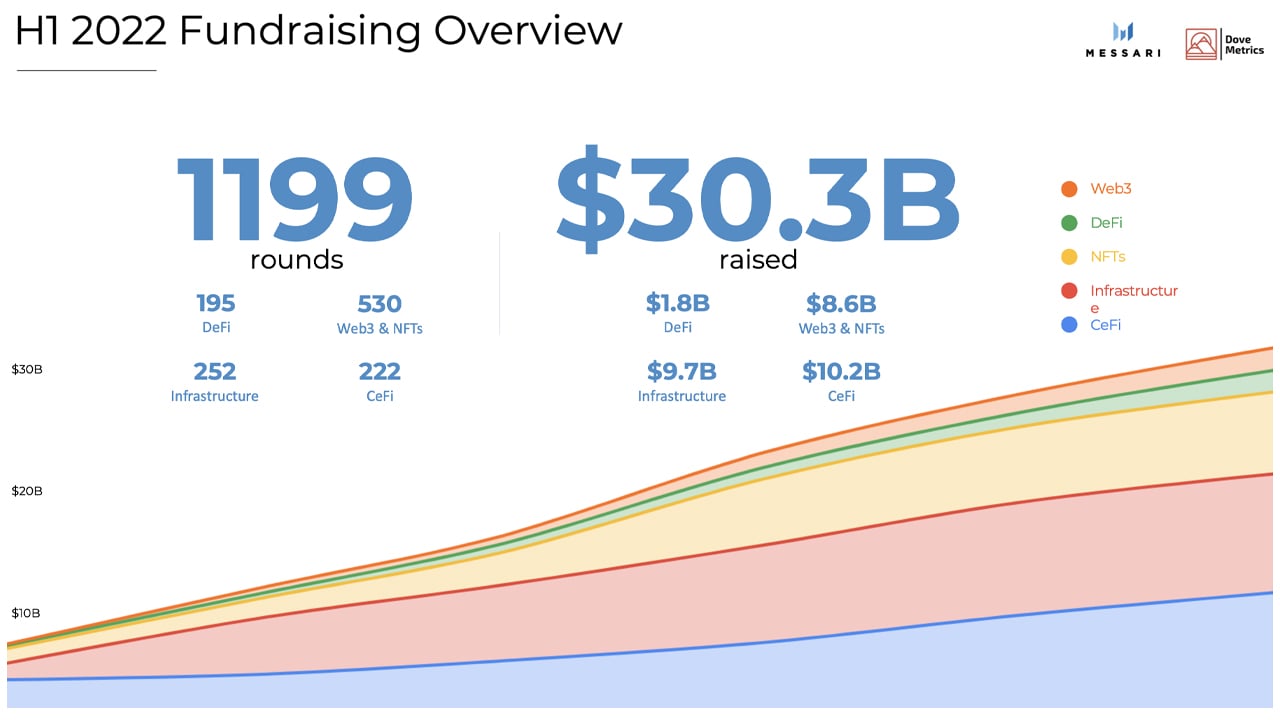

While cryptocurrency markets have seen poor performances during the first two quarters of 2022, a recently published fundraising report authored by Messari researchers notes that $30.3 billion was raised by crypto projects and startups during the first half of 2022. The $30.3 billion raised across 1,199 fundraising rounds surpasses all the funding blockchain startups and projects obtained last year.

H1 Crypto Ecosystem Funding Report Shows Capital Continues to Flow Despite Crypto Winter

A significant sum of money has been injected into specific blockchain projects and startups within the crypto industry, according to the “H1 2022 Fundraising Report” published by Messari and Dove Metrics, a subsidiary of Messari Holding Inc. According to the report, centralized finance (cefi) outpaced decentralized finance (defi), as cefi captured more than $10.2 billion in H1.

Defi managed to gather $1.8 billion, while Web3 and non-fungible token (NFT) projects and related companies raised $8.6 billion in the first six months of the year. $9.7 billion was injected into blockchain and crypto infrastructure sector and while Web3 and NFTs saw the third largest capital raised, the Web3-NFT sector saw the most fundraising rounds with 530 rounds during the first two quarters.

