-

Alameda borrowed user funds from FTX through open-term loans for illiquid investments.

-

FTX employees learned of this practice during a meeting.

-

Some employees resigned after learning of the extensive relationship between FTX and Alameda.

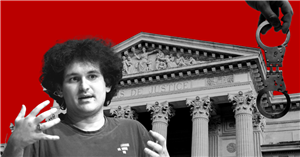

The FTX legal drama has been so full of new plot twists, that it could easily rival any blockbuster thriller. But here’s the harsh truth – this is about real people, real money, and real loss.

We’ve just uncovered some new details of this popular scandal, revealed through an audio recording – all you need to do is dive in!

An Explosive Secret

A secretly recorded 75-minute audio clip of Caroline Ellison, a former Alameda Research staff, had exposed the moment when 15 former Alameda employees learned that the hedge fund had been “borrowing” user funds from FTX. The recording was from an all-hands meeting in Hong Kong on Nov. 9, 2022.

Ellison explained that Alameda had borrowed money through open-term loans to make illiquid investments, including a large amount of FTX and FTX US equity. Most of these loans were called in, leading to a shortfall in FTX user funds.

Also Read: FTX-Alameda Bribery Scandal: Caroline Ellison Reveals $150M Payment to Chinese Officials

Courtroom Discoveries

Segments of this shocking recording were presented during Sam Bankman-Fried’s criminal trial on October 12. Christian Drappi, a former software engineer at Alameda, took the stand after Ellison. Before this meeting, many Alameda employees, including Drappi, had no inkling of the hedge fund’s alleged use of FTX customer deposits for its trading activities.

Ellison Under Scrutiny

Drappi questioned Ellison about when she became aware of this practice and who else in the company was privy to it. This exchange even saw Drappi explaining the term “YOLO” to the court. He went on to describe Ellison’s demeanor during the meeting as “sunken” and lacking confidence. The revelation of the extensive relationship between FTX and Alameda left both him and numerous colleagues so stunned that they resigned the very next day.

Witness Speaks

Aditya Bharadwaj, an engineer at Alameda Research who attended the meeting, described the atmosphere in the room as exceptionally tense. The meeting uncovered several undisclosed issues, including the abandoned acquisition of FTX by Binance, which left little hope for the company’s future.

Read More: Sam Bankman-Fried Was Manipulating Bitcoin Price to Stay Under $20,000, Ellison Claims

BlockFi’s Involvement

Zac Prince, the founder of BlockFi, testified that his company had extensive dealings with Alameda, providing substantial loans amounting to hundreds of millions of dollars. BlockFi also held a significant amount of cryptocurrency on the FTX platform due to its partnership with Alameda.

In other news, FTX will get $175 million from Genesis Global Capital’s bankruptcy estate, ending $1 billion in potential counterclaims after FTX’s collapse and mass withdrawals from Genesis. A final hearing is set for October 18.

Source: Read Full Article

-

Binance says it’s ‘different’ from other exchanges amid SEC lawsuit

-

Rocket Pool Token Eyes 5 Day Bullish Streak

-

Philippine SEC warns against unlicensed crypto exchanges amid FTX collapse

-

Binance exit aftershock: Can one resignation tip the crypto trust scales?

-

Litecoin Eliminates Pre-Halving Gains As Volume Drops, Is A Fall To $50 Coming?