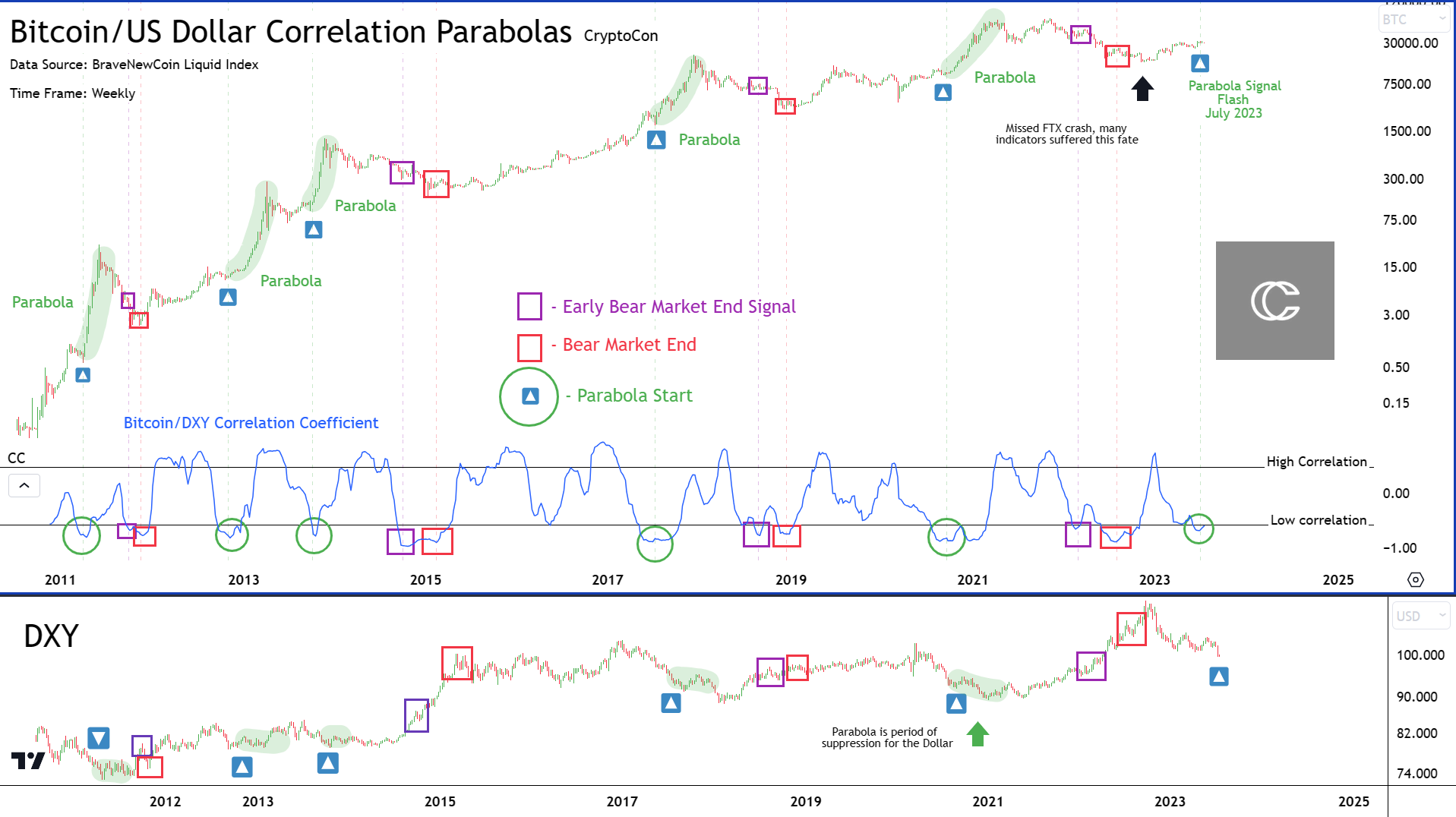

In a recent newsletter by renowned analyst CryptoCon, a groundbreaking indicator known as the “Bitcoin DXY correlation coefficient” has captured the attention of the community. This indicator, which measures the correlation between Bitcoin and the U.S. Dollar Index (DXY), has shown remarkable accuracy in predicting Bitcoin’s price movements and signaling the beginning of bull market parabolas.

According to CryptoCon, the Bitcoin DXY correlation coefficient is “one of the most interesting finds” he has come across in quite some time. In his newsletter, he explains the significance of this indicator and its implications for the future of Bitcoin’s price trajectory.

Bitcoin At Onset Of A Bull Market Parabola?

The analyst highlights the three distinct phases that the correlation coefficient enters during a market cycle. He states, “During a given market cycle, the correlation coefficient enters this zone in 3 phases.” These phases are represented by different colors:

- PURPLE: The first move into the low correlation zone, which occurs slightly before the bear market bottom.

- RED: The second move into the low correlation zone, marking the end of the bear market or the bottom of the cycle.

- GREEN: After some time, the metric returns to the low correlation zone, signaling the start of the true bull market parabola.

CryptoCon emphasizes the significance of these findings, stating, “And…there are no false signals when viewed in this way, extremely interesting! I have reviewed some other observations that allude to this, but not to this level of preciseness and caliber.”

Furthermore, the analyst brings attention to the influence of the U.S. dollar on Bitcoin’s parabola. He explains, “And this is from an outside factor, the Dollar. Meaning that the strength of the US dollar has great influence on when Bitcoin parabola takes place.” This correlation adds an additional layer of complexity and highlights the interplay between these two market forces.

Drawing comparisons to the 2013 cycle, the analyst speculates on the potential future trajectory of Bitcoin. He suggests that the upcoming market cycle could resemble a two-curve pattern. CryptoCon states:

I believe this could look something like a 2013 cycle. If we are indeed expecting an early powerful bull move, this could come in the form of two curves.

He further elaborates on the timeframes for these curves, stating, “The first comes early and would probably end sometime in 2024. The second comes later and ends late 2025 according to my Nov 28th Cycles Theory.”

The analyst also shared his price projections for the upcoming bull market parabola. He states, “As for the price target of this parabola, I will speak to the first one. Personally, I would expect it to come just over or short of ATHs. The secondary later top at 90-130k which is my personal range and projection for the cycle.”

Concluding the newsletter, he emphasizes the potential opportunity that lies ahead for Bitcoin investors. He states, “So regardless of the short term, big things are on the horizon for Bitcoin according to data. And maybe… just maybe… you might not have to be as patient as you expect for it.”

At press time, Bitcoin traded at $30,016.

Source: Read Full Article

-

Ripple CEO optimistic about US 'regulatory clarity for crypto'

-

Bitcoin, Ethereum Technical Analysis: BTC Hovers Below $24,000 on Friday, as Crypto Markets Consolidate – Market Updates Bitcoin News

-

CZ Binance And Vitalik Buterin Envision New Proof Of Reserve Solution, Over $6 Billion Leaves Centralized Exchanges

-

MATIC Price Shows Bullish Formation – What's Next?

-

Microsoft, Salesforce, and Nvidia swoop in to hire OpenAI employees as walkout threats increase