Despite the Bitcoin 2023 Conference kicking off in Miami, the price of Bitcoin remained relatively stagnant, prompting concerns among experts about the cryptocurrency’s future.

To be precise, the world’s largest cryptocurrency by market capitalisation has been fluctuating between $27,400 and $26,500 for the past ten days, with this lacklustre volatility mirroring on Ethereum and other top cryptocurrencies. On that note, traders and analysts have closely monitored Bitcoin’s movements, with fears growing that the price may drop lower this coming week.

On Sunday, May 21, “Rekt Capital”, a renowned crypto pundit, highlighted the significance of Bitcoin’s failure to reclaim the $27,600 level. According to him, a weekly close below approximately $27,600 by price would confirm a breakdown and potentially lead to further downside momentum.

“Price needs to reclaim $27600 to have a chance at bullish momentum,” he tweeted.

Another expert named Ali “@Alicharts” echoed similar sentiments on Twitter, emphasising the importance of the $27,640 resistance and $26,340 support levels. According to Ali’s analysis, using the TD Sequential indicator, Bitcoin is currently in a no-trade zone on the 4-hour chart. A TD sequential is a technical analysis indicator primarily used to identify potential trend reversals and exhaustion points in financial markets. According to the pundit, a sustained close outside this area will determine the direction of Bitcoin’s trend.

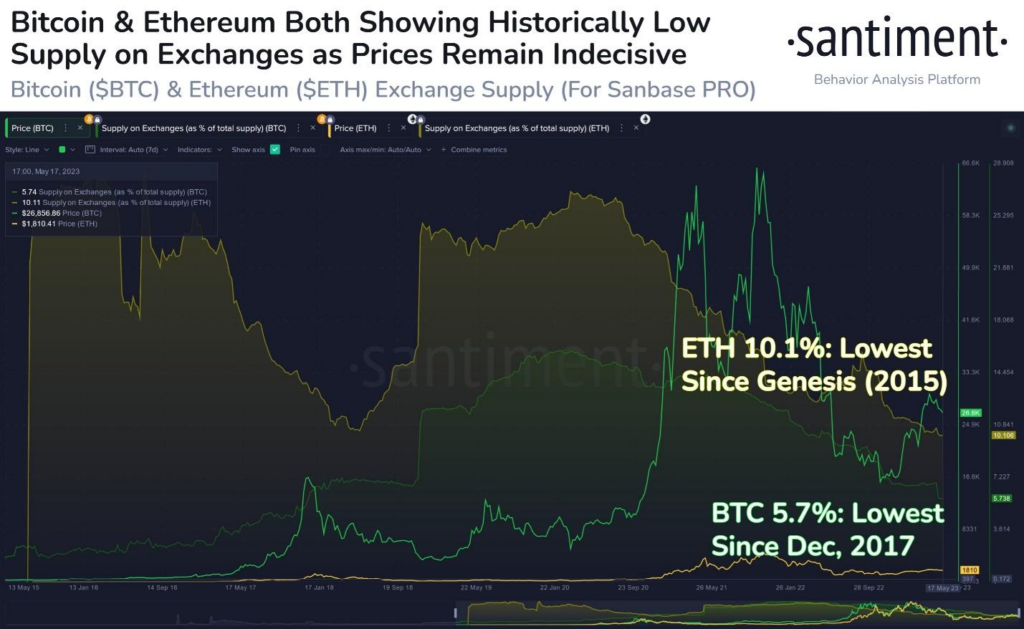

Nevertheless, despite the price stagnation, some fundamental indicators for Bitcoin have been turning green of late, signalling a bottom may be nearby. On Saturday, onchain analytics firm Santiment highlighted that both Bitcoin and Ethereum are experiencing an increase in their existing supplies and moving into self-custody. While not a foolproof indicator for a reversal, a decline in coins on exchanges often indicates potential future bull runs “given enough time”.

In an earlier post, the firm also highlighted the surge in fear among traders, as indicated by an increase in Bitcoin’s social dominance this week. Its analysis noted that this typically suggests a higher probability of a market recovery.

“With Bitcoin revisiting the $26k level, traders are showing increased worries of prices falling back to the $20k to $25k range. BTC social dominance has jumped high again, typically a sign of fear. Fear signals increase the probability of a rebound,” Santiment tweeted Friday, May 19.

That said, while it’s too early to predict where the price of Bitcoin will head next, it’s safe to say that the market’s future direction hangs in the balance if the $27,600 is not regained. While some indicators point towards a potential bullish trend for Bitcoin, it is important to stay patient and recognize that only time will reveal the true trajectory of the market.

Bitcoin was trading at $27,904 at press time, up 2.80% in the past 24 hours.

Source: Read Full Article

-

Anonymous user sends ETH from Tornado Cash to prominent figures following sanctions

-

2023 Predictions For Cardano Are Extremely Bullish; Here’s Why

-

Solana (SOL) On the Verge of Facing Potential Sell Pressure Amidst Market Rise – Coinpedia Fintech News

-

South Korea's financial watchdog wants to 'quickly' review crypto legislation: Report

-

Chiron Investigations Can Find Your Lost Crypto