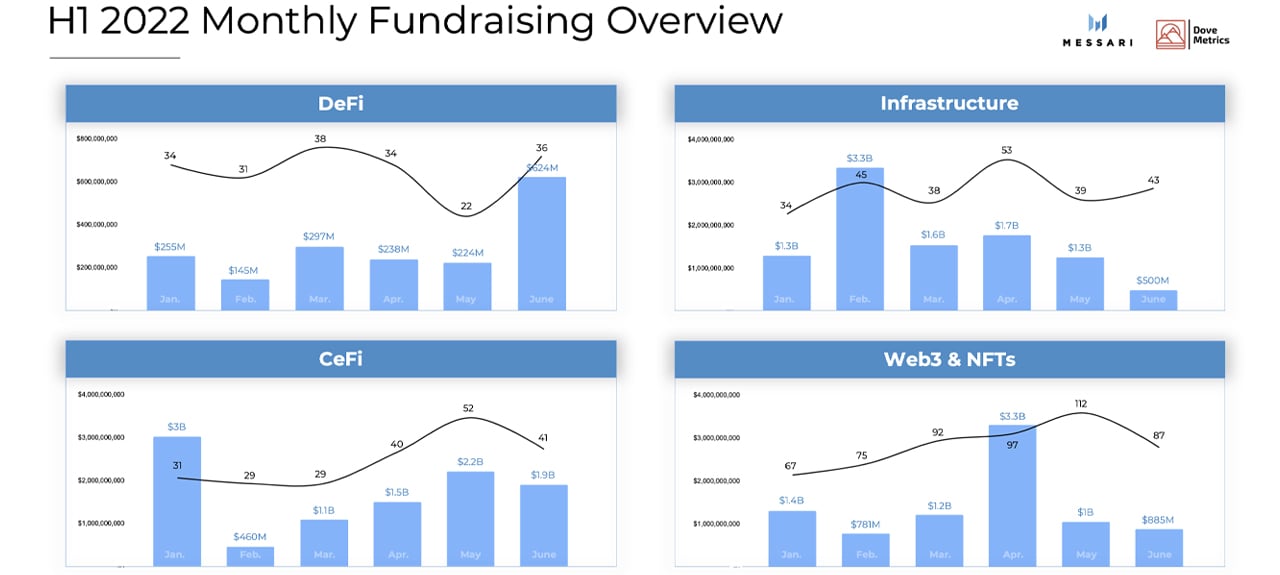

Defi’s biggest month was the month of June, as a number of defi projects and businesses raised $624 million. “Despite DeFi’s maturity, seed rounds continue to dominate,” Messari researchers explain in the report. The most funds raised during a month for infrastructure was February, for cefi the top month was January, and the Web3-NFT sector’s best month was April.

Ethereum-based defi projects and startups have received the most rounds and the highest dollar amounts, in comparison to alternative smart contract blockchains like Solana, Avalanche, and Polkadot when it comes to fundraising. Ethereum-based defi projects saw 54 deals in Q1 and 61 deals in Q2. In Q1, Ethereum-based defi projects raised $387 million while projects from alternative blockchains raised $309 million during the first quarter of 2022.

In Q2, ETH-based defi raised $890 million while alternative chain-based projects gathered around $193 million. Messari researchers note that in the Web3-NFT sector, early-stage funding rules the roost and gaming eclipsed most of the NFT funding. Once again, Ethereum also dominated in the Web3-NFT industry, in comparison to alternative smart contract platform networks.

Cefi, Infrastructure, Web3 Sectors Mature

As far as centralized finance is concerned, cefi “continues to mature,” Messari’s report says as it highlights that $10 million+ funding rounds “make up 50% of activity.” Messari’s latest H1 fundraising report follows the recently published “4th Annual Global Crypto Hedge Fund Report 2022,” authored by the international professional services firm Pricewaterhousecoopers (PWC).

The insights from PWC’s recent crypto study show that hedge funds injecting capital into cryptocurrency and blockchain projects have increased since last year. PWC researchers estimated that 21% of hedge funds participated in financing rounds tied to crypto, while this year’s participation rate is up to 38%.

Messari’s fundraising report details that many sectors are “maturing” as Series A financing rounds or later made up 40%+ of H1’s crypto infrastructure dedicated rounds. Web3’s Series A rounds or later equated to around 30%+ of the fundraising rounds in H1 2022. Investors mentioned in Messari’s fundraising report include companies like FTX, Mechanism Capital, Pantera Capital, Sequoia Capital, Gumi Cryptos, Dragonfly Capital, Slow Ventures, Seven Seven Six, and around a dozen and a half others.

Source: Read Full Article

-

Bitcoin Falls After Harsh Rejection At $28,400

-

Bithumb ordered to pay outage damages to investors by South Korean court

-

Microsoft bans cryptocurrency mining on cloud services

-

Bitcoin miner Northern Data says it has no financial debt, expects $204M in revenue for 2022

-

Elon Musk wants Twitter payments system built with crypto in mind