The Chicago Mercantile Exchange (CME) has secured its top position as the leader in Bitcoin futures contracts, surpassing even industry giant Binance for the first time in history. The surge in CME’s BTC futures holdings now stands at 111,100 BTC, making it a historic moment for the exchange.

CME Top Table

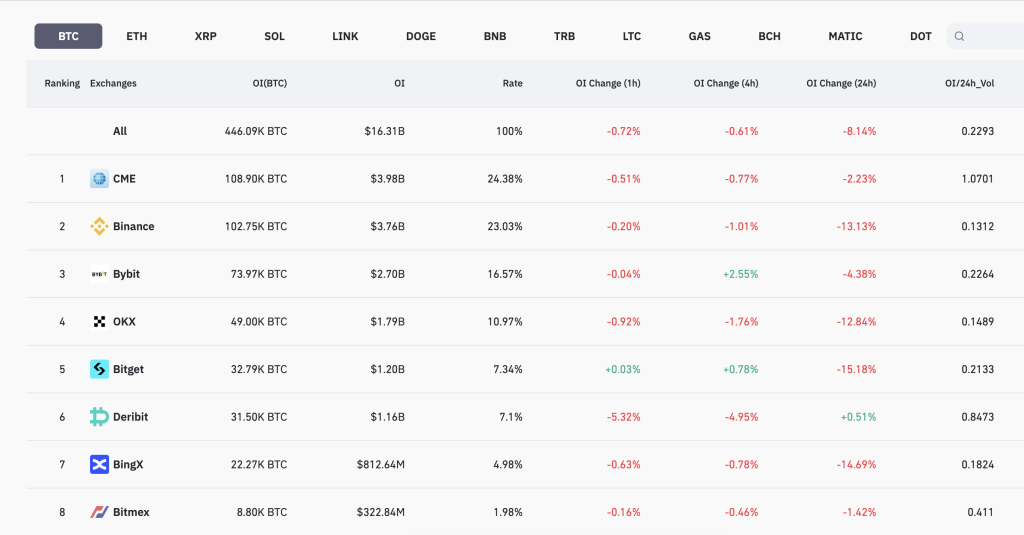

Over the past 24 hours, CME witnessed a remarkable 4.17% increase in its BTC futures contract positions. According to Coinglass, CME has seen its notional open interest (OI) rise from $3.57 billion to $4.08 billion, elevating it to the top position in the Bitcoin futures exchange from its previous second-place standing just weeks ago.

However, CME has also achieved a milestone by surpassing 111,100 BTC in open interest for its cash-settled futures contracts for the first time. Additionally, CME’s market share in the Bitcoin futures sector has reached an all-time high of 25%.

Meanwhile, this significant milestone not only solidifies CME’s position but also sets the stage for a new era in the world of cryptocurrency futures.

CME Dethrone Binance

For the first time in the history of these exchanges, CME has dethroned Binance, a major player in the cryptocurrency exchange landscape, from its top position.

Just a week ago, Coinpedia highlighted Binance’s market dominance with a notional open interest of $3.85 billion, which was about 8% higher than that of CME at that time.

With the recent turnaround, Binance slipped to the second position with a value of $3.77 billion, indicating a 10% decrease compared to CME’s OI. The market is abuzz with speculation about the primary driver of CME’s rise, with some attributing it to increased institutional investment.

Source: Read Full Article

-

Canadian police warn crypto investors on growing home robbery trend

-

Bitcoin Ordinals daily inscriptions surge due to ‘BRC-20 tokens’

-

The Green Revolution: Eco-Friendly Cryptocurrencies and Mining Carbon Footprints

-

MEXC Ventures Makes Eight-Figure Investment in Toncoin and Launches Strategic Partnership With TON Foundation

-

Stablecoins at Risk Amid Regulatory Confusion: Paul Grewal's Insight – Coinpedia Fintech News