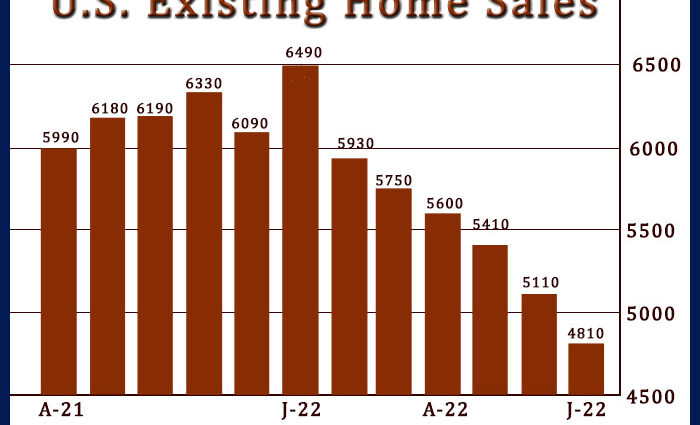

Existing home sales in the U.S. showed another significant decrease in the month of July, according to a report released by the National Association of Realtors on Thursday.

NAR said existing home sales plunged by 5.9 percent to an annual rate of 4.81 million in July after tumbling by 5.5 percent to a revised rate of 5.11 million in June.

Economists had expected existing home sales to slump by 4.5 percent to a rate of 4.89 million from the 5.12 million originally reported for the previous month.

Existing home sales declined for the sixth consecutive month, falling to their lowest annual rate since May 2020.

“The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun. “Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers.”

The report also showed housing inventory at the end of July totaled 1.31 million units, up 4.8 percent from 1.25 million units at the end of June and unchanged from the same month a year ago.

The unsold inventory represents 3.3 months of supply at the current sales rate, up from 2.9 months in June and 2.6 months in July 2021.

NAR also said the median existing home price tumbled by 2.4 percent to $403,800 in July from $413,800 in June but was still up by 10.8 percent compared $364,600 a year ago.

“We’re witnessing a housing recession in terms of declining home sales and home building,” Yun said. “However, it’s not a recession in home prices.”

He added, “Inventory remains tight and prices continue to rise nationally with nearly 40% of homes still commanding the full list price.”

The report also showed single-family home sales dove 5.5 percent to an annual rate of 4.31 million in July, while existing condominium and co-op sales plummeted by 9.1 percent to a rate of 500,000.

Next Tuesday, the Commerce Department is scheduled to release a separate report on new home sales in the month of July.

Source: Read Full Article

-

5 Reasons Inflation Will Surge

-

Last week I fixed half my home loan. Here are the tricks you should know

-

U.S. Pending Home Sales Soar Much More Than Expected In January

-

Alstom H1 Loss Narrows, Orders Climb; Sees Margin Growth In FY23; Stock Up

-

U.S. Consumer Sentiment Index For February Unexpectedly Upwardly Revised