Bitcoin has continued to struggle recently as its price is still in the low $29,000 level. Here’s what on-chain data says about if a rebound is likely or not.

What Does Bitcoin On-Chain Data Say About The Asset’s Near-Term Outlook?

Bitcoin has stagnated recently as the cryptocurrency’s price has failed to keep any significant moves going. Even the latest decline in the asset has been indecisive, as the price didn’t take long to fall back to a sideways movement. Under these conditions, it’s natural that investors may be wondering when the asset might break out of this consolidation.

Related Reading: Quant Explains How These Indicators Affect Ethereum Price

Recent on-chain data from Santiment sheds light on the underlying metrics related to the asset, which may contain hints about where the cryptocurrency’s price could be heading next.

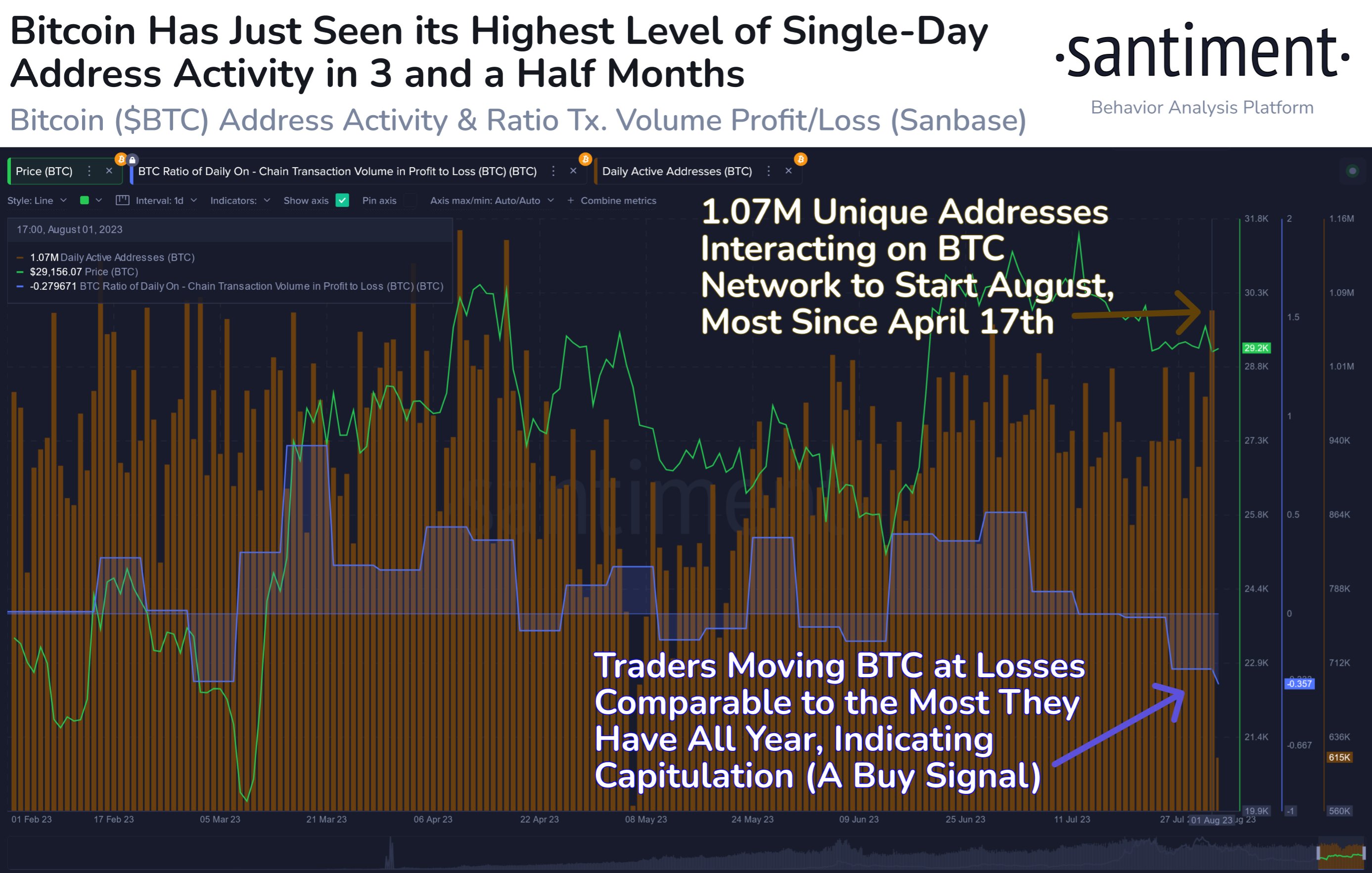

First, here is a chart that shows the data for two of the Bitcoin indicators that are of interest here:

The trend in the active addresses and ratio of volume in profit to loss | Source: Santiment on X

As you can see in the above graph, there are two indicators of relevance here: the “daily active addresses” and the “ratio of on-chain transaction volume in profit to loss.”

The former of these naturally keeps track of the total number of unique addresses on the Bitcoin blockchain that are taking part in some kind of transaction activity on the network.

From the chart, it’s visible that this metric has observed a large spike recently, suggesting that a high number of addresses have become active. Generally, a large number of addresses making transfers on the chain implies that a high amount of users are making use of the chain right now.

