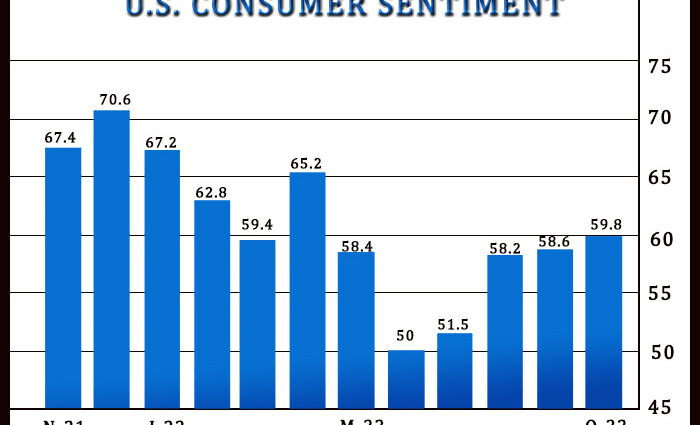

Consumer sentiment in the U.S. has seen a modest improvement in the month of October, according to preliminary data released by the University of Michigan on Friday.

The University of Michigan said its consumer sentiment index crept up to 59.8 in October from 58.6 in September. Economists had expected the index to inch up to 59.0.

With the slightly bigger than expected uptick, the consumer sentiment index continued to recover from all-time low in June, reaching its highest level since hitting 65.2 in April.

The increase by the headline index reflected a notable improvement in consumers’ assessment of current conditions, with the current economic conditions index jumping to 65.3 in October from 59.7 in September.

On the other hand, the index of consumer expectations dipped to 56.2 in October from 58.0 in September, suggesting the improvement in consumer sentiment remains tentative.

“Continued uncertainty over the future trajectory of prices, economies, and financial markets around the world indicate a bumpy road ahead for consumers,” said Surveys of Consumers Director Joanne Hsu.

Meanwhile, the report showed a rebound in inflation expectations, with one-year inflation expectations climbing to 5.1 in October after dropping to a one-year low of 4.7 in September.

Five-year inflation expectations also increased to 2.9 percent in October after falling to 2.7 percent in September.

“Last month, long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have returned to that range at 2.9%,” Hsu said.

She added, “After 3 months of expecting minimal increases in gas prices in the year ahead, both short and longer run expectations rebounded in October.

Source: Read Full Article

-

The $922-a-fortnight handout I left unclaimed – but you shouldn’t

-

U.S. Jobless Claims Unexpectedly Edge Down To Three-Month Low

-

German Ifo Business Confidence Weakens For First Time In 7 Months

-

Use it or lose it: Making the most of your health insurance is more important than ever

-

RM Plc Posts Prelim. FY22 Pre-Tax Loss; Annual Revenue Climbs