Terra Luna has seen the successful approval of community proposals 11658 and 11660, authorizing the retrieval and subsequent incineration of a total of 800 million USTC. The prevailing sentiment within the community leans towards directing these USTC tokens towards the burn address as opposed to reintegrating them into the community pool.

Conversely, a noteworthy shift has been detected in LUNC’s staking ratio within the past day, where a previous upward trajectory has now given way to a decline. This alteration in the staking ratio commonly signifies reduced assurance among stakers regarding a specific asset.

Here’s what’s going on within the struggling Terra community:

Recent Community Decisions Shape Terra Luna Future

In a significant turn of events, Proposal 11658 titled “Return of Community funds not used,” presented by Vegas, a former member of the ex-Terra Rebels developer group, has achieved approval with an affirmative vote percentage of 70.27%.

And it seems that once again.someone is fighting against us… So the 200 milion ustc that RH have “missed” used.. is one of the reasons that I was so vocal to not send all the rest of the funds to the CP. Now seems that is already moviments asking the signers to not do,the 11658…

— Vegas (@VegasMorph) August 8, 2023

Vegas has advocated for the reintegration of 800 million USTC on-chain funds back into the Terra Luna Classic community pool. This proposition stems from the observation that the Ozone Protocol project is presently deviating from the proposed development plan.

In a parallel development, Proposal 11660, labeled “Burn 100% of Funds Should Prop: 11658 Pass,” has garnered substantial support, amassing a “Yes” vote share of 82.55%. This counter-proposal asserts that a substantial segment of the community is advocating for the incineration of the 800 million tokens.

Consequently, even if Proposal 11658 is ratified, the counter-proposal is poised to take precedence due to its higher vote count.

Total crypto market cap reaches $1.12 trillion today. Chart: TradingView.com

Awaiting the community’s consideration is another proposal, suggesting the burning of 80% of the funds while allocating the remaining 20% to the community pool designated for developers. Notably, this proposal has encountered limited favor, with only 46% of the community showing agreement.

The aftermath of these recent updates has naturally sparked curiosity regarding their impact on the price dynamics of LUNC. How are these decisions influencing the valuation of the token?

Staking Confidence Wanes As LUNC Faces Price Challenges

Bringing the most recent developments to the forefront, there has been a notable decrease in the percentage of LUNC staked within the past 24 hours. This shift indicates that holders and users are opting to un-stake their holdings, signifying a diminished level of trust and confidence in the token’s performance.

The implications of this trend raise questions about the current sentiment surrounding LUNC.

A fresh analysis of LUNC’s price dynamics reveals that the token’s staking ratio now stands at 14.92%. This percentage signifies the portion of LUNC holdings that have been committed to staking, underscoring the level of engagement and commitment from the community.

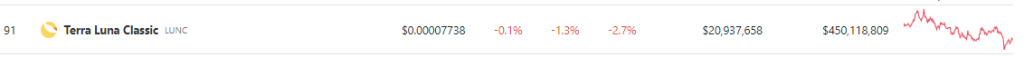

Source: Coingecko

Meanwhile, as observed on CoinGecko, LUNC is presently valued at $0.000077. Over the preceding 24 hours, the token’s price has experienced a reduction of 1.3%, while its value has declined by 2.7% over the past seven days.

These figures shed light on the challenges LUNC currently faces within the market and the potential impact on investor sentiment.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Analytics Insight

Source: Read Full Article

-

Cardano: Factors That Could Drive ADA Price As High As $12

-

Cathie Wood’s ARKW Holdings is Bullish on Coinbase But Hawkish on Grayscale’s GBTC – Coinpedia Fintech News

-

Bitcoin tackles unique challenges in emerging markets

-

Bulgaria’s oldest football club adopts Bitcoin and Lightning, joins Nostr

-

Uniswap Price Decline May Bring Fresh Buying Opportunities For Traders