The current value of the metric suggests that more than a million addresses have been active recently, which is the highest that the indicator has been since the middle of April. Such an increase in utility suggests that there is a large amount of interest in the coin at the moment.

Now, the other metric here measures the difference between the profit-taking and loss-taking volumes on the Bitcoin network. As is visible in the graph, this indicator has a negative value currently, which means that the majority of the selling in the market is happening at some loss.

These negative levels of the metric are similar in scale to those observed back during the March plunge. Historically, bottoms in the price have become more probable to form when investors are capitulating like this, as the coins of the weak hands are picked up by the strong hands in such periods.

If a rebound move does arise from this capitulation, then its timing may be ideal, as a high amount of active addresses can mean the presence of a large number of traders who can help fuel the move.

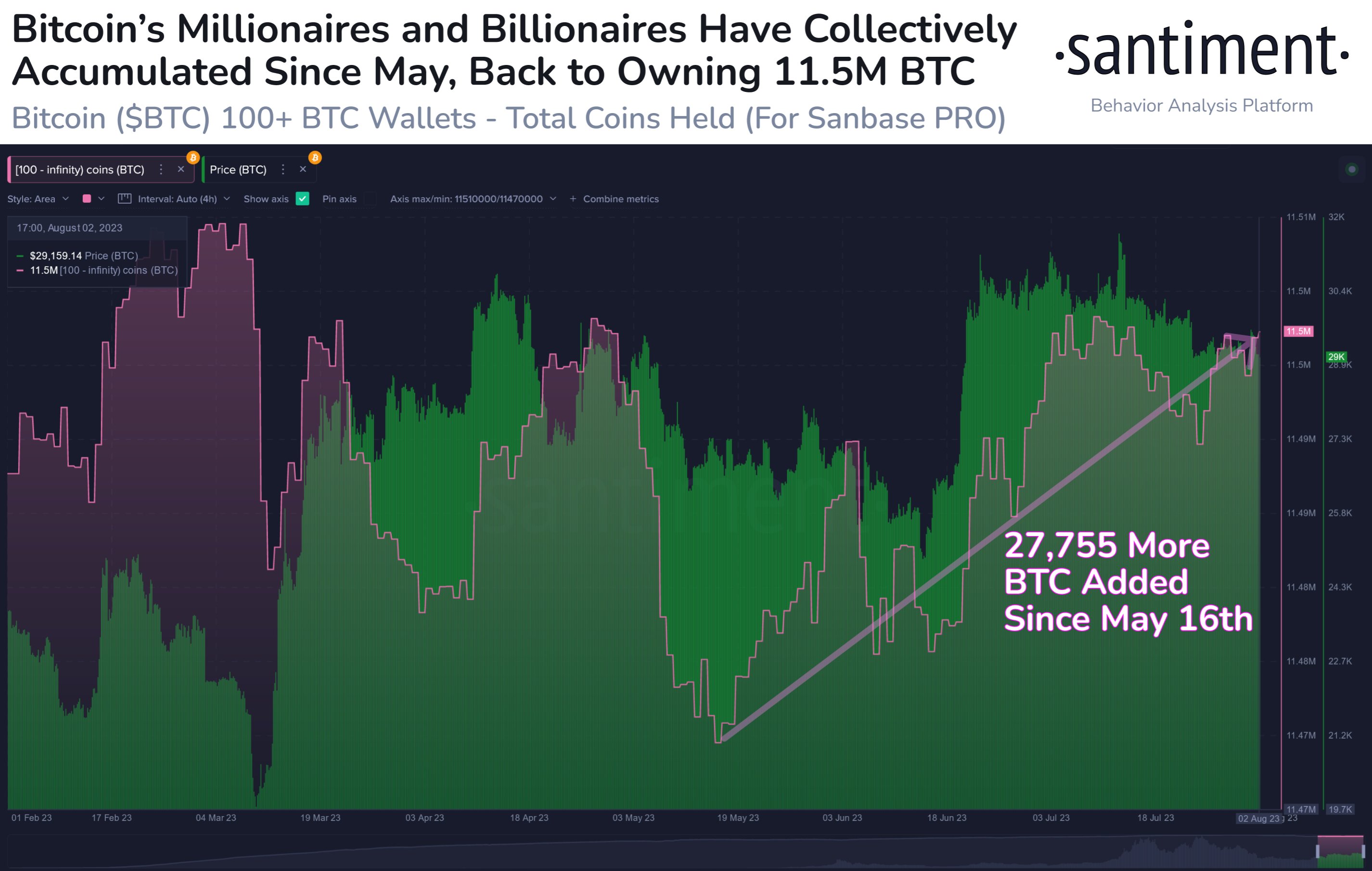

Additionally, the Bitcoin millionaire and billionaire addresses have also been behind the asset recently, as they have added 27,755 BTC to their holdings since May.

The value of the metric has been trending up recently | Source: Santiment on X

Based on these factors, it’s not hard to believe that a rebound in the cryptocurrency’s price might take place in the near future, although it may only be a short-term move.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, down 1% in the last week.

Source: Read Full Article

-

Traders Act Fast As Binance Australia Unveils Bitcoin Discount For Limited Period

-

Bitcoin Oscillates Below $35,000 And Targets Previous Highs

-

Aave proposes governance changes after failed $60M short attack

-

Are Crypto Scammers Becoming Less Busy?

-

CZ denies report Binance is considering major breakup with US business partners