Kara Szabo, a well-known figure in the cryptocurrency community, recently shared her investment strategy amidst the market’s downturn.

Szabo’s Investment Strategy

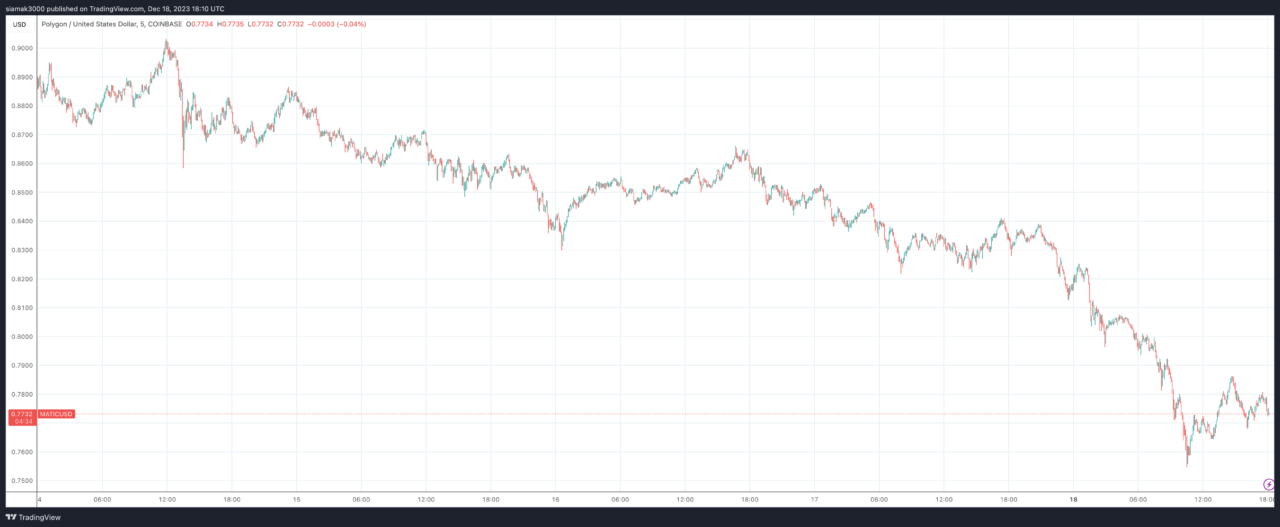

In a tweet dated 18 December 2023, Szabo suggested a proactive approach to investing in cryptocurrencies that are experiencing significant price drops. She mentioned increasing her holdings in ADA and starting a DCA strategy for MATIC.

Additionally, Szabo is keeping an eye on several other cryptocurrencies: $ALGO, $LINK, $GRT, $FIL, $ETH, $RNDR, $XRP, and $ATOM.

Understanding Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging is an investment strategy where an individual invests a fixed amount of money into an asset at regular intervals, regardless of its price. This method reduces the impact of volatility on the overall purchase. The benefits of DCA include lowering the average cost per share of the investment and mitigating the risks associated with market timing. In the context of cryptocurrencies, which are known for their high volatility, DCA can be a particularly effective strategy for managing investment risks and potentially increasing long-term returns.

Focused Investments in ADA and ALGO

Earlier, on 15 December 2023, Szabo disclosed investing $40,000 in ADA at a price of $0.61, following a 5% drop in its value. On the same day, she invested $20,000 in Algorand ($ALGO), citing its 9% decline and future growth potential.

Purchases During Market Dip

On 11 December 2023, Szabo detailed her investment actions during a market dip, where she diversified her portfolio with significant purchases in $LINK, $ETH, $MATIC, $ADA, and $XRP. She also mentioned her long-term holdings in $BTC, $DOT, $VRA, $KAS, and $CAKE, indicating a diversified and strategic approach to her cryptocurrency investments.

Featured Image via Unsplash

Source: Read Full Article

-

Pentagon forms ‘Task Force Lima’ to map generative AI for US defense

-

Crypto Twitter split as another NFT platform moves to opt-in royalties

-

Banking Crisis Looms: Is Crypto The Future Of Secure Investing? – Coinpedia Fintech News

-

Hackers take over Robinhood’s Twitter account to promote scam token

-

Bitcoin Cash Analysis: Recovery Could Fade Near $102